40 ASC 715 COMPENSATION—RETIREMENT BENEFITS

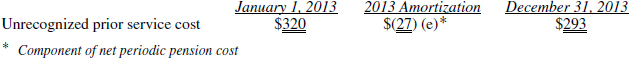

Amortization of unrecognized prior service cost

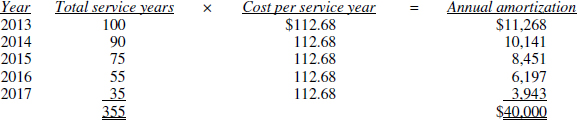

Example of the years-of-service amortization method

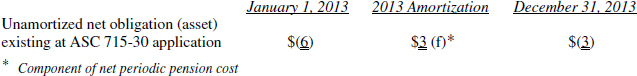

Amortization of unrecognized amount at date of initial ASC 715-30 application

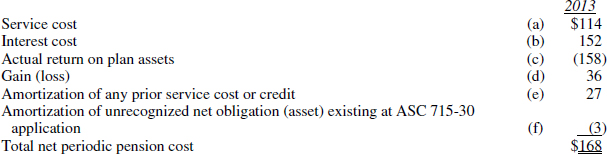

Summary of net periodic pension cost

Reconciliation of Beginning and Ending ABO, PBO, and Plan Assets

Employer's Liabilities and Assets under ASC 715-30

Additional ASC 715-30 Guidance

Reporting Funded Status: Requirements under ASC 715

Reporting when there are multiple plans

Reporting of benefit plan transactions and events in comprehensive income

Reporting loans to participants by defined contribution pension plans

Measurement date for year-end financial statements

Measurement date for interim financial statements

ASC 715 transition considerations

Interim Financial Reporting Requirements

Reporting and Disclosure by Not-for-Profit Entities

Annuity and insurance contracts

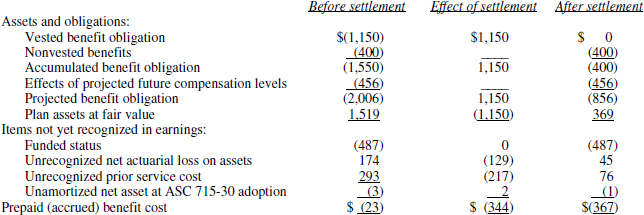

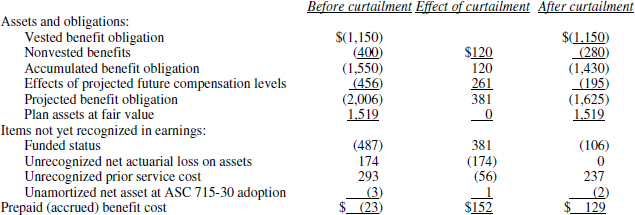

Settlements and Curtailments of Plans

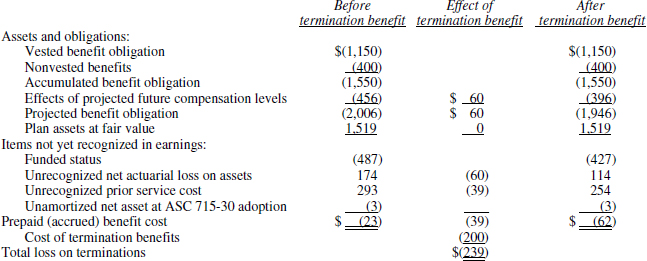

Example of termination benefits

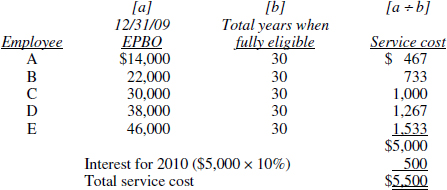

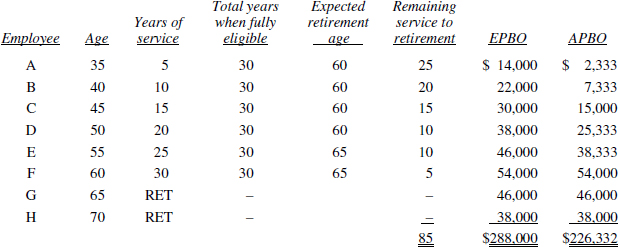

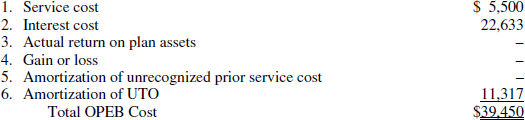

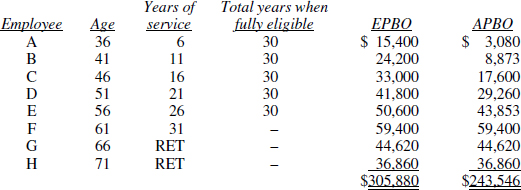

Postretirement Benefits other than Pensions

Accounting for postretirement benefits

Effect of the prescription drug benefit on OPEB computations

Deferred Compensation Contracts

PERSPECTIVE AND ISSUES

Subtopics

ASC 715, Compensation-Retirement Benefits, contains six subtopics:

- ASC 715-10, Overall, sets the objectives and the scope for ASC 715

- ASC 715-20, Defined Benefit Plans—General, provides guidance for single-employer defined benefit pension and other postretirement plans

- ASC 715-30, Defined Benefit Plans—Retirement, provides guidance related to single-employer defined benefit pension plans

- ASC 715-60, Defined Benefit Plans—Other Postretirement, provides guidance on defined benefit plans other than postretirement benefit plans

- ASC 715-70, Defined Contribution Plan, provides guidance on defined contribution plans

- ASC 715-80, Multiemployer Plans, provides guidance on multi-employer plans as opposed to multiple employer plans.

Scope and Scope Exceptions

ASC 715 applies to all entities and many types of compensation arrangements including any arrangement that is in substance a postretirement benefit plan (regardless of its form or means or timing of funding), written and unwritten plans, deferred compensation contracts with individuals which taken together are the equivalent of a plan, and health and other welfare benefits for employees on disability retirement.

ASC 715 does not apply to contracts with “selected employees under individual contracts with specific terms determined on an individual-by-individual basis.” It also does not apply to postemployment benefits paid after employment, but before retirement, like layoff benefits. (ASC 715-10-15-5)

Overview

This chapter focuses on accounting for postretirement benefits, including single-employer and multiemployer plans, defined benefit pension plans, defined contribution pension plans, and postretirement benefit plans other than pensions, such as those that help fund retiree costs of health care benefits. The accounting for such arrangements has historically been difficult, in large part because the accounting standard setters, influenced by preparers and issuers, have seen fit to include a variety of “smoothing” features that—whatever merits they may have—necessitated the use of various accruals and deferrals, and the reporting of certain elements within other comprehensive income. Thus, presentation of benefit plan expense and related items has involved lengthy and complex footnotes, and generally at least some “off the financial statement” measurements.

Accounting Standards Codification (ASC) 715-30, Compensation—Retirement Benefits—Defined Benefit Plans, Pension, specifies the accrual basis of accounting for pension costs. It includes three primary characteristics, which are

- Delayed recognition (changes are not recognized immediately but are subsequently recognized in a gradual and systematic way)

- Reporting net cost (various expense and income items are aggregated and reported as one net amount)

- Offsetting assets and liabilities (assets and liabilities are sometimes shown net).

Estimates and averages may be used as long as material differences do not result. Explicit assumptions and estimates of future events must be used for each specified variable included in pension costs and disclosed in the notes to the financial statements.

ASC 715-30 focuses directly on the terms of the plan to assist in the recognition of compensation cost over the service period of the employees. The full amount of under- and overfunding of pension plans is reported in the statement of financial position.

The principal emphasis of ASC 715-30 is the present value of the pension obligation and the fair value of plan assets. The main accounting issues revolve around the expense to recognize on the income statement and the liability to be accrued on the statement of financial position. As noted above, the periodic expense to be recognized under GAAP is a modified version of the actual economic consequence of the employer's commitment to pay future benefits, because of the substantial use of smoothing. (Over the full time horizon, which is measured in decades, all expense is recognized in results of operations.)

ASC 715-30 establishes standards to be followed by sponsors of defined benefit pension plans when obligations are settled, plans are curtailed, or benefits are terminated.

