27 ASC 410 ASSET RETIREMENT AND ENVIRONMENTAL OBLIGATIONS

Asset retirement obligations requiring recognition

Examples of the scope of ASC 410-20

Example of timing of recognition

Example of ongoing additions to the obligation

Accounting in subsequent periods

Example—initial measurement and recognition

Example—accounting in subsequent periods

Electronic equipment waste obligations

Environmental Remediation Costs

Environmental remediation liabilities

PERSPECTIVE AND ISSUES

Subtopics

ASC 410, Asset Retirement and Environmental Obligations, consists of three subtopics:

- ASC 410-10, Overall, which merely points out the differences between the other two Subtopics

- ASC 410-20, Asset Retirement Obligations, which provides guidance on asset retirement obligation and environmental remediation liabilities resulting from normal operations of long-lived assets

- ASC 410-30, Environmental Obligations, which provides guidance on environmental remediation liabilities.

Scope and Scope Exceptions

ASC 410-20 applies to all entities. It does not apply to these transactions:

- Obligations that arise solely from a plan to sell or otherwise dispose of a long-lived asset

- An environmental remediation liability that results from the improper operation of a long-lived asset

- Activities necessary to prepare an asset for an alternative use as they are not associated with the retirement of the asset.

- Historical waste held by private households.

- Obligations of a lessee in connection with leased property, whether imposed by a lease agreement or by a party other than the lessor, that meet the definition of either minimum lease payments or contingent rentals in paragraphs

- An obligation for asbestos removal resulting from the other-than-normal operation of an asset.

- Costs associated with complying with funding or assurance provisions.

- Obligations associated with maintenance, rather than retirement, of a long-lived asset.

- The cost of a replacement part that is a component of a long-lived asset.

(ASC 410-20-15-3)

ASC 410-30 applies to all entities. It does not apply to these transactions:

- Environmental contamination incurred in the normal operation of a long-lived asset.

- Pollution control costs with respect to current operations or on accounting for costs of future site restoration or closure that are required upon the cessation of operations or sale of facilities, as such current and future costs and obligations represent a class of accounting issues different from environmental remediation liabilities.

- Environmental remediation actions that are undertaken at the sole discretion of management and that are not induced by the threat, by governments or other parties, of litigation or of assertion of a claim or an assessment.

- Recognizing liabilities of insurance entities for unpaid claims.

- Natural resource damages and toxic torts

- Asset impairment issues.

(ASC 410-30-1503)

DEFINITIONS OF TERMS

Source: ASC 410

Accretion Expense. An amount recognized as an expense classified as an operating item in the statement of income resulting from the increase in the carrying amount of the liability associated with the asset retirement obligation.

Asset Retirement Cost. The amount capitalized that increases the carrying amount of the long-lived asset when a liability for an asset retirement obligation is recognized.

Asset Retirement Obligation. An obligation associated with the retirement of a tangible long-lived asset.

Closure. Related to the Resource Conservation and Recovery Act of 1976: the process in which the owner-operator of a hazardous waste management unit discontinues active operation of the unit by treating, removing from the site, or disposing of on site all hazardous wastes in accordance with an Environmental Protection Agency or state-approved plan. Included, for example, are the process of emptying, cleaning, and removing or filling underground storage tanks and the capping of a landfill. Closure entails specific financial guarantees and technical tasks that are included in a closure plan and must be implemented.

Conditional Asset Retirement Obligation. A legal obligation to perform an asset retirement activity in which the timing and (or) method of settlement are conditional on a future event that may or may not be within the control of the entity.

Discount Rate Adjustment Technique. A present value technique that uses a risk-adjusted discount rate and contractual, promised, or most likely cash flows.

Disposal. Related to the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 and the Resource Conservation and Recovery Act of 1976: under the Resource Conservation and Recovery Act of 1976, the discharge, deposit, injection, dumping, spilling, leaking, or placing of any solid waste or hazardous waste into or on any land or water so that such solid waste or hazardous waste or any constituent thereof may enter the environment or be emitted into the air or discharged into any waters, including groundwaters. Similarly under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 with regard to hazardous substances.

