Chapter 8

Vanilla FX Derivatives Structures

Vanilla options can be combined to create different payoffs. Some of these combinations are so common that the resultant structures have standardized names that are requested by clients or quoted in the interbank broker market.

For an FX derivatives trader, it is most important to understand how these combinations of long and short vanilla options impact the exposures in the trading position. Within this chapter, vega is the primary focus. If structures are traded to shorter maturities, the most important exposure will be gamma. As observed in Chapter 6; for vanilla options, gamma profiles and vega profiles have similar shapes but they evolve differently over time.

Straddle

A straddle contains two vanilla options with identical contract details (same currency pair, buy/sell direction, notional, expiry, strike, and cut) except that one is a call and the other is a put.

Exhibit 8.1 shows the value at maturity of a long USD/JPY 100.00 straddle in notional N per leg:

- Leg 1: Buy USD call/JPY put with strike 100.00 in notional N.

- Leg 2: Buy USD put/JPY call with strike 100.00 in notional N.

Exhibit 8.1 Value at maturity of long 100.00 straddle

Straddle Price Making

Thanks to put–call parity, making a volatility price for a straddle is the same as making a volatility price for a single vanilla option in the combined notional with the same expiry, strike, and cut. A single two-way volatility quote is made and, if dealt, that volatility is used to determine the premiums on both legs.

Zero-Delta ATM Straddles

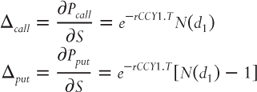

By far the most commonly traded straddle contracts are zero-delta straddles: a straddle with its strike set such that ![]() and therefore

and therefore ![]() . In all G10 and some EM currency pairs, the ATM contract is traded as a zero-delta straddle. Therefore, buying a 1mth ATM contract in EUR/USD actually means transacting a call and put, which forms a straddle.

. In all G10 and some EM currency pairs, the ATM contract is traded as a zero-delta straddle. Therefore, buying a 1mth ATM contract in EUR/USD actually means transacting a call and put, which forms a straddle.

Zero-Delta Straddle Strike Placement

The zero-delta straddle strike is positioned close to the forward for the same maturity but they are not exactly the same. Recall from Chapter 5 that the forward is derived from spot and interest rates:

where ![]() is the forward to time T (measured in years), S is the spot, and

is the forward to time T (measured in years), S is the spot, and ![]() and

and ![]() are continuously compounded interest rates (see Chapter 10) to time T in CCY1 and CCY2 respectively.

are continuously compounded interest rates (see Chapter 10) to time T in CCY1 and CCY2 respectively.

Dipping briefly into Black-Scholes mathematics:

where ![]() is the cumulative normal distribution function and σ is volatility.

is the cumulative normal distribution function and σ is volatility.

At the zero-delta straddle strike (K), ![]() . Therefore:

. Therefore:

Recalling the shape of cumulative normal distribution function from Chapter 5, if ![]() , then

, then ![]() . So

. So

Therefore, the zero-delta straddle strike is higher than the forward due to the adjustment ![]() , which is linked to the Itō correction within the Black-Scholes framework (see Chapter 5).

, which is linked to the Itō correction within the Black-Scholes framework (see Chapter 5).

Unfortunately, this is not quite the end of the story. The above is standard Black-Scholes mathematics, which assumes the premium is paid in CCY2. In, for example, EUR/USD (USD premium), this is the case; but in, for example, USD/JPY (USD premium), the market convention is to pay premium in CCY1.

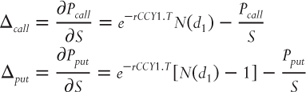

In CCY1 premium pairs (see Chapter 14 for more details on premium adjusted delta):

which works through as:

Therefore, when the premium is paid in CCY1, the zero-delta straddle strike is lower than the forward due to the adjustment: ![]() .

.

In both cases, the difference between the forward and the ATM zero-delta straddle strike increases as volatility and time to expiry get larger.

Straddle Trading Exposures

Exhibit 8.2 shows the vega profile of a straddle. It is identical to the vega profile of a single vanilla with the same (combined) notional, strike, and maturity. As expected, the vega peak occurs at the strike.