Although there are some major differences in terminology and measurement, other postretirement benefits (commonly referred to as OPEB) accounting basically follows the fundamental framework established for defined benefit pension accounting and applies to all forms of postretirement benefits other than pensions. In most cases, the main focus is on postretirement health care benefits, since that is by far the most costly commitment made by employers to retirees. ASC 715-60, Compensation—Retirement Benefits—Defined Benefit Plans, Other Postretirement considers OPEB to be a form of deferred compensation and requires accrual accounting. The terms of the individual contract govern the accrual of the employer's obligation for deferred compensation and the cost is attributed to employee service periods until full eligibility to receive benefits is attained. The employer's obligation for OPEB is fully accrued when the employee attains full eligibility for all expected benefits.

As stated in ASC 715, Compensation—Retirement Benefits, some or all of the underfunded postretirement benefit obligations must be displayed in the statement of financial position.

ASC 715-20, Compensation—Retirement Benefits, Defined Benefits Plans, General, eliminates less useful information, requires some additional data deemed useful by analysts, and allows some aggregation of presentation.

DEFINITIONS OF TERMS

Source: ASC 715

Accrued pension cost. Cumulative net pension cost accrued in excess of the employer's contributions.

Accumulated benefit obligation. Actuarial present value of benefits (whether vested or nonvested) attributed by the pension benefit formula to employee service rendered before a specified date and based on employee service and compensation (if applicable) prior to that date. The accumulated benefit obligation differs from the projected benefit obligation in that it includes no assumption about future compensation levels. For plans with flat-benefit or no-pay-related pension benefit formulas, the accumulated benefit obligation and the projected benefit obligation are the same.

Accumulated postretirement benefit obligation. The actuarial present value of benefits attributed to employee service rendered to a particular date. Prior to an employee's full eligibility date, the accumulated postretirement benefit obligation as of a particular date for an employee is the portion of the expected postretirement benefit obligation attributed to that employee's service rendered to that date. On and after the full eligibility date, the accumulated and expected postretirement benefit obligations for an employee are the same.

Actual return on plan assets (component of net periodic postretirement benefit cost). The change in the fair value of the plan's assets for a period including the decrease due to expenses incurred during the period (such as income tax expense incurred by the fund, if applicable), adjusted for contributions and benefit payments during the period. For a funded plan, the actual return on plan assets shall be determined based on the fair value of plan assets (see paragraph 715-60-35-107) at the beginning and end of the period, adjusted for contributions and benefit payments. If the fund holding the plan assets is a taxable entity, the actual return on plan assets shall reflect the tax expense or benefit for the period determined in accordance with generally accepted accounting principles (GAAP). Otherwise, no provision for taxes shall be included in the actual return on plan assets.

Actuarial present value. Value, as of a specified date, of an amount or series of amounts payable or receivable thereafter, with each amount adjusted to reflect (1) the time value of money (through discounts for interest) and (2) the probability of payment (by means of decrements for events such as death, disability, withdrawal, or retirement) between the specified date and the expected date of payment.

Amortization. The process of reducing a recognized liability systematically by recognizing revenues or by reducing a recognized asset systematically by recognizing expenses or costs. In accounting for postretirement benefits, amortization also means the systematic recognition in net periodic postretirement benefit cost over several periods of amounts previously recognized in other comprehensive income, that is, gains or losses, prior service cost or credits, and any transition obligation or asset.

Annuity contract. Irrevocable contract in which an insurance company1 unconditionally undertakes a legal obligation to provide specified benefits to specific individuals in return for a fixed consideration or premium. It involves the transfer of significant risk from the employer to the insurance company. Participating annuity contracts provide that the purchaser (either the plan or the employer) may participate in the experience of the insurance company. The insurance company ordinarily pays dividends to the purchaser. If the substance of a participating annuity contract is such that the employer remains subject to all or most of the risks and rewards associated with the benefit obligation covered or the assets transferred to the insurance company, the purchase of the contract does not constitute a settlement.

Assumed per Capita Claims Cost (by Age). The annual per capita cost, for periods after the measurement date, of providing the postretirement health care benefits covered by the plan from the earliest age at which an individual could begin to receive benefits under the plan through the remainder of the individual's life or the covered period, if shorter. To determine the assumed per capita claims cost, the per capita claims cost by age based on historical claims costs is adjusted for assumed health care cost trend rates. The resulting assumed per capita claims cost by age reflects expected future costs and is applied with the plan demographics to determine the amount and timing of future gross eligible charges.

Assumptions. Estimates of the occurrence of future events affecting pension costs, such as mortality, withdrawal, disablement and retirement, changes in compensation and national pension benefits, and discount rates to reflect the time value of money.

Attribution. Process of assigning pension benefits or cost to periods of employee service.

Attribution period. The period of an employee's service to which the expected postretirement benefit obligation for that employee is assigned. The beginning of the attribution period is the employee's date of hire unless the plan's benefit formula grants credit only for service from a later date, in which case the beginning of the attribution period is generally the beginning of that credited service period. The end of the attribution period is the full eligibility date. Within the attribution period, an equal amount of the expected postretirement benefit obligation is attributed to each year of service unless the plan's benefit formula attributes a disproportionate share of the expected postretirement benefit obligation to employees' early years of service. In that case, benefits are attributed in accordance with the plan's benefit formula.

Career-average-pay formula. Benefit formula that bases benefits on the employee's compensation over the entire period of service with the employer. A career-average-pay plan is a plan with such a formula.

Contributory plan. Pension plan under which employees contribute part of the cost. In some contributory plans, employees wishing to be covered must contribute. In other contributory plans, employee contributions result in increased benefits.

Credited Service Period. Employee service period for which benefits are earned pursuant to the terms of the plan. The beginning of the credited service period may be the date of hire or a later date. For example, a plan may provide benefits only for service rendered after a specified age. Service beyond the end of the credited service period does not earn any additional benefits under the plan.

Curtailment (of a Postretirement Benefit Plan). An event that significantly reduces the expected years of future service of active plan participants or eliminates the accrual of defined benefits for some or all of the future services of a significant number of active plan participants.

Defined benefit pension plan. Pension plan that defines an amount of pension benefit to be provided, usually as a function of one or more factors such as age, years of service, or compensation. Any pension plan that is not a defined contribution pension plan is, for purposes of ASC 715-30, a defined benefit pension plan.

Defined contribution pension plan. A pension plan that defines an amount of pension benefit to be provided, usually as a function of one or more factors such as age, years of service, or compensation. Any pension plan that is not a defined contribution pension plan is, for purposes of Subtopic 715-30, a defined benefit pension plan.

Expected long-term rate of return on plan assets. Assumption as to the rate of return on plan assets reflecting the average rate of earnings expected on the funds invested or to be invested to provide for the benefits included in the projected benefit obligation.

Expected postretirement benefit obligation. The actuarial present value as of a particular date of the benefits expected to be paid to or for an employee, the employee's beneficiaries, and any covered dependents pursuant to the terms of the postretirement benefit plan.

Expected return on plan assets. Amount calculated as a basis for determining the extent of delayed recognition of the effects of changes in the fair value of assets. The expected return on plan assets is determined based on the expected long-term rate of return on plan assets and the market-related value of plan assets.

Explicit approach to assumptions. Approach under which each significant assumption used reflects the best estimate of the plan's future experience solely with respect to that assumption.

Fair value. The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Final-pay formula. Benefit formula that bases benefits on the employee's compensation over a specified number of years near the end of the employee's service period or on the employee's highest compensation periods. For example, a plan might provide annual pension benefits equal to 1% of the employee's average salary for the last five years (or the highest consecutive five years) for each year of service.

Flat-benefit formula. A plan with a benefit formula that bases benefits on a fixed amount per year of service, such as $20 of monthly retirement income for each year of credited service.

Full eligibility (for benefits). The status of an employee having reached the employee's full eligibility date. Full eligibility for benefits is achieved by meeting specified age, service, or age and service requirements of the postretirement benefit plan.

Full eligibility date. The date at which an employee has rendered all of the service necessary to have earned the right to receive all of the benefits expected to be received by that employee (including any beneficiaries and dependents expected to receive benefits). Determination of the full eligibility date is affected by plan terms that provide incremental benefits expected to be received by or on behalf of an employee for additional years of service, unless those incremental benefits are trivial. Determination of the full eligibility date is not affected by plan terms that define when benefit payments commence or by an employee's current dependency status.

Fund. Used as a verb, to pay over to a funding agency (as to fund future pension benefits or to fund pension cost). Used as a noun, assets accumulated in the hands of a funding agency for the purpose of meeting pension benefits when they become due.

Funding policy. Program regarding the amounts and timing of contributions by the employer(s), participants, and any other sources (for example, state subsidies or federal grants) to provide the benefits a pension plan specifies.