Fair Value, The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Hazardous Waste. Related to Resource Conservation and Recovery Act of 1976: a waste, or combination of wastes, that because of its quantity, concentration, toxicity, corrosiveness, mutagenicity or inflammability, or physical, chemical, or infectious characteristics may cause, or significantly contribute to, an increase in mortality or an increase in serious irreversible, or incapacitating reversible illness or pose a substantial present or potential hazard to human health or the environment when improperly treated, stored, transported, or disposed of, or otherwise managed. Technically, those wastes that are regulated under the Resource Conservation and Recovery Act of 1976 40 CFR Part 261 are considered to be hazardous wastes.

Legal Obligation. An obligation that a party is required to settle as a result of an existing or enacted law, statute, ordinance, or written or oral contract or by legal construction of a contract under the doctrine of promissory estoppel.

Natural Resources. Under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, natural resources are defined as land, fish, wildlife, biota, air, water, groundwater, drinking water supplies, and other such resources belonging to, managed or held in trust by, or otherwise controlled by the United States, state or local governments, foreign governments, or Indian tribes.

Promissory Estoppel. “The principle that a promise made without consideration may nonetheless be enforced to prevent injustice if the promisor should have reasonably expected the promisee to rely on the promise and if the promisee did actually rely on the promise to his or her detriment.” (See Black's Law Dictionary, seventh edition.)

Retirement. The other-than-temporary removal of a long-lived asset from service. That term encompasses sale, abandonment, recycling, or disposal in some other manner. However, it does not encompass the temporary idling of a long-lived asset. After an entity retires an asset, that asset is no longer under the control of that entity, no longer in existence, or no longer capable of being used in the manner for which the asset was originally acquired, constructed, or developed.

CONCEPTS, RULES, AND EXAMPLES

Asset Retirement Obligations.

ASC 410-20 provides standards for measuring the future cost to retire an asset and recognizing that cost in the financial statements as a liability, and correspondingly, as part of the depreciable cost of the asset. ASC 410-20 applies to legal obligations associated with the retirement of tangible long-lived assets that result from their acquisition, construction, development, and/or normal operation (ASC 410-20015-2a). Lessee capital lease assets and lessor assets that are leased under operating leases are also subject to these rules (ASC 410-20-15-2d).

For the purposes of applying ASC 410-20, a legal obligation is “an obligation that a party is required to settle as a result of an existing or enacted law, statute, ordinance, or written or oral contract or by legal construction of a contract under the doctrine of promissory estoppel.” Promissory estoppel is a legal doctrine whereby a court of law will enforce a promise made by one party (the promisor) to another party (the promisee) even though no formal contract exists between the two parties or no consideration was exchanged. This situation can arise when a party (the promisee) relies on a promise to his or her detriment and the person making the promise (the promisor) should have reasonably expected the promisee to rely on the promise.

Asset retirement obligations requiring recognition.

When an entity acquires, constructs, and operates assets, it often incurs obligations that are unavoidable. Much of the discussion in ASC 410-20 pertains to specialized industry applications such as offshore oil platforms, nuclear power plants, mining operations, landfills, and underground storage tanks. However, the criteria for recognizing asset retirement obligations are intended to apply to situations encountered more frequently in practice, such as in the following examples.

Example 1—Leased premises. In accordance with the terms of a lease, the lessee is obligated to remove its specialized machinery from the leased premises prior to vacating those premises, or to compensate the lessor accordingly. The lease imposes a legal obligation on the lessee to remove the asset at the end of the asset's useful life or upon vacating the premises, and therefore this situation would be covered by ASC 410-20.

