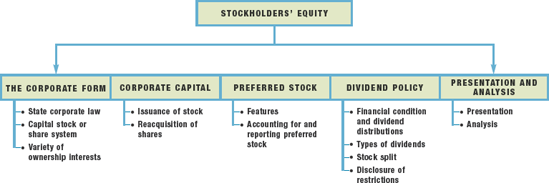

After studying this chapter, you should be able to:

Of the three primary forms of business organization—the proprietorship, the partnership, and the corporation—the corporate form dominates. The corporation is by far the leader in terms of the aggregate amount of resources controlled, goods and services produced, and people employed. All of the "Fortune 500" largest industrial firms are corporations. Although the corporate form has a number of advantages (as well as disadvantages) over the other two forms, its principal advantage is its facility for attracting and accumulating large amounts of capital.

The special characteristics of the corporate form that affect accounting include:

Anyone who wishes to establish a corporation must submit articles of incorporation to the state in which incorporation is desired. After fulfilling requirements, the state issues a corporation charter, thereby recognizing the company as a legal entity subject to state law. Regardless of the number of states in which a corporation has operating divisions, it is incorporated in only one state.

It is to the company's advantage to incorporate in a state whose laws favor the corporate form of business organization. General Motors, for example, is incorporated in Delaware; U.S. Steel is a New Jersey corporation. Some corporations have increasingly been incorporating in states with laws favorable to existing management. For example, to thwart possible unfriendly takeovers, at one time, Gulf Oil changed its state of incorporation to Delaware. There, the board of directors alone, without a vote of the shareholders, may approve certain tactics against takeovers.

Each state has its own business incorporation act. The accounting for stockholders' equity follows the provisions of these acts. In many cases states have adopted the principles contained in the Model Business Corporate Act prepared by the American Bar Association. State laws are complex and vary both in their provisions and in their definitions of certain terms. Some laws fail to define technical terms. As a result, terms often mean one thing in one state and another thing in a different state. These problems may be further compounded because legal authorities often interpret the effects and restrictions of the laws differently.

Stockholders' equity in a corporation generally consists of a large number of units or shares. Within a given class of stock each share exactly equals every other share. The number of shares possessed determines each owner's interest. If a company has one class of stock divided into 1,000 shares, a person who owns 500 shares controls one-half of the ownership interest. One holding 10 shares has a one-hundredth interest.

Each share of stock has certain rights and privileges. Only by special contract can a company restrict these rights and privileges at the time it issues the shares. Owners must examine the articles of incorporation, stock certificates, and the provisions of the state law to ascertain such restrictions on or variations from the standard rights and privileges. In the absence of restrictive provisions, each share carries the following rights:

To share proportionately in profits and losses.

To share proportionately in management (the right to vote for directors).

To share proportionately in corporate assets upon liquidation.

To share proportionately in any new issues of stock of the same class—called the preemptive right.[225]

The first three rights are self-explanatory. The last right is used to protect each stockholder's proportional interest in the company. The preemptive right protects an existing stockholder from involuntary dilution of ownership interest. Without this right, stockholders might find their interest reduced by the issuance of additional stock without their knowledge, and at prices unfavorable to them. However, many corporations have eliminated the preemptive right. Why? Because this right makes it inconvenient for corporations to issue large amounts of additional stock, as they frequently do in acquiring other companies.

The share system easily allows one individual to transfer an interest in a company to another investor. For example, individuals owning shares in Circuit City may sell them to others at any time and at any price without obtaining the consent of the company or other stockholders. Each share is personal property of the owner, who may dispose of it at will. Circuit City simply maintains a list or subsidiary ledger of stockholders as a guide to dividend payments, issuance of stock rights, voting proxies, and the like. Because owners freely and frequently transfer shares, Circuit City must revise the subsidiary ledger of stockholders periodically, generally in advance of every dividend payment or stockholders' meeting.

In addition, the major stock exchanges require ownership controls that the typical corporation finds uneconomic to provide. Thus, corporations often use registrars and transfer agents who specialize in providing services for recording and transferring stock. The Uniform Stock Transfer Act and the Uniform Commercial Code govern the negotiability of stock certificates.

In every corporation one class of stock must represent the basic ownership interest. That class is called common stock. Common stock is the residual corporate interest that bears the ultimate risks of loss and receives the benefits of success. It is guaranteed neither dividends nor assets upon dissolution. But common stockholders generally control the management of the corporation and tend to profit most if the company is successful. In the event that a corporation has only one authorized issue of capital stock, that issue is by definition common stock, whether so designated in the charter or not.

In an effort to broaden investor appeal, corporations may offer two or more classes of stock, each with different rights or privileges. In the preceding section we pointed out that each share of stock of a given issue has the same four inherent rights as other shares of the same issue. By special stock contracts between the corporation and its stockholders, however, the stockholder may sacrifice certain of these rights in return for other special rights or privileges. Thus special classes of stock, usually called preferred stock, are created. In return for any special preference, the preferred stockholder always sacrifices some of the inherent rights of common stock ownership.

A common type of preference is to give the preferred stockholders a prior claim on earnings. The corporation thus assures them a dividend, usually at a stated rate, before it distributes any amount to the common stockholders. In return for this preference the preferred stockholders may sacrifice their right to a voice in management or their right to share in profits beyond the stated rate.