Gain or loss. A change in the value of either the projected benefit obligation or the plan assets resulting from experience different from that assumed or from a change in an actuarial assumption. Gains and losses that are not recognized in net periodic pension cost when they arise are recognized in other comprehensive income. Those gains or losses are subsequently recognized as a component of net periodic pension cost based on the amortization provisions of Subtopic 715-30.

Gain or loss component (of net periodic pension cost). A change in the value of either the accumulated postretirement benefit obligation or the plan assets resulting from experience different from that assumed or from a change in an actuarial assumption, or the consequence of a decision to temporarily deviate from the substantive plan. Gains or losses that are not recognized in net periodic postretirement benefit cost when they arise are recognized in other comprehensive income. Those gains or losses are subsequently recognized as a component of net periodic postretirement benefit cost based on the recognition and amortization provisions of Subtopic 715-60.

Interest cost component (of net periodic pension cost). Increase in the projected benefit obligation due to passage of time.

Market-related value of plan assets. Balance used to calculate the expected return on plan assets. Market-related value can be either fair value or a calculated value that recognizes changes in fair value in a systematic and rational manner over not more than five years. Different ways of calculating market-related value may be used for different classes of assets, but the manner of determining market-related value must be applied consistently from year to year for each asset class. For a method to meet the criteria of being systematic and rational, it must reflect only the changes in the fair value of plan assets between various dates.

Measurement date. Date at which plan assets and obligations are measured.

Mortality. The relative incidence of death in a given time or place.

Mortality rate. Proportion of the number of deaths in a specified group to the number living at the beginning of the period in which the deaths occur. Actuaries use mortality tables, which show death rates for each age, in estimating the amount of pension benefits that will become payable.

Multiemployer plan. A pension or postretirment benefit plan to which two or more unrelated employers contribute, usually pursuant to one or more collective-bargaining agreements. A characteristic of multiemployer plans is that assets contributed by one participating employer may be used to provide benefits to employees of other participating employers since assets contributed by an employer are not segregated in a separate account or restricted to provide benefits only to employees of that employer. A multiemployer plan is usually administered by a board of trustees composed of management and labor representatives and may also be referred to as a joint trust or union plan. Generally, many employers participate in a multiemployer plan, and an employer may participate in more than one plan. The employers participating in multiemployer plans usually have a common industry bond, but for some plans the employers are in different industries and the labor union may be their only common bond. Some multiemployer plans do not involve a union. For example, local chapters of a not-for-profit entity (NFP) may participate in a plan established by the related national organization.

Net periodic pension cost. Amount recognized in an employer's financial statements as the cost of a pension plan for a period. Components of net periodic pension cost are service cost, interest cost, actual return on plan assets, gain or loss, amortization of unrecognized prior service cost, and amortization of the unrecognized net obligation or asset existing at the date of initial application of ASC 715-30. The term “net periodic pension cost” is used instead of “net pension expense” because part of the cost recognized in a period may be capitalized as part of an asset such as inventory.

Plan amendment. Change in terms of an existing plan or the initiation of a new plan. A plan amendment may increase benefits, including those attributed to years of service already rendered. See also Retroactive benefits.

Plan Curtailment. Event that significantly reduces the expected years of future service of present employees or eliminates for a significant number of employees the accrual of defined benefits for some or all of their future services.

Postretirement benefits. All forms of benefits, other than retirement income, provided by an employer to retirees. Those benefits may be defined in terms of specified benefits, such as health care, tuition assistance, or legal services, that are provided to retirees as the need for those benefits arises or they may be defined in terms of monetary amounts that become payable on the occurrence of a specified event, such as life insurance benefits.

Prepaid pension cost. Cumulative employer contributions in excess of accrued net pension cost.

Prior service cost. The cost of benefit improvements attributable to plan participants' prior service pursuant to a plan amendment or a plan initiation that provides benefits in exchange for plan participants' prior service.

Projected benefit obligation. Actuarial present value as of a date of all benefits attributed by the pension benefit formula to employee service rendered prior to that date. The projected benefit obligation is measured using assumptions as to future compensation levels if the pension benefit formula is based on those future compensation levels (pay-related, final-pay, final-average-pay, or career-average-pay plans).

Retroactive benefits. Benefits granted in a plan amendment (or initiation) that are attributed by the pension benefit formula to employee services rendered in periods prior to the amendment. The cost of the retroactive benefits is referred to as prior service cost.

Service. Employment taken into consideration under a pension plan. Years of employment before the inception of a plan constitute an employee's past service; years thereafter are classified in relation to the particular actuarial valuation being made or discussed. Years of employment (including past service) before the date of a particular valuation constitute prior service; years of employment following the date of the valuation constitute future service; a year of employment adjacent to the date of valuation, or in which such date falls, constitutes current service.

Service cost component (of net periodic pension cost). Actuarial present value of benefits attributed by the pension benefit formula to services rendered by employees during the period. The service cost component is a portion of the projected benefit obligation and is unaffected by the funded status of the plan.

Settlement. Transaction that (1) is an irrevocable action, (2) relieves the employer (or the plan) of primary responsibility for a pension benefit obligation, and (3) eliminates significant risks related to the obligation and the assets used to effect the settlement.

Substantive plan. The terms of the postretirement benefit plan as understood by an employer that provides postretirement benefits and the employees who render services in exchange for those benefits. The substantive plan is the basis for the accounting for that exchange transaction. In some situations an employer's cost-sharing policy, as evidenced by past practice or by communication of intended changes to a plan's cost-sharing provisions, or a past practice of regular increases in certain monetary benefits may indicate that the substantive plan differs from the existing written plan.

Transition obligation. The unrecognized amount, as of the date ASC 715-60 is initially applied, of (1) the accumulated postretirement benefit obligation in excess of (2) the fair value of plan assets plus any recognized accrued postretirement benefit cost or less any recognized prepaid postretirement benefit cost.

Unfunded accumulated benefit obligation. Excess of the accumulated benefit obligation over plan assets.

CONCEPTS, RULES, AND EXAMPLES

The principal objective of ASC 715-30 is to measure the compensation cost associated with employees' benefits and to recognize that cost over the employees' service period. This Subtopic is concerned only with the accounting aspects of pension costs. The funding (assets set aside to meet future payment obligations) of the benefits is not covered and is considered to be a financial management matter.

When an entity provides benefits that can be estimated in advance to its retired employees and their beneficiaries, the arrangement is a pension plan. The accounting for most types of retirement plans is covered by ASC 715-30. These plans include unfunded, insured, trust fund, defined contribution and defined benefit plans, and deferred compensation contracts, if equivalent. Independent deferred profit sharing plans and pension payments to selected employees on a case-by-case basis are not considered pension plans. The typical plan is written and the amount of benefits can be determined by reference to the associated documents. The plan and its provisions can also be implied, however, from unwritten but established past practices.

The establishment of a pension plan represents a commitment to employees that is of a long-term nature. Although some companies manage their own plans, this commitment usually takes the form of contributions made to an independent trustee. These contributions are used by the trustee to invest in plan assets of various types (treasury bonds and bills, certificates of deposit, annuities, marketable securities, corporate bonds, etc.). The plan assets are expected to generate a return generally in the form of interest, dividends, and/or appreciation in asset value. The return on the plan assets (and occasionally the proceeds from their liquidation) provides the trustee with cash to pay the benefits to which the employees are entitled. These benefits, in turn, are defined by the plan's benefit formula. The benefit formula incorporates many factors including employee compensation, employee service longevity, employee age, and the like, and is considered to provide the best indication of pension obligations and costs. It is used as the basis for determining the pension cost recognized in the financial statements each fiscal year.

Net Periodic Pension Cost

A pension plan creates long-term obligations. It is assumed that a company will continue to provide retirement benefits well into the future. The accounting for the plan's costs is reflected in the financial statements, and these amounts are not discretionary. All pension costs incurred are recognized as expenses but, under the smoothing approach taken by ASC 715-30 and ASC 715-60, recognition of some elements of pension and postretirement benefit expense may be partially deferred until later periods.

Because pension obligations are long-term liabilities, there was a consensus of opinion, when ASC 715-30 was being written, that some current period effects should not be fully recognized in earnings as they occurred. Short-term fluctuations in interest rates, market prices of plan investments, and other factors could, if recognized as incurred, cause material swings in the net periodic pension cost and net income to be reported in the financial statements of the employer/sponsor. It was thought that such fluctuations would quite likely be offset by reversals in subsequent periods—for example, market declines in one period would be followed by market upward movements in later periods.

This possibility has traditionally been cited to justify the use of smoothing techniques in order to recognize certain of these changes in a systematic and rational manner (e.g., by amortization) instead of recognizing them immediately.