Example 2—Owned premises. The same machinery described in example 1 is installed in a factory that the entity owns. At the end of the useful life of the machinery, the entity will either incur costs to dismantle and remove the asset or will leave it idle in place. If the entity chooses to do nothing and not remove the equipment, this would adversely affect the fair value of the premises should the entity choose to sell the premises on an “as is” basis. Conceptually, to apply the matching principle in a manner consistent with example 1, the cost of asset retirement should be recognized systematically and rationally over the productive life of the asset and not in the period of retirement. However, in this example, there is no legal obligation on the part of the owner of the factory and equipment to retire the asset and, thus, this would not be covered by ASC 410-20.

Example 3—Promissory estoppel. Assume the same facts as in example 2. In this example, however, the owner of the property sold to a third party an option to purchase the factory, exercisable at the end of five years. In offering the option to the third party, the owner verbally represented that the factory would be completely vacant at the end of the five-year option period and that all machinery, furniture and fixtures would be removed from the premises. The property owner would reasonably expect that the purchaser of the option relied to the purchaser's detriment (as evidenced by the financial sacrifice of consideration made in exchange for the option) on the representation that the factory would be vacant. This would trigger promissory estoppel and the owner's obligation would be covered by ASC 410-20.

Phyl Corporation owns and operates a chemical company. At its premises, it maintains underground tanks used to store various types of chemicals. The tanks were installed when Phyl Corporation purchased its facilities seven years prior. On February 1, 2012, the governor of the state signed a law requiring removal of such tanks when they are no longer being used. Since the law imposes a legal obligation on Phyl Corporation, upon enactment, recognition of an asset retirement obligation (ARO) would be required.

Joyce Manufacturing Corporation (JMC) operates a factory. As part of its normal operations it stores production byproducts and used cleaning solvents on site in a reservoir specifically designed for that purpose. The reservoir and surrounding land, all owned by JMC, are contaminated with these chemicals. On February 1, 2012, the governor of the state signed a law requiring cleanup and disposal of hazardous waste from an already existing production process upon retirement of the facility. Upon enactment of the law, immediate recognition would be required for the ARO associated with the contamination that had already occurred. In addition, liabilities will continue to be recognized over the remaining life of the facility as additional contamination occurs.

Accounting considerations.

Several important accounting issues merit careful consideration.

Recognition and allocation. Upon initial recognition, the entity records an increase to the carrying amount of the related long-lived asset and an offsetting liability. The entity then depreciates the combined cost of the asset and the capitalized asset retirement obligation using a systematic and rational allocation method over the period during which the long-lived asset is expected to provide benefits, taking into consideration any expected salvage value. Conceptually, this accounting treatment is an application of the matching principle in that the total investment in the asset, including the cost of its eventual retirement, is charged to expense over the periods benefited. Depending on the pattern and timing of obligating events, an entity could, under these rules, capitalize an amount of asset retirement cost during a period and, in the same period, allocate an equal amount to depreciation expense. It is important to note that, for the purpose of capitalizing interest under ASC 835-20, these additions to the carrying amounts of long-lived assets are not considered expenditures.

Impairment. Retirement obligations added to the carrying amounts of long-lived assets must be included in those carrying amounts for the purpose of testing those assets for impairment. In estimating future cash flows under the impairment rules (ASC 360-10-35), the cash flows related to settling the liability for an asset retirement obligation are to be excluded from both the undiscounted cash flows used to assess the recoverability of the asset's carrying amount and the discounted cash flows used to measure the asset's fair value.

Measurement. Asset retirement obligations are initially measured at fair value. Fair value (as defined in ASC 820 and discussed in detail in the chapter on ASC 820) is the price that would be paid to transfer the liability in an orderly transaction between market participants at the measurement date. This measurement is not based on the amount that the reporting entity (the obligor) would be required to pay to settle the liability on the measurement date (which would be difficult, if not impossible, to estimate in the absence of a market for the transfer of such obligations). Rather, the measurement assumes that the reporting entity remains the obligor under the ARO and that the obligee has transferred its rights by selling them to a hypothetical market participant on the measurement date. In determining the price it would be willing to pay for the rights associated with the ARO, a third-party market participant would consider the risk of nonperformance of the reporting entity, since that entity will continue to be the obligor after the measurement date. Thus, the fair value measurement of the obligation, under ASC 820, takes into consideration the reporting entity's own risk of nonperformance that includes, but is not limited to, the effect of its own credit standing.