Exhibit 8.2 Vega profile of long 100.00 straddle

Strangle

A strangle is like a straddle except that the call and put have different strikes. Both strikes are placed out-of-the-money and therefore the call strike is always higher than the put strike.

Exhibit 8.3 shows the value at maturity of a long USD/JPY 90/110 strangle in notional N per leg:

- Leg 1: Buy USD call/JPY put with strike 110.00 in notional N.

- Leg 2: Buy USD put/JPY call with strike 90.00 in notional N.

Exhibit 8.3 Value at maturity of long 90.00/110.00 strangle

Strangles are often quoted for a given delta. For example, a 25 delta strangle is constructed with strikes such that call delta = 25% and put delta = (−)25%.

Strangle Price Making

When making a price on a strangle, a single two-way volatility is quoted. If dealt, that volatility is used to determine the premiums on both legs. The bid–offer spread quoted on a strangle in volatility terms will usually be wider than the ATM spread to the same maturity because strikes away from the ATM have less vega (see Chapter 7).

A strangle containing strikes ![]() and

and ![]() has (approximate) implied volatility:

has (approximate) implied volatility:

where strike ![]() has implied volatility

has implied volatility ![]() and vega

and vega ![]() while strike

while strike ![]() has implied volatility

has implied volatility ![]() and vega

and vega ![]() . Therefore, if the strangle contains equal delta call and put strikes with roughly equal vega, the strangle volatility will be close to the average of the two individual strike volatilities.

. Therefore, if the strangle contains equal delta call and put strikes with roughly equal vega, the strangle volatility will be close to the average of the two individual strike volatilities.

Strangle Trading Exposures

The vega profile of a strangle is similar to the vega profile of a straddle with the same maturity and notional per leg except that the strangle vega profile is wider because the strikes are spread out away from the ATM. At lower deltas the vega profile of the strangle has two distinct peaks from the two strikes as shown in Exhibit 8.4.

Exhibit 8.4 Vega profile of long 90.00/110.00 strangle

Butterfly (Fly)

The butterfly contract is a combination of a straddle and a strangle:

- Long butterfly = long strangle + short straddle

- Short butterfly = short strangle + long straddle

Buying the butterfly means buying the strangle, or put another way, buying the wings. Exhibit 8.5 shows the value at maturity of a long USD/JPY 90.00/100.00/110.00 equal notional butterfly:

- Leg 1: Buy USD put/JPY call with strike 90.00 in notional N.

- Leg 2: Sell USD put/JPY call with strike 100.00 in notional N.

- Leg 3: Sell USD call/JPY put with strike 100.00 in notional N.

- Leg 4: Buy USD call/JPY put with strike 110.00 in notional N.

Legs 1 and 4 form a long strangle and legs 2 and 3 form a short straddle. The contract is called a butterfly because its value at maturity looks like a butterfly if you really squint.

Exhibit 8.5 Value at maturity of long 90.00/100.00/110.00 equal notional butterfly

In the interbank broker market, the broker fly contract is the most commonly traded butterfly contract. A broker fly has equal notional strangle strikes and the notional on the ATM straddle is set such that the package is initially vega-neutral. Broker fly contracts are quoted for a given delta but the strikes for a given delta are generated using a different calculation. The broker fly product is examined in far more detail in Chapter 12.

Butterfly Price Making

In the interbank market, prices on broker fly contracts are quoted as the volatility differential between the strangle strikes and the ATM strikes. Plus the contract is quoted such that the butterfly notional is the strangle notional.

The broker fly has zero vega and minimal gamma by construction. Therefore, it is quoted significantly tighter than the strangle component in isolation. A bid–offer spread less than half the strangle bid–offer spread will often be shown.

Butterfly Trading Exposures

A long butterfly position is often flat ATM vega by construction and long vega in the wings from the long strangle strikes as shown in Exhibit 8.6.

Exhibit 8.6 Vega profile of long 90.00/100.00/110.00 vega-neutral butterfly

Risk Reversal (RR)

A risk reversal contains two vanilla options with the same currency pair, notional, expiry, and cut. However, the two legs have different strikes, one is a call and the other is a put, plus one is bought while the other is sold. The contract is called a risk reversal because it transfers optionality between the two strikes.