The benefits earned and costs recognized over the employees' service periods are computed by reference to the pension plan's benefit formula. Net periodic pension cost consists of the sum of the following six components:

- Service cost

- Interest cost on projected benefit obligation

- Actual return on plan assets

- Gain or loss

- Amortization of unrecognized prior service cost

- Amortization of unrecognized net assets or net obligation existing at date of initial application of ASC 715-30.

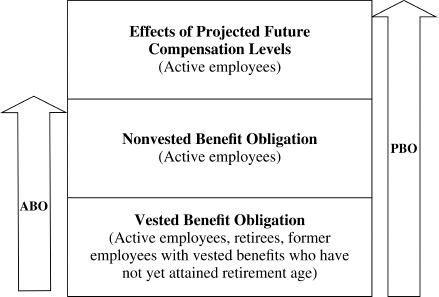

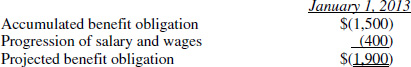

Pension plans may or may not be sensitive to future salary progression. The obligation, in present value terms, for future pension payments including the effects of future compensation adjustments is referred to as the projected benefit obligation, while the obligation computed without regard to salary progression is called the accumulated benefit obligation. For those plans that do not depend on salary progression, the accumulated and the projected benefit obligations are the same.

To calculate the net periodic pension cost, the accumulated benefit obligation (ABO) and the projected benefit obligation (PBO) must both be computed. Both of these obligation amounts are actuarially determined using the actuarial present value of benefits earned that are attributable to services rendered by the employee to the date of the computation. Under the provisions of most pension plans, PBO provides a more relevant measure of the estimated cost of the benefits to be paid upon retirement. This is because the benefit formula set forth in the plan normally results in increases in future pension benefits based on increases in the employee's compensation.

Pay-related, final-pay, or career-average-pay plans are examples of plans where future payments are based on future compensation levels. These plans measure benefits based on service performed to date but include assumptions as to future compensation increases, staff turnover rates, etc. In non-pay-related or flat-benefit plans, both obligations (ABO and PBO) are the same.

The following discussion employs a component-by-component analysis, providing a series of examples that cumulatively build to the comprehensive summary of net periodic pension costs and the sample pension disclosures that follow. Key amounts are cross-referenced between examples using parenthesized lowercase letters [(a), (b), etc.]. In accordance with accounting convention, obligations and increases thereto are presented in parentheses.

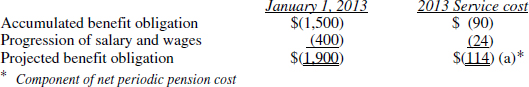

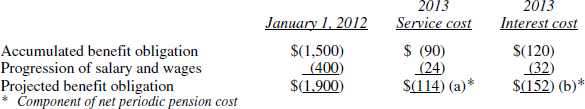

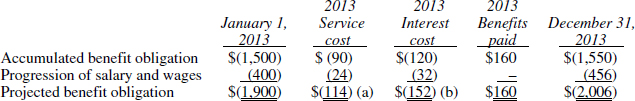

The expected progression of salary and wages is added to the accumulated benefit obligation to arrive at the projected benefit obligation. These amounts are provided by the actuary in a pension plan report.

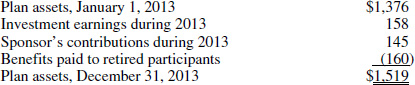

Computation of the amounts to be presented on the statement of financial position requires the determination of plan assets. Plan assets include contributions made by the employer that sponsors the pension plan (sponsor) plus the net earnings on the plan's investments (dividends, interest, and asset appreciation, less asset depreciation), less benefits paid to retired participants.

Service costs.

This component of net periodic pension cost is the actuarial present value of benefits attributed during the current period. Under ASC 715-30, the plan's benefit formula is the key to attributing benefits to employee service periods. In most cases, this attribution is straightforward.

If the benefit formula is ambiguous, the accounting for pension service costs must be based on the substantive plan. In some cases, this means that if an employer has committed to make future amendments to provide benefits greater than those written in the plan, that commitment is the basis for the accounting. The relevant facts regarding that implicit commitment are disclosed.

Employers use pensions as a compensation tool to aid in the recruitment and long-term retention of employees. To provide incentives for employees to continue their employment with the company over time, plan participants' rights to receive present or future pension benefits are often conditioned on continued employment with the employer/plan sponsor for a specified period. As the conditions are satisfied, the employee is said to “vest” in that portion of the future benefits that become unconditional.

Vesting schedules can result in a disproportionate share of plan benefits being attributed to later years of employment. In this situation, instead of applying the benefit formula, proportions or ratios are used to attribute projected benefits to years of service in a manner that more equitably reflects the substance of timing of earning of the employee benefits. Normally, the actuary accomplishes this by attributing plan benefits to completed years of service by multiplying total benefits by the following ratio:

![]()

Certain types of benefits are not includable in vested benefits (e.g., death or disability benefit) and, thus, require a different allocation formula to attribute them to years of service. If the plan's benefit formula does not specify how to relate the benefit to years of service, the following formula is used by the actuary to attribute the benefits to years of service:

![]()

ASC 715-30 actuarial assumptions must reflect plan continuation, must be consistent as to future economic expectations, and must be the best estimate in regard to each individual assumption. It is not acceptable to determine that the aggregate assumptions are reasonable if any of the individual assumptions are unreasonable.

The discount rate used in the calculation of service costs is the rate at which benefits could be settled. Examples include those rates in current annuity contracts, those published by the Pension Benefit Guaranty Corporation (PBGC), and those that reflect returns on high-quality, fixed-income investments.

Future compensation is considered in the calculation of the service cost component to the extent specified by the benefit formula. To the degree considered in the benefit formula, future compensation includes changes due to advancement, longevity, inflation, etc. Indirect effects, such as predictable bonuses based on compensation levels, and automatic increases specified by the plan also need to be considered. The effect of retroactive amendments is included in the calculation when the employer has contractually agreed to them. Service costs attributed during the period increase both the ABO and PBO, since they result in additional benefits to be payable in the future.

The current period service cost component is found in the actuarial report.

Interest on PBO.

The PBO is a discounted amount. It represents the discounted actuarial present value, at the date of the valuation, of all benefits attributed under the plan's formula to employee service rendered prior to that date. Each year, when the actuary calculates the end-of-year PBO, it is one year closer to the year in which the benefits attributed in prior years will be paid to participants. Consequently, the present value of those previously attributed benefits will have increased to take into account the time value of money. This annual increase, computed by multiplying the assumed settlement discount rate times the PBO at the beginning of the year, increases net periodic pension cost and PBO.

Since this “interest” cost is accounted for as part of pension cost, it is not treated as interest for the purposes of computing capitalized interest under ASC 835-20.

The interest cost component is calculated by multiplying the start of the year obligation balances by an assumed 8% settlement rate. This amount is found in the actuarial report.

Benefits paid.

Benefits paid to retirees are deducted from the above to arrive at the end of the year statement of financial position amounts of the accumulated benefit obligation and the projected benefit obligation.

Benefits of $160 were paid to retirees during the current year. This amount is found in the report of the pension plan trustee.

Actual return on plan assets.

This component is the difference between the fair value of the plan assets at the end of the period and the fair value of the plan assets at the beginning of the period adjusted for contributions and payments during the period. Another way to express the result is that it is the net (realized and unrealized) appreciation and depreciation of plan assets plus earnings from the plan assets for the period.

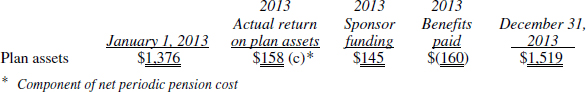

The actual return on plan assets of $158, cash deposited with the trustee of $145, and benefits paid ($160) are amounts found in the report of the pension plan trustee. These items increase the plan assets to $1,519 at the end of the year. The actual return on plan assets is adjusted, however, to the expected long-term rate (9% assumed) of return on plan assets ($1,376 × 9% = $124). The difference ($158 − $124 = $34) is a return on asset adjustment and is deferred as a gain (loss). The return on asset adjustment is a component of net periodic pension cost and is discussed in detail in the following section.

ASC 715 requires that measurements of defined benefit plan assets and obligations must (with limited exceptions) be as of the date of the statement of financial position of the respective reporting entity.

Gain or loss.

Gains (losses) result from (1) changes in plan assumptions, (2) changes in the amount of plan assets, and (3) changes in the amount of the projected benefit obligation. As discussed previously, even though these gains or losses are economic events that impact the sponsor's obligations under the plan, immediately upon their occurrence, their instantaneous recognition in the sponsor's results of operations is not permitted by ASC 715-30. Instead, to provide “smoothing” of the effects of what are viewed as being short-term fluctuations, the net gain (loss) is amortized if it meets certain criteria specified below.