ASC 820 amended ASC 410-20 to conform its fair value guidance to the new, uniform guidance regarding measuring fair value that is applicable throughout GAAP. In this amendment, FASB acknowledged that

Rarely, if ever, would there be an observable rate of interest for a liability that has cash flows similar to an asset retirement obligation being measured. In addition, an asset retirement obligation usually will have uncertainties in both timing and amount. In that circumstance, employing a discount rate adjustment technique, where uncertainty is incorporated into the rate, will be difficult, if not impossible.

This lack of observability means that management, in order to estimate the ARO, will be required to use an expected present value technique that uses its own assumptions regarding the necessary adjustment for market risk. These are referred to as “Level 3 inputs” by ASC 820.

Initially applying an expected present value method. ASC 820-10-55 provides two alternative methods for determining expected present value. To apply Method 1, management adjusts the expected cash flows for market risk by incorporating a cash risk premium in them and uses a risk-free interest rate to discount the risk-adjusted expected cash flows. To apply Method 2, management does not adjust the expected cash flows, but instead adjusts the risk-free interest rate by incorporating a risk premium in it.

As discussed later in this section, Method 1 cannot be used to estimate the expected present value of an ARO due to computational difficulties that cannot be overcome. As a result, the following discussion, adapted from ASC 410-20, uses Method 2 to illustrate the estimation of expected present value.

Management begins by estimating a series of cash flows that reflect its marketplace estimates of the cost and timing of performing the required retirement activities. Marketplace amounts are those amounts that would be expended by the entity to hire a third party to perform the work. Explicit assumptions are to be developed and incorporated in the estimates about all of the following matters:

- The costs that a third party would incur in performing the necessary tasks associated with retiring the asset.

- Additional amounts that the third party would include in pricing the work, related to such factors as inflation, overhead, equipment charges, profit margins, anticipated technological advances, and offsetting cash inflows, if any.

- The extent to which the amount of the third party's costs or their timing might differ under various future scenarios and the relative probabilities of those scenarios actually occurring.

- The price that the third party would demand and could expect to receive for bearing the uncertainties and unforeseeable circumstances inherent in the obligation. This is referred to as a market-risk premium.

If data is available regarding assumptions that marketplace participants would make that contradicts management's own assumptions, management must adjust its assumptions accordingly. For example, if the costs of labor in the marketplace exceed those of the entity, the higher marketplace costs are to be used in the cash flow estimates. Even if the entity can and will retire the asset using internal resources, the obligation must be computed as if a third party will be retained to perform the work, including provisions for recovery of the contractor's overhead and profit.

The discount rate to be used in the present value calculations is the credit-adjusted risk-free rate that adjusts a risk-free rate of interest for the effects of the entity's own credit standing. The risk-free interest rate is the interest rate on monetary assets with maturity dates or durations that coincide with the period covered by the estimated cash flows associated with the ARO. When the measurement involves cash flows denominated in US dollars, the yield curve for US Treasury securities is used.

In adjusting the risk-free rate for the entity's credit standing, the entity takes into account the effects on the fair value estimate of all terms, collateral, and existing guarantees. In ASC 820, FASB indicated that it believed, when it issued ASC 410, that it would be more practical for management to reflect an estimate of its own credit standing as an adjustment to the risk-free rate rather than as an adjustment to the expected cash flows. In fact, based on the model FASB chose to account for subsequent upward and downward changes in the ARO, ASC 410 would not be operational unless the adjustment for credit-standing was made to the risk-free interest rate.

As a practical matter, for companies whose debt is not rated by a bond-rating agency, the adjustment for credit standing may be difficult to establish. For such companies, the incremental borrowing rate used for lease testing may serve as an acceptable approximation of the credit-adjusted risk-free rate.