Some companies grant preferences to different shareholders by issuing different classes of common stock. Recent stock bids put the spotlight on dual-class stock structures. For example, ownership of Dow Jones & Co., publisher of the Wall Street Journal, was controlled by family members who owned Class B shares, which carry super voting powers. The same is true for the Ford family's control of Ford Motor Co. Class B shares are often criticized for protecting owners' interest at the expense of shareholder return. These shares often can determine if a takeover deal gets done, or not. Here are some notable companies with two-tiered shares.

For most retail investors, voting rights are not that important. But for family-controlled companies, issuing newer classes of lower or non-voting stock effectively creates currency for acquisitions, increases liquidity, or puts a public value on the company without diluting the family's voting control. Thus, investors must carefully compare the apparent bargain prices for some classes of stock—they may end up as second-class citizens with no voting rights.

Source: Adapted from Andy Serwer, "Dual-Listed Companies Aren't Fair or Balanced," Fortune (September 20, 2004), p. 83; and Alex Halperin, "A Class (B) Act," BusinessWeek (May 28, 2007), p. 12.

Owner's equity in a corporation is defined as stockholders' equity, shareholders' equity, or corporate capital. The following three categories normally appear as part of stockholders' equity:

Capital stock.

Additional paid-in capital.

Retained earnings.

The first two categories, capital stock and additional paid-in capital, constitute contributed (paid-in) capital. Retained earnings represents the earned capital of the company. Contributed capital (paid-in capital) is the total amount paid in on capital stock—the amount provided by stockholders to the corporation for use in the business. Contributed capital includes items such as the par value of all outstanding stock and premiums less discounts on issuance. Earned capital is the capital that develops from profitable operations. It consists of all undistributed income that remains invested in the company.

Stockholders' equity is the difference between the assets and the liabilities of the company. That is, the owners' or stockholders' interest in a company like Walt Disney Co. is a residual interest.[226] Stockholders' (owners') equity represents the cumulative net contributions by stockholders plus retained earnings. As a residual interest, stockholders' equity has no existence apart from the assets and liabilities of Disney—stockholders' equity equals net assets. Stockholders' equity is not a claim to specific assets but a claim against a portion of the total assets. Its amount is not specified or fixed; it depends on Disney's profitability. Stockholders' equity grows if it is profitable. It shrinks, or may disappear entirely, if Disney loses money.

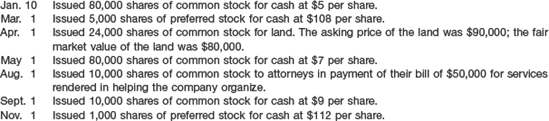

In issuing stock, companies follow these procedures: First, the state must authorize the stock, generally in a certificate of incorporation or charter. Next, the corporation offers shares for sale, entering into contracts to sell stock. Then, after receiving amounts for the stock, the corporation issues shares. The corporation generally makes no entry in the general ledger accounts when it receives its stock authorization from the state of incorporation.

We discuss the accounting problems involved in the issuance of stock under the following topics.

Accounting for par value stock.

Accounting for no-par stock.

Accounting for stock issued in combination with other securities (lump-sum sales).

Accounting for stock issued in noncash transactions.

Accounting for costs of issuing stock.

The par value of a stock has no relationship to its fair value. At present, the par value associated with most capital stock issuances is very low. For example, PepsiCo's par value is 1⅔¢, Kellogg's is $0.25, and Hershey's is $1. Such values contrast dramatically with the situation in the early 1900s, when practically all stock issued had a par value of $100. Low par values help companies avoid the contingent liability associated with stock sold below par.[227]

To show the required information for issuance of par value stock, corporations maintain accounts for each class of stock as follows.

Preferred Stock or Common Stock. Together, these two stock accounts reflect the par value of the corporation's issued shares. The company credits these accounts when it originally issues the shares. It makes no additional entries in these accounts unless it issues additional shares or retires them.

Additional Paid-in Capital (also called Paid-in Capital in Excess of Par). The Additional Paid-in Capital account indicates any excess over par value paid in by stockholders in return for the shares issued to them. Once paid in, the excess over par becomes a part of the corporation's additional paid-in capital. The individual stockholder has no greater claim on the excess paid in than all other holders of the same class of shares.

Many states permit the issuance of capital stock without par value, called no-par stock. The reasons for issuance of no-par stock are twofold: First, issuance of no-par stock avoids the contingent liability (see footnote 3) that might occur if the corporation issued par value stock at a discount. Second, some confusion exists over the relationship (or rather the absence of a relationship) between the par value and fair value. If shares have no par value, the questionable treatment of using par value as a basis for fair value never arises. This is particularly advantageous whenever issuing stock for property items such as tangible or intangible fixed assets.

A major disadvantage of no-par stock is that some states levy a high tax on these issues. In addition, in some states the total issue price for no-par stock may be considered legal capital, which could reduce the flexibility in paying dividends.