ASC 715 requires that actuarial gains and losses be given recognition in other comprehensive income as they occur, thus affecting statement of financial position display in full, even as the expense recognition is deferred and amortized. If actuarial gains are realized, this will give rise to a pension- or other benefit plan-related asset (or reduction in a pension- or benefit plan-related liability); if actuarial losses are incurred, these will give rise to a benefit plan liability, or reduction in an extant plan asset.

Since actuarial cost methods are based on numerous assumptions (employee compensation, mortality, turnover, earnings of the pension plan, etc.), it is not unusual for one or more of these assumptions to be invalidated by changes over time. Adjustments will invariably be necessary to bring prior estimates back into line with actual events. These adjustments are known as actuarial gains (losses). The accounting issue regarding the recognition of actuarial adjustments is their timing. All pension costs must eventually be recognized as expense. Actuarial gains (losses) are not considered prior period adjustments since they result from a refinement of estimates arising from obtaining subsequent information. These are considered changes in an estimate, and are to be recognized in current and future periods (i.e., prospectively only).

Plan asset gains (losses) result from both realized and unrealized amounts. They represent periodic differences between the actual return on assets and the expected return. The expected return is generated by multiplying the expected long-term rate of return by the market-related value of plan assets. Market-related value is a concept unique to pension accounting. It results from the previously discussed actuarial smoothing techniques under ASC 715-30.

Market-related value consists of two components. The first component is the fair value of the plan assets. The second component is an adjustment for the unrecognized portion of previous years' market gains or losses that are being amortized over a period of five years or less using a consistently applied method. Consistently applied means from year to year for each asset class (i.e., bonds, equities), since different classes of assets may have their market-related value calculated in a different manner (i.e., fair value in one case, moving average in another case). Thus, the market-related value may be fair value, but it also may be other than fair value if all or a portion of it results from calculation.

Plan asset gains (losses) include both (1) changes in the market-related value of assets (regardless of definition) from one period to another and (2) any changes that are not yet reflected in market-related value (i.e., the difference between the actual fair values of assets and the calculated market-related values). Only the former changes are recognized and amortized. The latter changes are recognized over time through the calculated market-related values. Differences between the actual amount of PBO from the assumed amount will also result in gain (loss).

Irrespective of the income smoothing techniques used, if this unrecognized net gain (loss) exceeds a “corridor” of 10% of the greater of the beginning balances of the market-related value of plan assets or the projected benefit obligation, a minimum amount of amortization is required. The excess over 10% is divided by the average remaining service period of active employees and included as a component of net pension costs. Average remaining life expectancies of inactive employees may be used if that is a better measure due to the demographics of the plan participants. ASC 715-30 sets forth a methodology for the deferred recognition of the income statement effects of actuarial changes pertaining to plan assets and obligations.

Net pension costs include only the expected return on plan assets. Any difference between actual and expected returns is deferred through the gain (loss) component of net pension cost. If actual return is greater than expected return, net pension cost is increased to adjust the actual return to the lower expected return. If expected return is greater than actual return, the adjustment results in a decrease to net pension cost to adjust the actual return to the higher expected return. If the unrecognized net gain (loss) is large enough, it is amortized. Conceptually, the expected return represents the best estimate of long-term performance of the plan's investments. In any given year, however, an unusual short-term result may occur given the volatility of financial markets.

The expected long-term rate of return used to calculate the expected return on plan assets is the average rate of return expected to be earned on invested funds to provide for pension benefits included in the PBO. Present rates of return and expected future reinvestment rates of return are considered in arriving at the rate to be used.

To summarize, net periodic pension cost includes a gain (loss) component consisting of both of the following, if applicable:

- As a minimum, the portion of the unrecognized net gain (loss) from previous periods that exceeds the greater of 10% of the beginning balances of the market-related value of plan assets or the PBO, usually amortized over the average remaining service period of active employees expected to receive benefits.

- The difference between the expected return and the actual return on plan assets.

An accelerated method of amortization of unrecognized net gain (loss) is acceptable if it is applied consistently to both gains and losses, and if the method is disclosed in the notes to the financial statements. In all cases, at least the minimum amount discussed above must be amortized.

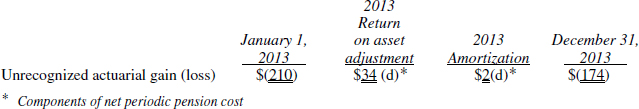

The return on asset adjustment of $34 is the difference between the actual return of $158 and the expected return of $124 on plan assets. The actuarial loss at the start of the year ($210 assumed) is amortized if it exceeds a “corridor” of the larger of 10% of the projected benefit obligation at the beginning of the period ($1,900 × 10% = $190) or 10% of the fair value of plan assets ($1,376 × 10% = $138). In this example, $20 ($210 − $190) is amortized by dividing the years of average remaining service (twelve years assumed), with a result rounded to $2. The straight-line method is used, and it is assumed that market-related value is the same as fair value.

Amortization of unrecognized prior service cost.

Prior service costs are incurred when the sponsor adopts plan amendments that increase plan benefits attributable to services rendered by plan participants in the past. These costs are accounted for as a change in estimate. Prior service costs are measured at the amendment date by the increase in the projected benefit obligation. The remaining service period of every active employee expected to receive benefits is estimated, and an equal amount of prior service cost is assigned to each future period. This is called the years-of-service amortization method.

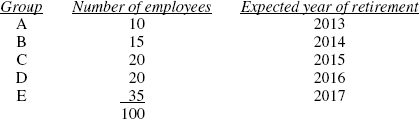

The ABC Company amends its pension plan, granting $40,000 of prior service costs to its 100 employees. The employees are expected to retire in accordance with the following schedule:

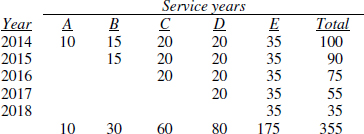

The calculation of the service years to be recognized from this group is as follows:

Consequently, there are 355 service years over which the $40,000 prior service cost can be spread, which equates to $112.68 per service year. The following table shows the annual amortization expense based on the standard charge of $112.68 per service year.

The foregoing example illustrates the years-of-service amortization method. Consistent use of an accelerated amortization method is also acceptable and must be disclosed if used.

If most of the plan's participants are inactive, remaining life expectancy is used as a basis for amortization instead of estimated remaining service period. If economic benefits will be realized by plan participants over a shorter period than remaining service period, amortization of costs is accelerated to recognize the costs in the periods that the participants benefit. If an amendment reduces the projected benefit obligation, unrecognized prior service costs are reduced to the extent that they exist and any excess is amortized in the manner described above for benefit increases.

Unrecognized prior service cost ($320) is amortized over the years of average remaining service (twelve years assumed) at the amendment date with a result rounded to $27. The straight-line method was used. These amounts are found in the actuarial report.

While the vast preponderance of changes to plans increase benefits with credit for prior service, there may be plan amendments that reduce benefits, also with reference to past service. In such instances, under ASC 715, the decreases to the projected benefit obligation are given immediate recognition. The reduction in benefits is to be recognized as a credit (referred to as a prior service credit) to other comprehensive income, which is to be used to offset any remaining prior service cost included in accumulated other comprehensive income (i.e., from previous plan amendments increasing benefits). Any remaining prior service credit is to be amortized as a component of net periodic pension cost on the same basis as the cost of a benefit increase.

Thus, under requirements established by ASC 715, changes in prior service costs (and in certain other components affecting pension and other postretirement benefit costs) arising in a given reporting period, but not included in current period pension or other benefit costs (e.g., due to the above-described amortization requirements) are fully reported in other comprehensive income.

Amortization of unrecognized amount at date of initial ASC 715-30 application.

ASC 715-30 has been GAAP for more than twenty years, and few plans likely still remain with unamortized transition amounts. The difference between the PBO and the fair value of plan assets minus recognized prepaid or plus accrued pension cost at the beginning of the fiscal year of the initial ASC 715-30 application was to be amortized using the straight-line method over the average remaining active employee service period. If the average remaining service period was less than fifteen years, the employer could elect to use a fifteen-year period. If all or almost all of a plan's participants were inactive, the employer used the inactive participants' average remaining life expectancy.

NOTE: Solely for purposes of illustrating amortization of an unrecognized amount at transition, implementation of ASC 715-30 is assumed to be currently taking place.