The ARO may be incurred in one or more of the entity's reporting periods. Each period's incremental liability incurred is recognized as a separate liability and is estimated using these principles based on market and interest rate assumptions existing in the period of recognition.

ASC 410-20 clarified that an ARO is required to be recognized when incurred (or acquired), even if uncertainty exists regarding the timing and/or method of eventually settling the obligation. In effect, ASC 410-20 distinguishes between a contingency and an uncertainty. If the obligation to perform the retirement activities is unconditional, the fact that uncertainty exists regarding the timing and/or method of retirement does not relieve the reporting entity of the requirement to estimate and record the obligation if, in fact, it is reasonably estimable. The assumptions regarding the probabilities of the various outcomes used in the computation are to take into account that uncertainty. An ARO is considered reasonably estimable if:

- It is evident that the obligation's fair value is included in an asset's acquisition price,

- An active market exists for the transfer of the obligation, or

- Sufficient information is available to enable the use of the CON 7 expected present value technique to estimate the obligation.

Sufficient information is considered to be available to reasonably estimate the obligation if either:

- The settlement date and method of settlement have been specified by others (e.g., the end of a lease term or the end of a statutory period) or

- Information is available to reasonably estimate:

- The settlement date or range of potential settlement dates

- The settlement method or potential settlement methods

- The probabilities of occurrence of the dates and methods in a and b.

The information necessary to make these estimates can be based on the reporting entity's own historical experience, industry statistics or customary practices, management's own intent, or estimates of the asset's economic useful life.

The determination of fair value for an ARO may be difficult, especially if the volume and level of activity for the asset or liability have significantly decreased to the extent where there are few recent transactions or price quotations vary substantially. If so, it may be necessary to use multiple valuation techniques, and select a point within the derived range of values that is most representative of fair value.

Even if management concludes that sufficient information does not exist to record the obligation at inception, management is expected to continuously consider whether this remains true in future accounting periods, and to recognize the obligation in the first period when sufficient information becomes available to enable the fair value estimate.

Accounting in subsequent periods.

After the initial period of ARO recognition, the liability will change as a result of either the passage of time or revisions to the original estimates of either the amounts of estimated cash flows or their timing. Such changes can arise due to the effects of inflation, changes in the probabilities used in the original estimate, changes in interest rates, changes in laws, regulations, statutes, and contracts.

ASC 410-20 does not require detailed cash flow estimates every reporting period, but rather allows the exercise of judgment as to when facts and circumstances indicate that the initial estimate requires updating.

If a change to the liability is deemed necessary, it is recognized by first adjusting its carrying amount for changes due to the passage of time (referred to as accretion and discussed in detail below) and then, if applicable, for changes due to revisions in either amounts or timing of estimated cash flows.

Changes due to the passage of time increase the carrying amount of the liability because there are fewer periods remaining from the initial measurement date until the settlement date; thus, the present value of the discounted future settlement amount increases. These changes are recorded as a period cost called accretion expense and classified separately in the operating section of the statement of income (or not-for-profit statement of activities). Accretion is computed using an interest method of allocation that results in periodic accretion expense that represents a level effective interest rate applied to the carrying amount of the liability at the beginning of each period. The effective interest rate used to calculate accretion is the credit-adjusted risk-free rate or rates (or incremental borrowing rate) applied when the liability or portion of the liability (as explained below) was initially measured and recognized. Accretion expense is not combined with interest expense, and is not considered interest cost for the purpose of applying the interest capitalization criteria of ASC 835-20.

Changes in the ARO that result from changes in the estimates of the timing or amounts of future cash flows are accounted for differently for increases and decreases. If the expected present value increases, the increase gives rise to a new obligation accounted for separately just as the ARO was originally measured but using current market value assumptions, and the current credit-adjusted risk-free rate. Thus, over time, a particular long-lived asset may have multiple layers of obligations associated with it that are based on different assumptions measured at different dates during the asset's useful life. The incremental obligation is recorded by increasing the recorded ARO and capitalizing the additional cost as a part of the carrying amount of the related long-lived asset. If multiple layers have been recorded and it is not practical to separately identify the period (or layer) to which subsequent revisions in estimated cash flows relate, management is permitted to use a weighted-average credit-adjusted risk-free rate to measure the change in the liability resulting from that revision.