Exhibit 8.7 shows the value at maturity of a USD/JPY 90/110 risk reversal (buying topside) in notional N per leg:

- Leg 1: Buy USD call/JPY put with strike 110.00 in notional N.

- Leg 2: Sell USD put/JPY call with strike 90.00 in notional N.

Exhibit 8.7 Value at maturity of 90.00/110.00 risk reversal (buying topside)

Risk reversals are usually quoted to a specific delta. They are constructed using a long call and a short put (or short call and long put) and the delta exposures from the two legs therefore compound (i.e., the delta on both legs is either positive or negative). To calculate the delta hedge on the risk reversal, the delta of the two legs is summed. For example, to delta hedge a 25d risk reversal, containing a long 25d call and a short 25d put, ![]() of the single leg notional of spot must be sold.

of the single leg notional of spot must be sold.

Corporates often call risk reversals “collars” when they are used as instruments to hedge future cash flows. A popular structure is a zero-premium collar, which caps and floors the P&L from an FX exposure as demonstrated in Exhibit 8.8.

Exhibit 8.8 Hedging an FX exposure with a collar (risk reversal)

Risk Reversal Price Making

A risk reversal is a spread contract. It has two legs: one bought, one sold. There are offsetting gamma and vega exposures between the legs and therefore the product is quoted tighter than the equivalent contract where either both legs are bought or both legs are sold. When quoting a price on spread, rather than quoting tighter two-way prices on both legs, the market convention is to quote one leg with a choice price (i.e., a single volatility at which it is possible to buy or sell, often denoted CH) and the other leg with a spread price (i.e., a two-way volatility price). In other words, all the bid–offer spread is put onto one of the legs. Risk reversals are usually quoted with around half the overall bid–offer spread of the equivalent strangle.

For example, USD/BRL 1yr 25d risk reversal:

- Outright 1yr 25d call implied volatility: 14.35 / 14.85%

- Outright 1yr 25d put implied volatility: 10.75 / 11.25%

- 1yr 25d risk reversal implied volatility: 14.35 / 14.85% vs. 11.0% CH

Risk reversals for a given delta are often quoted as an implied volatility differential between the two strikes (e.g., 3.35/3.85% in the above USD/BRL example). This is appropriate when the risk reversals strikes have the same delta and hence there is minimal net vega on the structure. Once the trade is agreed in volatility differential terms, the volatility on one of the strikes is agreed and that determines the volatility of the other strike; hence both premiums can be calculated. The risk reversal product is examined in far more detail in Chapter 12.

Risk Reversal Trading Exposures

The bought leg in the risk reversal generates a long vega exposure with a peak at the long strike while the sold leg generates a short vega exposure with a (negative) peak at the short strike. This is shown in Exhibit 8.9.

Exhibit 8.9 Vega profile of a 90.00/110.00 risk reversal

Leveraged Forward

Recall from Chapter 6 that a synthetic forward is constructed using a long vanilla call and short vanilla put with all other contract details the same.

A leveraged forward is an extension of a synthetic forward in which the two notional amounts are no longer equal. A 200% leveraged forward in which USD/JPY is bought at 100.00 is constructed using two legs with double the notional on the sold leg:

- Leg 1: Buy USD call/JPY put with strike 100.00 in notional N.

- Leg 2: Sell USD put/JPY call with strike 100.00 in notional 2 N.

Leveraged forwards can be decomposed into a forward in the matched notional plus a vanilla in the unmatched notional. Since forwards have no optionality, the vega trading risk is equal to a vanilla in the unmatched notional and the implied volatility price will also be equal to the volatility price of the vanilla option in the unmatched notional.

This product is popular with clients hedging FX flows because the underlying can be transacted at a better rate than the forward for zero premium. The better rate is funded by the increased notional on the sell leg.

ATM Calendar Spread

ATM calendar spreads are combinations of two ATM contracts, one bought and one sold (hence a spread), to different maturities. In old-school trading language, calendar spreads are called horizontal spreads.