At initial adoption of ASC 715-30, the “transition amount” was computed as an asset of $48. This transition asset is being amortized using the straight-line method over sixteen years ($3 per year), which represents the average remaining service period of employees expected to receive benefits under the plan at transition. Thus, the unamortized balance at January 1, 2013, was $6 and the amortization for 2013 was $3. These amounts would be found in the actuarial report.

Summary of net periodic pension cost.

The components that were identified in the above examples are summed as follows to determine the amount defined as net periodic pension cost:

One possible source of confusion is the actual return on plan assets ($158) and the unrecognized gain of $36 that net to $122. The actual return on plan assets reduces pension cost because, to the extent that plan assets generate earnings, those earnings help the plan sponsor subsidize the cost of providing the benefits. Thus, the plan sponsor will not have to fund benefits as they become due, to the extent that plan earnings provide the plan with cash to pay those benefits. This reduction, however, is adjusted by increasing pension cost by the difference between actual and expected return of $34 and the amortization of the excess actuarial loss of $2, for a total of $36. The net result is to include the expected return of $124 ($158 − $34) less the amortization of the excess of $2 for a total of $122 ($158 − $36). In recognizing the components of net periodic pension costs, ASC 715-20 requires the disclosure of this expected return of $124 and the loss of $2.

Note that, while the components of periodic pension cost nominally remain the same under ASC 715 as under preamendment ASC 715-30, two of the components have changed in substance. Amortization of prior service cost previously meant the income statement recognition of what had in prior periods been an amount not given any financial statement recognition. Now, however, the prior service cost is included in accumulated other comprehensive income, and then amortized, under the formula set forth by ASC 715-30, to pension cost.

Second, the amortization of gain or loss (which pertains to actuarially driven changes to the projected benefit obligation, as well as to asset valuation adjustments not recognized in current income), which under ASC 715-30 was not given financial statement recognition before the point in time when they were to be included in pension cost, now is associated with an item incorporated in accumulated other comprehensive income.

Thus, under ASC 715 there is display of both prior service costs and actuarial gains or losses immediately upon the occurrence or determination of the item, but there is still deferred recognition in expense via the ASC 715-30-prescribed amortization process, set forth above.

If any transition amount dating from the adoption of ASC 715-30 still exists, that too must be recorded in accumulated other comprehensive income upon adoption of ASC 715, and amortization over any remaining period as originally determined when ASC 715-30 was adopted will continue as prescribed under that standard.

Under ASC 715, there will be both the componentized periodic pension expense and changes to the amounts reported in other comprehensive income, although for nonpublic entities the components of pension cost may be omitted. The suggested informative (i.e., footnote) form of disclosure consists of two tables, and is as follows for a publicly held reporting entity (these amounts, which assume partial funding of other postretirement benefits, are not related to the earlier examples):

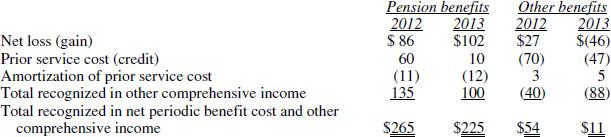

Components of net periodic benefit cost and other amounts recognized in other comprehensive income

Other changes in plan assets and benefit obligations recognized in other comprehensive income

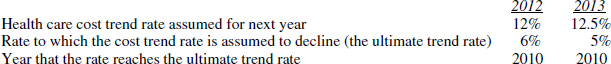

Finally, the assumptions used in computing projected and accumulated benefits and expected return on plan assets must be disclosed. For postretirement health benefits, so-called sensitivity data must also be presented, since the amount of this often significant and most commonly unfunded future obligation is highly responsive to changes in health care cost levels. The following tables set forth these key parameters:

Assumptions

Weighted-average assumptions used to determine benefit obligations at December 31

Weighted-average assumptions used to determine net periodic benefit cost for years ended December 31

![]()

Assumed health care cost trend rates at December 31

Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plans. A one-percentage-point change in assumed health care cost trend rates (not required for nonpublic reporting entities) would have the following effects:

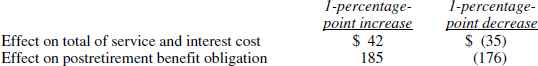

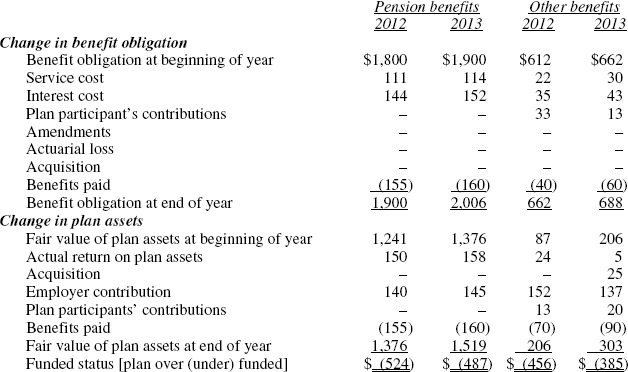

Reconciliation of Beginning and Ending ABO, PBO, and Plan Assets

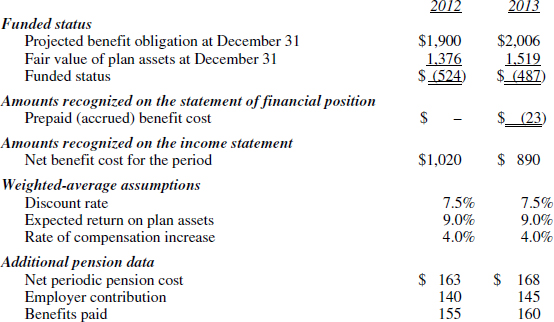

The following table summarizes the 2013 activity affecting ABO, PBO, and plan assets and reconciles the beginning and ending balances per the actuarial report:

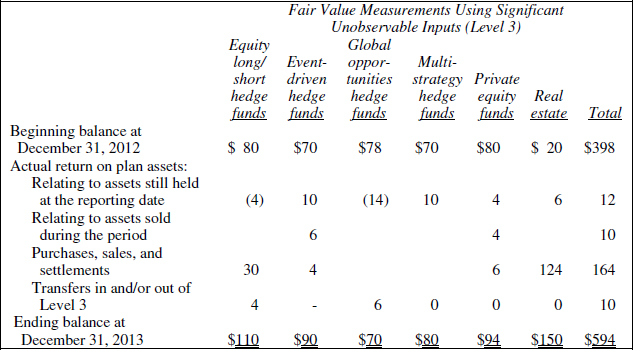

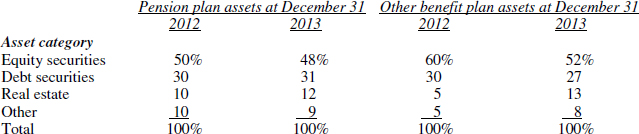

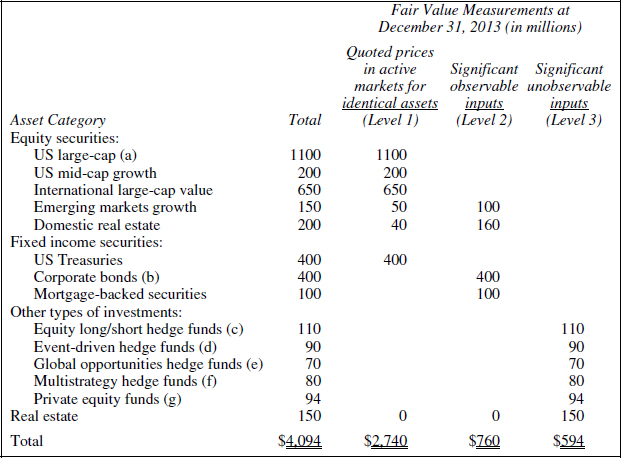

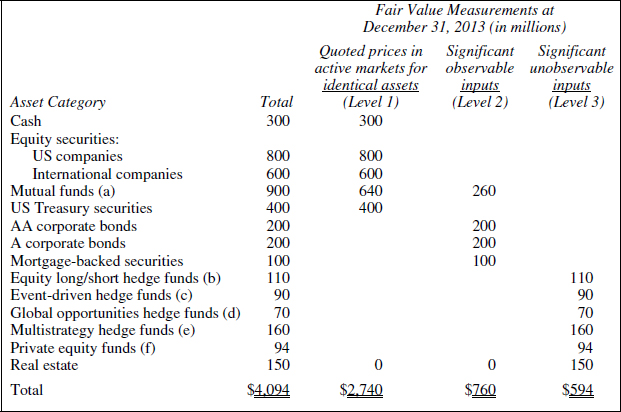

Expanded disclosure is now required regarding the portfolio assets maintained to pay future pension and other postretirement benefits. This information should be presented in a tabular format illustrated as follows:

Plan assets.