Corporations sell no-par shares, like par value shares, for whatever price they will bring. However, unlike par value shares, corporations issue them without a premium or a discount. The exact amount received represents the credit to common or preferred stock. For example, Video Electronics Corporation is organized with authorized common stock of 10,000 shares without par value. Video Electronics makes only a memorandum entry for the authorization, inasmuch as no amount is involved. If Video Electronics then issues 500 shares for cash at $10 per share, it makes the following entry:

If it issues another 500 shares for $11 per share, Video Electronics makes this entry:

True no-par stock should be carried in the accounts at issue price without any additional paid-in capital or discount reported. But some states require that no-par stock have a stated value. The stated value is a minimum value below which a company cannot issue it. Thus, instead of being no-par stock, such stated-value stock becomes, in effect, stock with a very low par value. It thus is open to all the criticism and abuses that first encouraged the development of no-par stock.[228]

If no-par stock has a stated value of $5 per share but sells for $11, all such amounts in excess of $5 are recorded as additional paid-in capital, which in many states is fully or partially available for dividends. Thus, no-par value stock, with a low stated value, permits a new corporation to commence its operations with additional paid-in capital that may exceed its stated capital. For example, if a company issued 1,000 of the shares with a $5 stated value at $15 per share for cash, it makes the following entry.

Most corporations account for no-par stock with a stated value as if it were par value stock with par equal to the stated value.

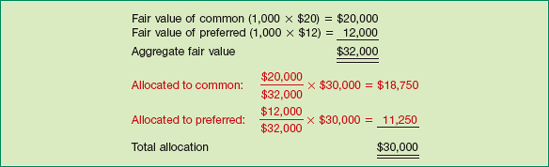

Generally, corporations sell classes of stock separately from one another. The reason to do so is to track the proceeds relative to each class, as well as relative to each lot. Occasionally, a corporation issues two or more classes of securities for a single payment or lump sum, in the acquisition of another company. The accounting problem in such lump-sum sales is how to allocate the proceeds among the several classes of securities. Companies use one of two methods of allocation: (1) the proportional method and (2) the incremental method.

Proportional Method. If the fair value or other sound basis for determining relative value is available for each class of security, the company allocates the lump sum received among the classes of securities on a proportional basis. For instance, assume a company issues 1,000 shares of $10 stated value common stock having a fair value of $20 a share, and 1,000 shares of $10 par value preferred stock having a fair value of $12 a share, for a lump sum of $30,000. Illustration 15-1 shows how the company allocates the $30,000 to the two classes of stock.

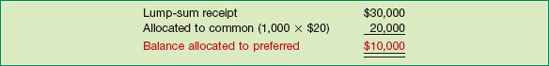

Incremental Method. In instances where a company cannot determine the fair value of all classes of securities, it may use the incremental method. It uses the fair value of the securities as a basis for those classes that it knows, and allocates the remainder of the lump sum to the class for which it does not know the fair value. For instance, if a company issues 1,000 shares of $10 stated value common stock having a fair value of $20, and 1,000 shares of $10 par value preferred stock having no established fair value, for a lump sum of $30,000, it allocates the $30,000 to the two classes as shown in Illustration 15-2.

If a company cannot determine fair value for any of the classes of stock involved in a lump-sum exchange, it may need to use other approaches. It may rely on an expert's appraisal. Or, if the company knows that one or more of the classes of securities issued will have a determinable fair value in the near future, it may use a best estimate basis with the intent to adjust later, upon establishment of the future fair value.

Accounting for the issuance of shares of stock for property or services involves an issue of valuation. The general rule is: Companies should record stock issued for services or property other than cash at either the fair value of the stock issued or the fair value of the noncash consideration received, whichever is more clearly determinable.

If a company can readily determine both, and the transaction results from an arm's-length exchange, there will probably be little difference in their fair values. In such cases the basis for valuing the exchange should not matter.

If a company cannot readily determine either the fair value of the stock it issues or the property or services it receives, it should employ an appropriate valuation technique. Depending on available data, the valuation may be based on market transactions involving comparable assets or the use of discounted expected future cash flows. Companies should avoid the use of the book, par, or stated values as a basis of valuation for these transactions.

A company may exchange unissued stock or treasury stock (issued shares that it has reacquired but not retired) for property or services. If it uses treasury shares, the cost of the treasury shares should not be considered the decisive factor in establishing the fair value of the property or services. Instead, it should use the fair value of the treasury stock, if known, to value the property or services. Otherwise, if it does not know the fair value of the treasury stock, it should use the fair value of the property or services received, if determinable.

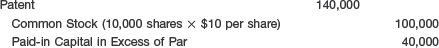

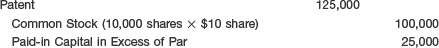

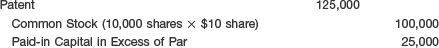

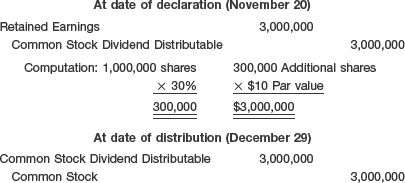

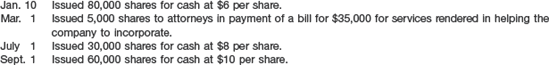

The following series of transactions illustrates the procedure for recording the issuance of 10,000 shares of $10 par value common stock for a patent for Marlowe Company, in various circumstances.