If, however, the expected present value subsequently decreases, the difference between the remeasured amount and the carrying amount of the liability (after adjustment for inception-to-date accretion) is recorded as a gain in the current period. In this case, the previously recognized layers of liabilities are reduced pro rata so as not to affect the overall effective rate of accretion over the remaining life of the obligation.

For the purposes of measurement in subsequent periods, in the unlikely event that an entity originally determined its ARO based on available market prices rather than using the expected present value method, it would be required to determine the undiscounted cash flows embedded in that market price. This process is analogous to computing the rate of interest implicit in a lease.

If the increase in carrying amount of the affected long-lived asset resulting from the remeasurement of ARO in a subsequent period impacts only that period, then the increase is fully depreciated in that period. Otherwise, the increase is depreciated in the period of change and future periods as a change in estimate in accordance with ASC 250. Both depreciation and accretion are classified as operating expenses in the statement of income.

Other provisions.

Other provisions of ASC 410 affect the calculation of the credit-adjusted rate as well as how it is to be applied by rate-regulated entities.

Funding and assurance provisions. Factors such as laws, regulations, public policy, the entity's creditworthiness, or the sheer magnitude of the future obligation may cause an entity to be required to provide third parties with assurance that the entity will be able to satisfy its ARO in the future. Such assurance is provided using such instruments as surety bonds, insurance policies, letters of credit, guarantees by other entities, establishment of trust funds, or by custodial arrangements segregating other assets dedicated to satisfying the ARO. Although providing such means of assurance does not satisfy the underlying obligation, the credit-adjusted interest rate used in calculating the expected present value is adjusted for the effect on the entity's credit standing of employing one or more of these techniques.

Rate-regulated entities. Many rate-regulated entities (as defined in ASC 980 and discussed in Chapter 33) follow current specialized accounting that capitalizes costs not otherwise afforded that treatment under GAAP. These entities recover these additional costs in the rates that they charge their customers. These additional capitalized costs may or may not meet the definition of ARO under ASC 410. The differences in the amounts and timing of assets and liabilities between GAAP and regulatory accounting used for rate-making purposes give rise to temporary differences and the resultant deferred income tax accounting.

ASC 410 provides that, if the criteria in ASC 980 are met, the rate-regulated entity is to recognize a regulatory asset or liability for differences in the timing of recognition of the period costs associated with ARO for financial reporting and rate-making purposes. Accounting for the ARO arising from closed or abandoned long-lived assets of rate-regulated entities is covered by ASC 980-360.

Gerald Corporation constructs and places into service on January 1, 2012, specialized machinery on premises that it leases under a fifteen-year lease. The machinery cost $1,750,000 and has an estimated useful life of ten years. Gerald Corporation is contractually obligated, under the terms of the lease, to remove the machinery from the premises when it is no longer functional. Gerald is unable to obtain current market-related information regarding the costs of settling the liability at inception and, therefore, chooses to estimate the initial fair value of the ARO using an expected present value technique. The significant assumptions used by Gerald in applying this technique are as follows:

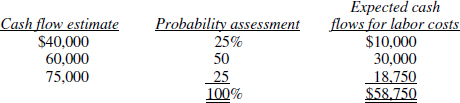

- Labor costs are based on prevailing wage rates in that geographic area that a contractor would pay to hire qualified workers. Gerald assigns probability assessments to the range of cash flow estimates as follows:

- Based on its own experience, which Gerald believes is indicative of local market conditions, Gerald estimates that a contractor will apply a 75% rate to labor costs to charge for overhead and equipment usage and that, based on published industry statistics for the region, a contractor would add a markup of 8% to the combined labor, overhead, and equipment costs.