The entity's pension plan weighted-average asset allocations at December 31, 2012 and 2013, by asset category are as follows:

The foregoing allocation information should be accompanied by an entity-specific narrative description of investment policies and strategies for plan assets, including weighted-average target asset allocations, where such are used as part of those policies and strategies. If the reporting entity holds its own shares in the trusteed assets of the plan(s), this fact, and the amounts held at each reporting date, should also be set forth.

Employer's Liabilities and Assets under ASC 715-30

Accounting for defined benefit plans remains a controversial topic. In particular, the fact that plan assets and liabilities are, with certain exceptions, not considered to be the employers' assets and liabilities, continues to be a contentious issue. When ASC 715-30 was first imposed, the FASB concluded that full imposition of accrual-basis recognition rules would have caused unacceptably large adjustments to the financial statements of companies whose plans were materially underfunded. The adjustments would have been necessary to recognize previously unrecognized assets or liabilities representing the differences between PBO and the fair value of plan assets. To ease the perceived burden on these plan sponsors, FASB developed a compromise minimum liability approach for ASC 715-30. This minimum liability was computed by reference to the excess of the ABO (which is a smaller obligation than the PBO, since it does not recognize projected future compensation increases) over the fair value of the plan assets. Note that, for the purpose of this calculation, the fair value of the assets was used, rather than the market-related value that was used to calculate the expected return on plan assets. To the extent that there was a pension liability already recorded, the sponsor needed only to recognize the additional amount necessary to increase the recorded liability to the amount of the minimum liability.

The theory behind using the ABO was the fact that, if the pension plan were terminated at the date of the statement of financial position, the future compensation increases would never occur and the pension obligation could be settled for the smaller amount. Some might argue that this approach conflicted with the underlying going concern assumption that is fundamental to financial accounting theory. ASC 715 has eliminated the minimum liability approach of ASC 715-30, and the full amount of over- or underfunding of pension plans must now be displayed in the statement of financial position, as described later in this section.

Fair value is determined as of the financial statement date. The amount is that which would result from negotiations between a willing buyer and seller not in a liquidation sale. Fair value is measured in preferred order by market price, selling price of similar investments, or discounted cash flows at a rate indicative of the risk involved.

Regarding the additional minimum liability required under ASC 715-30 prior to being amended by ASC 715, there were several important matters impacting upon the actual computation of the amount to be displayed. First, an asset could not be recorded if the fair value of the plan assets exceeded the accumulated benefit obligation. Second, the calculation of the minimum liability required consideration of any already recorded prepaid or accrued pension cost. The net liability had to be equal to at least the unfunded accumulated benefit obligation. An already recorded prepaid pension cost would increase the amount of the recognized additional liability. An already recorded accrued pension cost would decrease it.

Third, the intangible asset was not subject to amortization. Fourth, at the time of the subsequent calculation, the amounts were to be either added to or reversed out with no effect on net income. These statement of financial position entries were entirely independent of net income and would not affect the calculation of net pension costs. Fifth, unless a significant event occurred or measures of obligations and assets as of a more current date became available, interim financial statements were to show the year-end additional minimum liability adjusted for subsequent contributions and accruals. In such a case, previous year-end assumptions regarding net pension cost would also carry over to the interim financial statements.

The advent of ASC 715 has made the minimum liability recognition, together with the associated intangible asset, extinct. Under ASC 715 the full amount (measured by projected or accumulated benefit obligations, for pensions and other postretirement benefits, respectively) of over- or underfunding will be given statement of financial position recognition, with the offsetting entry being to other comprehensive income.

A schedule showing the variables of the above example in accordance with ASC 715-20, reconciling the statement of financial position amounts with the funded status of the plan, is shown below. Assumed activity for 2013 is provided for comparative purposes. This example is to illustrate the information required for publicly held entities; see comments below for reduced disclosure requirements applicable to nonpublicly held companies. Also, this example combines information about pension plans and other benefit plans, the latter of which are assumed data not detailed in the foregoing discussion.

Nonpublic reporting entities are not required to provide the information in the above tables. Instead, they are only required to disclose the employer's contributions, participants' contributions, benefit payments, and the funded status. Of course, expanded disclosures are not precluded under such circumstances.

Note that since this example disclosure addresses both pension and other postretirement plans, the captions are generically worded, but it is implicit that they refer to projected benefits for pension plans and accumulated benefits for other defined benefit plans.

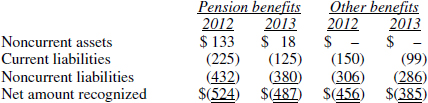

ASC 715 requires the funded status of defined benefit plans to be reported in the statement of financial position, using a simple table identifying the locations in the statement of financial position where the net funded amounts are presented, as follows:

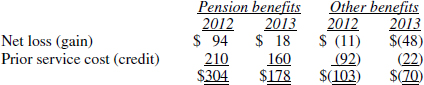

Amounts recognized in accumulated other comprehensive income must also be identified; for this example, these consist of:

As set forth above, under the provisions of ASC 715 the actual underfunded or—for the first time—overfunded status of defined benefit pension plans will be reported without limitation in the statement of financial position of reporting sponsoring entities. Under ASC 715—for defined benefit pension arrangements—under- or overfunding will be defined by the differences between plan assets and the corresponding projected benefit obligations. Thus, the measure is derived from the (almost inevitably) larger projections of future benefit payments, including the effects of anticipated salary progressions.

Additional ASC 715-30 Guidance

In situations not specifically addressed by ASC 715-30, ASC 715-30-35 states that the vested benefit obligation can be either (1) the actuarial present value of the vested benefits that the employee is entitled to if the employee separates immediately, or (2) the actuarial present value of the vested benefits to which the employee is currently entitled, but based on the employee's expected date of separation or retirement.

Pension plans sometimes are coupled with life insurance plans with the employer as beneficiary. According to ASC 325-30-35, it is not appropriate for the purchaser of life insurance to recognize income from death benefits on an actuarially expected basis.

In recent years a trend has emerged for employers to terminate classic defined benefit pension plans and replace them with “cash balance” plans, the accounting for which has not been well understood. These hybrid plans typically describe the pension benefit by reference to an account balance rather than a monthly annuity at retirement. ASC 715-30-15 considers plans that are characterized by defined principal-crediting rates as percentages of salary, and offer defined, noncontingent interest-crediting rates that entitle participants to future interest credits at stated, fixed rates until retirement. The standard states that “cash balance” plans with the foregoing attributes are to be deemed defined benefit plans, consistent with definitions set forth in ASC 715-30. This is true because an employer's contributions to a cash balance plan trust and the earnings on the invested plan assets may be unrelated to the principal and interest credits to participants' hypothetical accounts.

The standard also determined that the benefit promise in the cash balance arrangement is not pay-related and, accordingly, use of a projected unit credit method is neither required nor appropriate for purposes of measuring the benefit obligation and annual cost of benefits earned under ASC 715-30. The appropriate cost attribution approach, therefore, is the traditional unit credit method.

If an entity had been accounting for such a plan as a defined benefit plan, the effect of remeasuring the pension obligation using the guidance in this consensus was to have been calculated as of the above-mentioned measurement date. Any difference in the measurement of the obligation as a result of applying the standard was to be reported as a component of actuarial gains and losses under ASC 715-30. For an entity that has an accounting policy of immediate recognition of all gains and losses, or all gains and losses outside the 10% corridor described in ASC 715-30, the component of such gain or loss that could be attributed to the adoption of the guidance in Issue 03-4, applying a with-and-without calculation, was to have been reported as the effect of adopting the standard (in a manner similar to a cumulative-effect-type adjustment) as of the measurement date.

Reporting Funded Status: Requirements under ASC 715

ASC 715 has two major implications. First, it requires business entities having defined benefit plans (other than multiemployer plans) to display the funded status of those plans on the face of their statements of financial position, instead of being reported, to greater or lesser degree, only in the informative disclosures. And second, it requires that actuarial gains and losses and prior service costs and credits arising in the reporting period, but not (under provisions of ASC 715-30 and ASC 715-60) reported in the current period's reported benefit cost, be included as items of other comprehensive income. These matters will be addressed in the following paragraphs.

Additionally, ASC 715 imposes a definitive requirement that the measurement date for plan assets and obligations be the end of the annual reporting period (that is, the date of the statement of financial position). Previously, the measurement date could be either year-end or a date not more than three months prior to that date, if used consistently.

Finally, the standard requires that additional information be presented in the notes to financial statements about certain effects on net periodic benefit cost for the upcoming fiscal year that arise as a consequence of the delayed recognition of actuarial gains or losses, prior service costs or credits, and transition asset or obligation.