Marlowe cannot readily determine the fair value of the patent, but it knows the fair value of the stock is $140,000.

Marlowe cannot readily determine the fair value of the stock, but it determines the fair value of the patent is $150,000.

Marlowe cannot readily determine the fair value of the stock nor the fair value of the patent. An independent consultant values the patent at $125,000 based on discounted expected cash flows.

In corporate law, the board of directors has the power to set the value of noncash transactions. However, boards sometimes abuse this power. The issuance of stock for property or services has resulted in cases of overstated corporate capital through intentional overvaluation of the property or services received. The overvaluation of the stockholders' equity resulting from inflated asset values creates watered stock. The corporation should eliminate the "water" by simply writing down the overvalued assets.

If, as a result of the issuance of stock for property or services, a corporation undervalues the recorded assets, it creates secret reserves. An understated corporate structure (secret reserve) may also result from other methods: excessive depreciation or amortization charges, expensing capital expenditures, excessive write-downs of inventories or receivables, or any other understatement of assets or overstatement of liabilities. An example of a liability overstatement is an excessive provision for estimated product warranties that ultimately results in an understatement of owners' equity, thereby creating a secret reserve.

When a company like Walgreens issues stock, it should report direct costs incurred to sell stock, such as underwriting costs, accounting and legal fees, printing costs, and taxes, as a reduction of the amounts paid in. Walgreens therefore debits issue costs to Additional Paid-in Capital because they are unrelated to corporate operations. In effect, issue costs are a cost of financing. As such, issue costs should reduce the proceeds received from the sale of the stock.

Walgreens should expense management salaries and other indirect costs related to the stock issue because it is difficult to establish a relationship between these costs and the sale proceeds. In addition, Walgreens expenses recurring costs, primarily registrar and transfer agents' fees, as incurred.

Sometimes companies issue stock but may not receive cash in return. As a result, a company records a receivable.

Controversy existed regarding the presentation of this receivable on the balance sheet. Some argued that the company should report the receivable as an asset similar to other receivables. Others argued that the company should report the receivable as a deduction from stockholders' equity (similar to the treatment of treasury stock). The SEC settled this issue: It requires companies to use the contra-equity approach because the risk of collection in this type of transaction is often very high.

This accounting issue surfaced in Enron's accounting. Starting in early 2000, Enron issued shares of its common stock to four "special-purpose entities," in exchange for which it received a note receivable. Enron then increased its assets (by recording a receivable) and stockholders' equity, a move the company now calls an accounting error. As a result of this accounting treatment, Enron overstated assets and stockholders' equity by $172 million in its 2000 audited financial statements and by $828 million in its unaudited 2001 statements. This $1 billion overstatement was 8.5 percent of Enron's previously reported stockholders' equity at that time.

As Lynn Turner, former chief accountant of the SEC, noted, "It is a basic accounting principle that you don't record equity until you get cash, and a note doesn't count as cash." Situations like this led investors, creditors, and suppliers to lose faith in the credibility of Enron, which eventually caused its bankruptcy.

Source: Adapted from Jonathan Weil, "Basic Accounting Tripped Up Enron—Financial Statements Didn't Add Up—Auditors Overlook a Simple Rule," Wall Street Journal (November 11, 2001), p. C1.

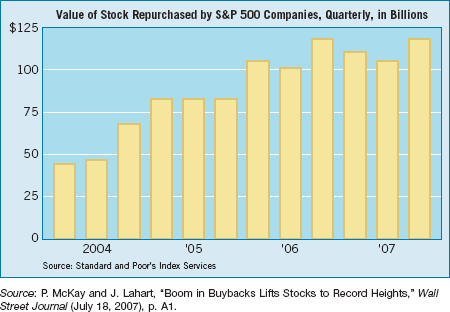

Companies often buy back their own shares. In fact, share buybacks now exceed dividends as a form of distribution to stockholders.[229] For example, oil producer ConocoPhillips, health-care–products giant Johnson & Johnson, and discount retailer Wal-Mart Stores recently announced ambitious buyback plans. Illustration 15-3 indicates that buybacks are increasing and that $118 billion was spent in the first quarter of 2007, more than any previous quarter.

Corporations purchase their outstanding stock for several reasons:

To provide tax-efficient distributions of excess cash to shareholders. Capital gain rates on sales of stock to the company by the stockholders have been approximately half the ordinary tax rate for many investors. This advantage has been somewhat diminished by recent changes in the tax law related to dividends.

To increase earnings per share and return on equity. Reducing both shares outstanding and stockholders' equity often enhances certain performance ratios. However, strategies to hype performance measures might increase performance in the short-run, but these tactics add no real long-term value.

To provide stock for employee stock compensation contracts or to meet potential merger needs. Honeywell Inc. reported that it would use part of its purchase of one million common shares for employee stock option contracts. Other companies acquire shares to have them available for business acquisitions.

To thwart takeover attempts or to reduce the number of stockholders. By reducing the number of shares held by the public, existing owners and managements bar "outsiders" from gaining control or significant influence. When Ted Turner attempted to acquire CBS, CBS started a substantial buyback of its stock. Companies may also use stock purchases to eliminate dissident stockholders.