- Since the eventual dismantlement and removal will be occurring ten years later, Gerald expects that a contractor would receive a market-risk premium of 5% of the expected cash flows adjusted for inflation. This premium is to compensate the contractor for assuming the risks and uncertainties of contracting now for a project ten years later.

- The risk-free rate of interest as evidenced by the price of zero-coupon US Treasury instruments that mature in ten years is 4.5%. Gerald adjusts that rate by 2.5% to reflect the effect of its credit standing as evidenced by its incremental borrowing rate of 7%. Therefore, the credit-adjusted risk-free rate used to compute the expected present value is 7%.

- Gerald assumes an average rate of inflation of 3.5% over the ten-year period.

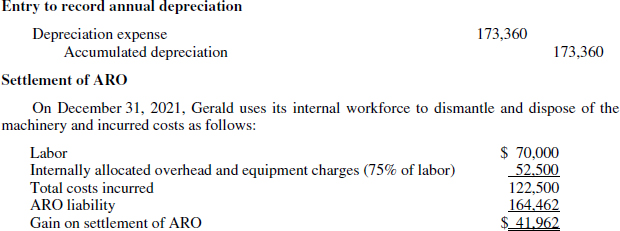

The ARO is initially measured as follows as of January 1, 2012:

On January 1, 2012, Gerald would record the initial ARO as follows:

![]()

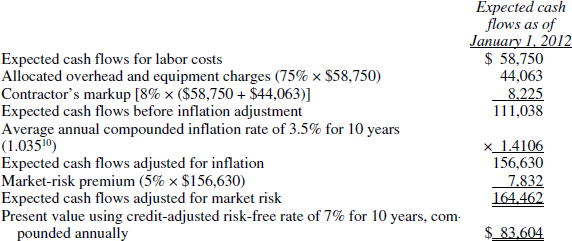

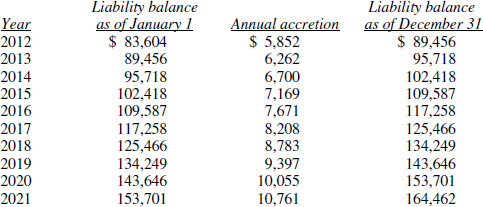

Assuming the same facts as above, during the ten year life of the machinery, Gerald would record entries to recognize accretion and depreciation as follows (assuming no remeasurement of the ARO is required):

Entries to record annual accretion

The accretion for each year presented in the table is recorded as follows:

![]()

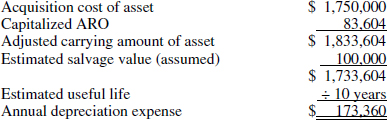

Depreciation computations

Note that, because Gerald chose to perform the retirement activities using its own workforce, the “market approach” mandated by ASC 410 and ASC 820 does not achieve an even matching of the total costs of acquisition and retirement to the periods benefited. The period of the retirement reflects a gain on settlement that would not have occurred had Gerald hired a contractor to perform the work instead of using its own employees.

Electronic equipment waste obligations.

ASC 720-40 prescribes the proper treatment of electronic equipment waste obligations.

A commercial user of electronic equipment acquired on or prior to August 13, 2005, is required to capitalize an asset retirement cost, as outlined in ASC 410, by increasing the carrying amount of the related asset by the same amount as the liability associated with the waste disposal obligation. If the asset is subsequently replaced, the obligation is shifted to the producer of the replacement equipment, so the user must calculate that portion of the payment to the replacement equipment producer relating to the transfer of the ARO, and eliminate the associated liability from its statement of financial position, while recognizing a gain or loss based on the difference between the liability on the sale date and that portion of the payment related to the ARO. Meanwhile, the producer of the new asset recognizes revenue for the total amount of the sale, less the fair value of the ARO.