ASC 715 does not change the accounting by employers participating in multiemployer defined benefit plans. For essentially practical reasons, ASC 715-30 provides that contributions made to such plans for the reporting period be recognized as net pension cost, and that any contributions due and unpaid be recognized as a liability. Thus, most of the complexities arising from smoothing were avoided in accounting for sponsors participating in multiemployer plans.

Display of funded status.

The most important change wrought by ASC 715 is to move disclosure of the plan's funded status to the face of the statement of financial position proper. By requiring that the amounts of net overfunding and underfunding of benefit plans be included in assets and liabilities, respectively, there will be a very substantial improvement in financial statement users' comprehension of the implications of the defined benefit plans under which the reporting entity is obligated. Previously, this was only revealed in the benefit plan footnotes, where the funded status was reconciled to the amount presented in the statement of financial position itself.

Determination of funded status varies as between defined benefit pension plans and all other defined benefit arrangements (that is, those addressed by ASC 715-60). For the former, ASC 715 states that funded status is measured by the difference between the fair value of plan assets and the projected benefit obligation (explained earlier in this chapter). For the latter, it is the spread between the fair value of plan assets and the accumulated benefit obligation that measures funded status.

ASC 715 requires that the difference between plan assets and the projected benefit obligation—be used to gauge the liability to be reported. Projected benefit obligation takes into account expected salary progression, while accumulated benefit obligation does not. For all defined benefit plans, other than those that do not take salary progression into account, a larger liability will now be recognized.

The net obligations associated with underfunded plans (which will likely describe virtually all postretirement benefit plans other than pensions, as well as some pension plans) must be displayed in the statement of financial position. In contrast with the requirement for defined benefit pension plans, for these arrangements the measure is based on the accumulated postretirement benefit obligation, which is the actuarial present value of benefits attributed to employees as of the date of the statement of financial position, which until full eligibility is achieved, will be a lesser amount than the projected benefit obligation.

Reporting when there are multiple plans.

When the reporting entity has multiple plans, it is not acceptable to display one single net amount of over- or underfunding. Rather, all overfunded plans must be separately aggregated, as must underfunded plans. The amount of overfunding is included in noncurrent assets, with no portion of the overfunding permitted to be displayed as a current asset. On the other hand, total underfunding is allocated between current and noncurrent liabilities, with the current portion computed (on a plan-by-plan basis) as the sum of the actuarial present value of benefits included in the benefit obligation payable over the ensuing twelve months' time, to the extent that it exceeds the fair value of plan assets.

Conceivably, an employer may have the right to use the assets of an overfunded plan to pay the obligations of another, underfunded plan. Only in such circumstances would it be acceptable to offset the overfunding asset and the underfunding liability. Such a situation would be highly unlikely to occur, however.

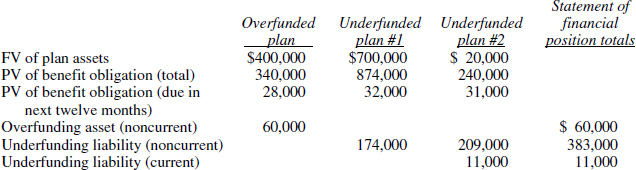

To illustrate, if the reporting entity has three postretirement benefit plans, one of which is overfunded and two of which are underfunded, the amount of overfunding must be included in noncurrent assets. The amount of underfunding of the two other plans must be reported in liabilities, but a portion of this total might have to be included in current liabilities. This is illustrated in the following table:

In the table above, note that the overfunded plan results in the reporting of a noncurrent asset, and this is not mitigated by the simultaneous existence of underfunded plans. Also note that underfunded plan #1 has sufficient assets to satisfy the amounts due within one year, and therefore the sponsoring entity's statement of financial position will not report any current liability with respect to this plan. However, plan #2, which is also underfunded, has benefit payments due over the twelve months following the statement of financial position date that exceed the amount of plan assets, and thus the sponsor will have to provide additional funding in the current period. That amount must be reported as a current liability. Finally, observe that the noncurrent obligations pertaining to both underfunded plans are combined into a single statement of financial position amount.

Reporting of benefit plan transactions and events in comprehensive income.

ASC 715 requires an employer to recognize all transactions and events affecting the overfunded or underfunded status of a defined benefit postretirement plan in comprehensive income (or changes in unrestricted net assets, if the entity is a not-for-profit enterprise) in the year in which they occur. Previously, many delayed-recognition elements of pension and other postretirement benefit plan expense were “off-the-books,” albeit subject to disclosure in the financial statement notes.

Under ASC 715, the reporting entity must recognize as a component of other comprehensive income the gains or losses and prior service costs or credits arising during that reporting period that are not recognized as components of net periodic benefit cost of the period pursuant to ASC 715-30 and ASC 715-60. For example, if a plan amendment is adopted that credits employees with prior service, this is not reflected immediately in benefit costs, but rather is subject to amortization (i.e., it is to be recognized as part of pension or other postretirement benefit plan cost over an extended period of time). The requirements established by ASC 715 do not alter the piecemeal recognition of expense (that is, smoothing) under current GAAP, but they do make it necessary to record in other comprehensive income, in the year the amendment is effected, the full amount of the prior service cost less what is recognized in pension cost in that period.

In other words, the methodology of expense measurement has not been affected by the issuance of ASC 715, but disclosure on the face of the statement of financial position is now achieved. The effect of recording this debit in comprehensive income is balanced by recording an additional underfunding liability. In accordance with ASC 740, this is treated as a temporary difference, since the liability has a different basis (carrying value) for financial reporting purposes than it does for tax purposes. Hence, it must be tax effected within accumulated other comprehensive income, and a deferred tax asset (in the normal circumstances) will be recorded. The tax asset, in turn, will be subject to the “more likely than not” test for realizability, to determine whether it needs to be reduced or offset fully by an allowance.

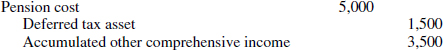

If Varga Corp., which is in the 30% tax bracket, grants its workers an amendment to a defined benefit pension plan that increases its obligation by $60,000, to be reflected in pension expense over fifteen years (i.e., amortized at $4,000 per year), under ASC 715 the following entry would be made (assuming the amendment is granted at year-end, and thus amortization will begin in the next period):

![]()

As noted earlier, the elements that will be reported in accumulated other comprehensive income, until taken into benefit expense as directed under ASC 715-30 or ASC 715-60, include gains and losses (i.e., those due to differences between expected and actual returns on plan assets, and those arising from actuarially determined adjustments), prior service cost or credits from plan amendments, and any remaining transition amounts deferred when ASC 715-30 was adopted. For new amounts (e.g., actuarial adjustment in the current period), there will be an entry similar to the above, whereby accumulated other comprehensive income is adjusted to reflect the full amount of the item, as well as the (offsetting) deferred tax effect thereof.

In subsequent periods, there will be opposite direction adjustments to the amount provided in other comprehensive income, as the normal, ASC 715-30-driven amortization occurs. For example, if the prior service cost recognized by Varga Corp. above is to be amortized based on average remaining service lives of current employees and the amount so determined for 2012, the first period after the amendment, is $5,000, the following entry would be recorded:

For each annual statement of income presented, these amounts are to be recognized in accumulated other comprehensive income, showing separately the amounts ascribed to net gain or loss and net prior service cost or credit. Those amounts are to be separated into amounts arising during the period and reclassification adjustments of other comprehensive income as a result of being recognized as components of net periodic benefit cost for the period.

Reporting loans to participants by defined contribution pension plans.

ASC 962-310 requires that loans to the participants in an entity's defined contribution pension plan be classified as notes receivable. These loans are to be reported separately from plan investments. The proper measurement of these loans is their unpaid principal balances, plus all accrued but unpaid interest. This requirement keeps entities from recording such loans at their fair value. The reason for making this distinction is that US GAAP requires most investments by a pension plan to be recorded at their fair values, which would normally include loans to plan participants. By recording these loans as notes receivable, rather than investments, the fair value recordation requirement no longer applies.

Measurement date for year-end financial statements.

ASC 715 requires that valuations be as of the date of the statement of financial position.

The only exceptions to the foregoing general statement occur in the instance of plans sponsored by consolidated subsidiaries or equity-method investees. This is a practical concession, but given that under US GAAP subsidiaries and investees are permitted to report financial results using year-ends different than the parent's or investor's, the exception is a reasonable and logical one. In those situations, the determinations of the fair values of plan assets and obligations must be as of the subsidiaries' or investees' respective dates of the statements of financial position.

Measurement date for interim financial statements.