To make a market in the stock. As one company executive noted, "Our company is trying to establish a floor for the stock." Purchasing stock in the marketplace creates a demand. This may stabilize the stock price or, in fact, increase it.

Some publicly held corporations have chosen to "go private," that is, to eliminate public (outside) ownership entirely by purchasing all of their outstanding stock. Companies often accomplish such a procedure through a leveraged buyout (LBO), in which the company borrows money to finance the stock repurchases.

After reacquiring shares, a company may either retire them or hold them in the treasury for reissue. If not retired, such shares are referred to as treasury stock (treasury shares). Technically, treasury stock is a corporation's own stock, reacquired after having been issued and fully paid.

Treasury stock is not an asset. When a company purchases treasury stock, a reduction occurs in both assets and stockholders' equity. It is inappropriate to imply that a corporation can own a part of itself. A corporation may sell treasury stock to obtain funds, but that does not make treasury stock a balance sheet asset. When a corporation buys back some of its own outstanding stock, it has not acquired an asset; it reduces net assets.

The possession of treasury stock does not give the corporation the right to vote, to exercise preemptive rights as a stockholder, to receive cash dividends, or to receive assets upon corporate liquidation. Treasury stock is essentially the same as unissued capital stock. No one advocates classifying unissued capital stock as an asset in the balance sheet.[230]

Market analysts sometimes look to stock buybacks as a buy signal for a stock. That strategy is not that surprising if you look at the performance of companies that did buybacks. For example, in one study, buyback companies outperformed similar companies without buybacks by an average of 23 percent. In a recent three-year period, companies followed by Buybackletter.com were up 16.4 percent, while the S&P 500 Stock Index was up just 7.1 percent in that period. Why the premium? Well, the conventional wisdom is that companies who buy back shares believe their shares are undervalued. Thus, analysts view the buyback announcement as an important piece of inside information about future company prospects.

On the other hand, buybacks can actually hurt businesses and their shareholders over the long-run. Whether the buyback is a good thing appears to depend a lot on why the company did the buy-back and what the repurchased shares were used for. One study found that companies often increased their buybacks when earnings growth slowed. This allowed the companies to prop up earnings per share (based on fewer shares outstanding). Furthermore, many buybacks do not actually result in a net reduction in shares outstanding. For example, companies, such as Microsoft and Broadcom, bought back shares to meet share demands for stock option exercises, resulting in higher net shares outstanding when it reissued the repurchased shares to the option holders upon exercise. In this case the buyback actually indicated a further dilution in the share ownership in the buyback company.

This does not mean you should never trust a buyback signal. But if the buyback is intended to manage the company's earnings or if the buyback results in dilution, take a closer look.

Source: Adapted from Ann Tergesen, "When Buybacks Are Signals to Buy," Business Week Online (October 1, 2001); and Rachel Beck, "Stock BuyBacks Not Always Good for the Company, Shareholders," Naples [FL] Daily News (March 7, 2004). p. I1.

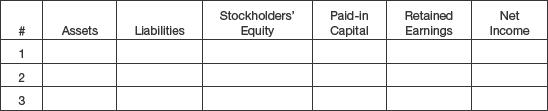

Companies use two general methods of handling treasury stock in the accounts: the cost method and the par value method. Both methods are generally acceptable. The cost method enjoys more widespread use.[231]

The cost method results in debiting the Treasury Stock account for the reacquisition cost and in reporting this account as a deduction from the total paid-in capital and retained earnings on the balance sheet.

The par or stated value method records all transactions in treasury shares at their par value and reports the treasury stock as a deduction from capital stock only.

No matter which method a company uses, most states consider the cost of the treasury shares acquired as a restriction on retained earnings.

Companies generally use the cost method to account for treasury stock. This method derives its name from the fact that a company maintains the Treasury Stock account at the cost of the shares purchased.[232] Under the cost method, the company debits the Treasury Stock account for the cost of the shares acquired. Upon reissuance of the shares, it credits the account for this same cost. The original price received for the stock does not affect the entries to record the acquisition and reissuance of the treasury stock.

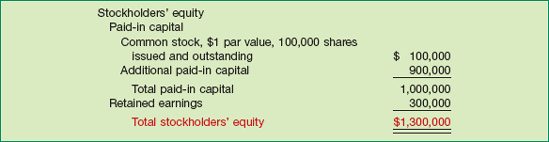

To illustrate, assume that Pacific Company issued 100,000 shares of $1 par value common stock at a price of $10 per share. In addition, it has retained earnings of $300,000. Illustration 15-4 shows the stockholders' equity section on December 31, 2009, before purchase of treasury stock.

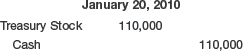

On January 20, 2010, Pacific acquires 10,000 shares of its stock at $11 per share. Pacific records the reacquisition as follows:

Note that Pacific debited Treasury Stock for the cost of the shares purchased. The original paid-in capital account, Common Stock, is not affected because the number of issued shares does not change. The same is true for the Additional Paid-in Capital account. Pacific deducts treasury stock from total paid-in capital and retained earnings in the stockholders' equity section.