Environmental Remediation Costs

Environmental remediation costs, the costs of cleaning up environmental contamination, are generally expensed as incurred as operating expenses (ASC 410-30-25-16). The exceptions to this general rule that result in capitalizing these costs are as follows:

- If the costs result from legal obligations associated with the eventual retirement of an asset or group of assets they will be capitalized as an ARO, as discussed and illustrated in the previous section of this chapter on ASC 410-20.

- If the costs do not qualify as ARO, but they meet one of the following criteria, they may be capitalized subject to reduction for impairment, if warranted:

- The costs extend the life, increase the capacity, or improve the safety or efficiency of property owned by the reporting entity.

- The costs mitigate or prevent future environmental contamination while also improving the property compared with its condition when originally constructed or acquired by the reporting entity.

- The costs are incurred in preparing for sale a property that is currently held for sale (the application of this criterion must be balanced with the limitation in ASC 360 regarding assets held for sale being carried at the lower of carrying value or, fair value less cost to sell).

(ASC 410-30-25-17)

SEC registrants are required to disclose any significant exposure for asbestos treatment in the management discussion and analysis (MD&A).

Environmental costs associated with the improper operation or use of an asset (e.g., penalties and fines) are specifically excluded from the accounting guidance with respect to ARO and, should they be incurred, under ASC 410-30, they would most likely not qualify to be capitalized under GAAP.

Environmental remediation liabilities.

Obligations arising from pollution of the environment have become a major cost for businesses. ASC 410-30 sets forth a very detailed description of relevant laws, remediation provisions and other pertinent information, which is useful to auditors as well as to reporting entities. In terms of accounting guidance, ASC 43020 contains the principal rules with respect to accounting for environmental obligations (e.g., determining the threshold for accrual of a liability, etc.) and its sets “benchmarks” for liability recognition. The benchmarks for the accrual and evaluation of the estimated liability (i.e., the stages which are deemed to be important to ascertaining the existence and amount of the liability) are:

- The identification and verification of an entity as a potentially responsible party (PRP), since ASC 410-30 stipulates that accrual is to be based on the premise that expected costs will be borne by only the “participating potentially responsible parties” and that the “recalcitrant, unproven and unidentified” PRP will not contribute to costs of remediation

- The receipt of a “unilateral administrative order”

- Participation, as a PRP, in the remedial investigation/feasibility study (RI/FS)

- Completion of the feasibility study

- Issuance of the Record of Decision (RoD)

- The remedial design through operation and maintenance, including postremediation monitoring.

(ASC 430-30-25-15)

The amount of the liability that is to be accrued is affected by the entity's allocable share of liability for a specific site and by its share of the amounts related to the site that will not be paid by the other PRP or the government. The categories of costs to be included in the accrued liability include incremental direct costs of the remediation effort itself, as well as the costs of compensation and benefits for employees directly involved in the remediation effort. Costs are to be estimated based on existing laws and technologies and are not to be discounted to estimated present values unless timing of cash payments is fixed or reliably determinable.

Incremental direct costs will include such items as fees paid to outside law firms for work related to the remediation effort, costs relating to completing the RI/FS, fees to outside consulting and engineering firms for site investigations and development of remedial action plans and remedial actions, costs of contractors performing remedial actions, government oversight costs and past costs, the cost of machinery and equipment dedicated to the remedial actions that do not have an alternative use, assessments by a PRP group covering costs incurred by the group in dealing with a site, and the costs of operation and maintenance of the remedial action, including costs of postremediation monitoring required by remedial action plan.

ASC 410-30 states that potential recoveries cannot be offset against the estimated liability, and further notes that any recovery recognized as an asset is to be reflected at fair value, which implies that only the present value of future recoveries can be recorded. It also stipulates that environmental clean-up costs are not unusual in nature, and thus cannot be shown as extraordinary items in the income statement. Furthermore, it is presumed that the costs are operating in nature and thus cannot normally be included in “other income and expense” category of the income statement, either. Disclosure of accounting policies regarding recognition of the liability and of any related asset (for recoveries from third parties) are also needed, where pertinent.