Buying the calendar spread means buying the longer date (the “back date” or “far date”) and selling the shorter date (the “near date”). If the notionals are set such that there is zero net vega on the structure, it becomes a vega-neutral ATM calendar spread.

A long 3mth/6mth equal notional ATM calendar spread is constructed using four legs, assuming the ATM is traded as a straddle:

- Leg 1: Sell 3mth ATM USD call/JPY put in notional N.

- Leg 2: Sell 3mth ATM USD put/JPY call in notional N.

- Leg 3: Buy 6mth ATM USD call/JPY put in notional N.

- Leg 4: Buy 6mth ATM USD put/JPY call in notional N.

Legs 1 and 2 form a short ATM straddle and legs 3 and 4 form a long ATM straddle.

ATM Calendar Spread Price Making

Standard vanilla spread pricing rules apply: A spread (two-way) price is shown on the ATM straddle with more vega and the other ATM straddle is shown choice. Therefore, for ATM calendar spreads the far ATM straddle is spread since vega increases at longer maturities. Calendar spreads usually have substantial offsetting vega risk and are therefore quoted tighter than two ATM contracts in the same direction: Perhaps the standard bid–offer spread will be shown on the far leg, with the near leg quoted choice.

ATM Calendar Spread Trading Exposures

ATM calendar spreads give exposures to the shape of the ATM curve since they contain offsetting vega positions in two tenors. Exhibit 8.10 shows the bucketed vega profile from the long 3mth/6mth vega-neutral ATM calendar spread. This position will make money if the 3mth ATM volatility rises more than the 6mth ATM volatility.

Exhibit 8.10 Bucketed vega profile from long 3mth/6mth vega-neutral ATM calendar spread

Call/Put Spreads

Vanilla call spreads and vanilla put spreads have two legs in the same notional and to the same maturity, either both calls or both puts. One leg is a buy and the other is a sell; hence the structure is a spread. When buying the call/put spread, the bought leg is always more expensive, and hence further in-the-money than the sold leg.

Exhibit 8.11 shows the value at maturity of a long USD/JPY 100.00/110.00 USD call spread in notional N per leg:

- Leg 1: Buy USD call/JPY put with strike 100.00 in notional N.

- Leg 2: Sell USD call/JPY put with strike 110.00 in notional N.

Exhibit 8.11 Value at maturity of long 100.00/110.00 call spread

Buying call/put spreads is popular with institutional clients because they enable a directional view with no possible downside other than the initial premium at a cheaper cost than the outright vanilla. In old-school trading language, call/put spreads are called vertical spreads.

If left unhedged until maturity:

- A long CCY1 call spread pays out if spot is above the lower strike with the payoff capped at the higher strike.

- A long CCY1 put spread pays out if spot is below the higher strike with the payoff capped at the lower strike.

Call/Put Spread Price Making

The standard vanilla spread quoting rules apply to call spreads and put spreads too: Spread the leg with more vega and choice the other leg. It is interesting to note that once call/put spreads are placed in a delta hedged trading portfolio, the vega exposures are the same as the vega exposures from a risk reversal with the same strikes; the long strike generates a long vega exposure and the short strike generates a short vega exposure.

Seagull

A long seagull contract is a long call/put spread plus an additional short put/call. It is most often a product sold for zero initial premium to investors who want to hedge an underlying FX exposure.

Exhibit 8.12 shows the value at maturity of a long USD/JPY 90.00/100.00/110.00 seagull in notional N per leg:

- Leg 1: Sell USD put/JPY call with strike 90.00 in notional N.

- Leg 2: Buy USD call/JPY put with strike 100.00 in notional N.

- Leg 3: Sell USD call/JPY put with strike 110.00 in notional N.

Legs 2 and 3 form a long call spread.

Exhibit 8.12 Value at maturity of long 90.00/100.00/110.00 seagull

Seagull Price Making

On vanilla spreads with more than two legs there are few concrete rules on how to quote prices but generally the price is easier to understand if as many legs as possible are quoted choice. Plus the legs with the most vega should be spread because their price quoted in volatility terms will be the tightest.