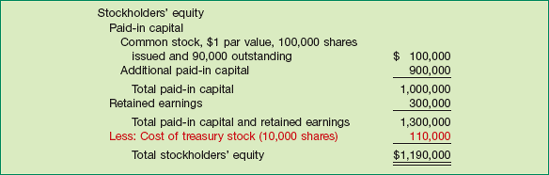

Illustration 15-5 shows the stockholders' equity section for Pacific after purchase of the treasury stock.

Pacific subtracts the cost of the treasury stock from the total of common stock, additional paid-in capital, and retained earnings. It therefore reduces stockholders' equity. Many states require a corporation to restrict retained earnings for the cost of treasury stock purchased. The restriction keeps intact the corporation's legal capital that it temporarily holds as treasury stock. When the corporation sells the treasury stock, it lifts the restriction.

Pacific discloses both the number of shares issued (100,000) and the number in the treasury (10,000). The difference is the number of shares of stock outstanding (90,000). The term outstanding stock means the number of shares of issued stock that stockholders own.

Companies usually reissue or retire treasury stock. When selling treasury shares, the accounting for the sale depends on the price. If the selling price of the treasury stock equals its cost, the company records the sale of the shares by debiting Cash and crediting Treasury Stock. In cases where the selling price of the treasury stock is not equal to cost, then accounting for treasury stock sold above cost differs from the accounting for treasury stock sold below cost. However, the sale of treasury stock either above or below cost increases both total assets and stockholders' equity.

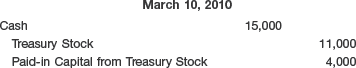

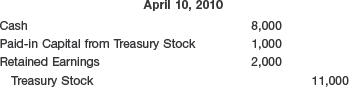

Sale of Treasury Stock above Cost. When the selling price of shares of treasury stock exceeds its cost, a company credits the difference to Paid-in Capital from Treasury Stock. To illustrate, assume that Pacific acquired 10,000 shares of its treasury stock at $11 per share. It now sells 1,000 shares at $15 per share on March 10. Pacific records the entry as follows.

There are two reasons why Pacific does not credit $4,000 to Gain on Sale of Treasury Stock: (1) Gains on sales occur when selling assets; treasury stock is not an asset. (2) A gain or loss should not be recognized from stock transactions with its own stockholders. Thus, Pacific should not include paid-in capital arising from the sale of treasury stock in the measurement of net income. Instead, it lists paid-in capital from treasury stock separately on the balance sheet, as a part of paid-in capital.

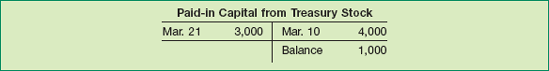

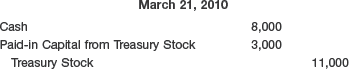

Sale of Treasury Stock below Cost. When a corporation sells treasury stock below its cost, it usually debits the excess of the cost over selling price to Paid-in Capital from Treasury Stock. Thus, if Pacific sells an additional 1,000 shares of treasury stock on March 21 at $8 per share, it records the sale as follows.

We can make several observations based on the two sale entries (sale above cost and sale below cost): (1) Pacific credits Treasury Stock at cost in each entry. (2) Pacific uses Paid-in Capital from Treasury Stock for the difference between the cost and the resale price of the shares. (3) Neither entry affects the original paid-in capital account, Common Stock.

After eliminating the credit balance in Paid-in Capital from Treasury Stock, the corporation debits any additional excess of cost over selling price to Retained Earnings. To illustrate, assume that Pacific sells an additional 1,000 shares at $8 per share on April 10. Illustration 15-6 shows the balance in the Paid-in Capital from Treasury Stock account (before the April 10 purchase).

In this case, Pacific debits $1,000 of the excess to Paid-in Capital from Treasury Stock. It debits the remainder to Retained Earnings. The entry is:

The board of directors may approve the retirement of treasury shares. This decision results in cancellation of the treasury stock and a reduction in the number of shares of issued stock. Retired treasury shares have the status of authorized and unissued shares. The accounting effects are similar to the sale of treasury stock except that corporations debit the paid-in capital accounts applicable to the retired shares instead of cash. For example, if a corporation originally sells the shares at par, it debits Common Stock for the par value per share. If it originally sells the shares at $3 above par value, it also debits Paid-in Capital in Excess of Par Value for $3 per share at retirement.

As noted earlier, preferred stock is a special class of shares that possesses certain preferences or features not possessed by the common stock.[233] The following features are those most often associated with preferred stock issues.

Preference as to dividends.

Preference as to assets in the event of liquidation.

Convertible into common stock.

Callable at the option of the corporation.

Nonvoting.

The features that distinguish preferred from common stock may be of a more restrictive and negative nature than preferences. For example, the preferred stock may be nonvoting, noncumulative, and nonparticipating.

Companies usually issue preferred stock with a par value, expressing the dividend preference as a percentage of the par value. Thus, holders of 8 percent preferred stock with a $100 par value are entitled to an annual dividend of $8 per share. This stock is commonly referred to as 8 percent preferred stock. In the case of no-par preferred stock, a corporation expresses a dividend preference as a specific dollar amount per share, for example, $7 per share. This stock is commonly referred to as $7 preferred stock.

A preference as to dividends does not assure the payment of dividends. It merely assures that the corporation must pay the stated dividend rate or amount applicable to the preferred stock before paying any dividends on the common stock.

A company often issues preferred stock (instead of debt) because of a high debt-to-equity ratio. In other instances, it issues preferred stock through private placements with other corporations at a lower-than-market dividend rate because the acquiring corporation receives largely tax-free dividends (owing to the IRS's 70 percent or 80 percent dividends received deduction).

A corporation may attach whatever preferences or restrictions, in whatever combination it desires, to a preferred stock issue, as long as it does not specifically violate its state incorporation law. Also, it may issue more than one class of preferred stock. We discuss the most common features attributed to preferred stock below.

Cumulative preferred stock requires that if a corporation fails to pay a dividend in any year, it must make it up in a later year before paying any dividends to common stockholders. If the directors fail to declare a dividend at the normal date for dividend action, the dividend is said to have been "passed." Any passed dividend on cumulative preferred stock constitutes a dividend in arrears. Because no liability exists until the board of directors declares a dividend, a corporation does not record a dividend in arrears as a liability but discloses it in a note to the financial statements. A corporation seldom issues noncumulative preferred stock because a passed dividend is lost forever to the preferred stockholder. As a result, this stock issue would be less marketable.

Holders of participating preferred stock share ratably with the common stockholders in any profit distributions beyond the prescribed rate. That is, 5 percent preferred stock, if fully participating, will receive not only its 5 percent return, but also dividends at the same rates as those paid to common stockholders if paying amounts in excess of 5 percent of par or stated value to common stockholders. Note that participating preferred stock may be only partially participating. Although seldom used, examples of companies that have issued participating preferred stock are LTV Corporation, Southern California Edison, and Allied Products Corporation.

Convertible preferred stock allows stockholders, at their option, to exchange preferred shares for common stock at a predetermined ratio. The convertible preferred stockholder not only enjoys a preferred claim on dividends but also has the option of converting into a common stockholder with unlimited participation in earnings.

Callable preferred stock permits the corporation at its option to call or redeem the outstanding preferred shares at specified future dates and at stipulated prices. Many preferred issues are callable. The corporation usually sets the call or redemption price slightly above the original issuance price and commonly states it in terms related to the par value. The callable feature permits the corporation to use the capital obtained through the issuance of such stock until the need has passed or it is no longer advantageous.

The existence of a call price or prices tends to set a ceiling on the market value of the preferred shares unless they are convertible into common stock. When a corporation redeems preferred stock, it must pay any dividends in arrears.

Recently, more and more issuances of preferred stock have features that make the security more like debt (legal obligation to pay) than an equity instrument. For example, redeemable preferred stock has a mandatory redemption period or a redemption feature that the issuer cannot control.

Previously, public companies were not permitted to report these debt-like preferred stock issues in equity, but they were not required to report them as a liability either. There were concerns about classification of these debt-like securities, which may have been reported as equity or in the "mezzanine" section of balance sheets between debt and equity. There also was diversity in practice as to how dividends on these securities were reported. The FASB now requires debt-like securities, like redeemable preferred stock, to be classified as liabilities and be measured and accounted for similar to liabilities. [1]

The accounting for preferred stock at issuance is similar to that for common stock. A corporation allocates proceeds between the par value of the preferred stock and additional paid-in capital. To illustrate, assume that Bishop Co. issues 10,000 shares of $10 par value preferred stock for $12 cash per share. Bishop records the issuance as follows:

Thus, Bishop maintains separate accounts for these different classes of shares.

In contrast to convertible bonds (recorded as a liability on the date of issue) corporations consider convertible preferred stock as a part of stockholders' equity. In addition, when exercising convertible preferred stocks, there is no theoretical justification for recognition of a gain or loss. A company recognizes no gain or loss when dealing with stockholders in their capacity as business owners. Instead, the company employs the book value method: debit Preferred Stock, along with any related Additional Paid-in Capital; credit Common Stock and Additional Paid-in Capital (if an excess exists).

Preferred stock generally has no maturity date. Therefore, no legal obligation exists to pay the preferred stockholder. As a result, companies classify preferred stock as part of stockholders' equity. Companies generally report preferred stock at par value as the first item in the stockholders' equity section. They report any excess over par value as part of additional paid-in capital. They also consider dividends on preferred stock as a distribution of income and not an expense. Companies must disclose the pertinent rights of the preferred stock outstanding. [2]

Dividend payouts can be important signals to the market. The practice of paying dividends declined sharply in the 1980s and 1990s as companies focused on growth and plowed profits back into the business. A resurgence in dividend payouts is due in large part to the dividend tax cut of 2003, which reduced the rate of tax on dividends to 15 percent (quite a bit lower than the ordinary income rate charged in the past). In addition, investors who were burned by accounting scandals in recent years began demanding higher payouts in the form of dividends. Why? A dividend check provides proof that at least some portion of a company's profits is genuine.[234]

Determining the proper amount of dividends to pay is a difficult financial management decision. Companies that are paying dividends are extremely reluctant to reduce or eliminate their dividend. They fear that the securities market might negatively view this action. As a consequence, companies that have been paying cash dividends will make every effort to continue to do so. In addition, the type of shareholder the company has (taxable or nontaxable, retail investor or institutional investor) plays a large role in determining dividend policy.

Very few companies pay dividends in amounts equal to their legally available retained earnings. The major reasons are as follows.

To maintain agreements (bond covenants) with specific creditors, to retain all or a portion of the earnings, in the form of assets, to build up additional protection against possible loss.

To meet state corporation requirements, that earnings equivalent to the cost of treasury shares purchased be restricted against dividend declarations.

To retain assets that would otherwise be paid out as dividends, to finance growth or expansion. This is sometimes called internal financing, reinvesting earnings, or "plowing" the profits back into the business.

To smooth out dividend payments from year to year by accumulating earnings in good years and using such accumulated earnings as a basis for dividends in bad years.

To build up a cushion or buffer against possible losses or errors in the calculation of profits.

The reasons above are self-explanatory except for the second. The laws of some states require that the corporation restrict its legal capital from distribution to stockholders, to protect against loss for creditors.[235] The applicable state law determines the legality of a dividend.

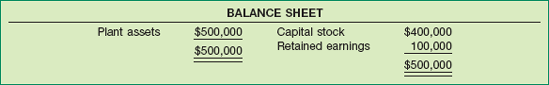

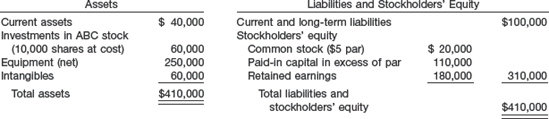

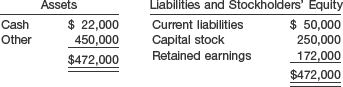

Effective management of a company requires attention to more than the legality of dividend distributions. Management must also consider economic conditions, most importantly, liquidity. Assume an extreme situation as shown in Illustration 15-7.

The depicted company has a retained earnings credit balance. Unless restricted, it can declare a dividend of $100,000. But because all its assets are plant assets used in operations, payment of a cash dividend of $100,000 would require the sale of plant assets or borrowing.

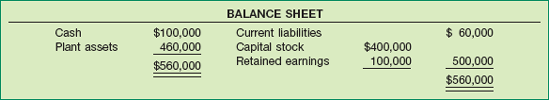

Even if a balance sheet shows current assets, as in Illustration 15-8, the question remains as to whether the company needs those cash assets for other purposes.

The existence of current liabilities strongly implies that the company needs some of the cash to meet current debts as they mature. In addition, day-by-day cash requirements for payrolls and other expenditures not included in current liabilities also require cash.

Thus, before declaring a dividend, management must consider availability of funds to pay the dividend. A company should not pay a dividend unless both the present and future financial position warrant the distribution.

The SEC encourages companies to disclose their dividend policy in their annual report, especially those that (1) have earnings but fail to pay dividends, or (2) do not expect to pay dividends in the foreseeable future. In addition, the SEC encourages companies that consistently pay dividends to indicate whether they intend to continue this practice in the future.

Companies generally base dividend distributions either on accumulated profits (that is, retained earnings) or on some other capital item such as additional paid-in capital. Dividends are of the following types.

Cash dividends.

Property dividends.

Liquidating dividends.

Stock dividends.

Although commonly paid in cash, companies occasionally pay dividends in stock or some other asset.[236] All dividends, except for stock dividends, reduce the total stockholders' equity in the corporation. When declaring a stock dividend, the corporation does not pay out assets or incur a liability. It issues additional shares of stock to each stockholder and nothing more.

The natural expectation of any stockholder who receives a dividend is that the corporation has operated successfully. As a result, he or she is receiving a share of its profits. A company should disclose a liquidating dividend—that is, a dividend not based on retained earnings—to the stockholders so that they will not misunderstand its source.

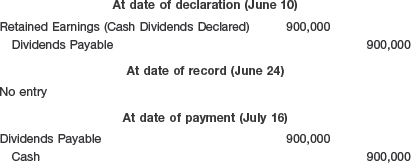

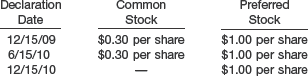

The board of directors votes on the declaration of cash dividends. Upon approval of the resolution, the board declares a dividend. Before paying it, however, the company must prepare a current list of stockholders. For this reason there is usually a time lag between declaration and payment. For example, the board of directors might approve a resolution at the January 10 (date of declaration) meeting, and declare it payable February 5 (date of payment) to all stockholders of record January 25 (date of record).[237] In this example, the period from January 10 to January 25 gives time for the company to complete and register any transfers in process. The time from January 25 to February 5 provides an opportunity for the transfer agent or accounting department, depending on who does this work, to prepare a list of stockholders as of January 25 and to prepare and mail dividend checks.

A declared cash dividend is a liability. Because payment is generally required very soon, it is usually a current liability. Companies use the following entries to record the declaration and payment of an ordinary dividend payable in cash. For example, Roadway Freight Corp. on June 10 declared a cash dividend of 50 cents a share on 1.8 million shares payable July 16 to all stockholders of record June 24.

To set up a ledger account that shows the amount of dividends declared during the year, Roadway Freight might debit Cash Dividends Declared instead of Retained Earnings at the time of declaration. It then closes this account to Retained Earnings at year-end.

A company may declare dividends either as a certain percent of par, such as a 6 percent dividend on preferred stock, or as an amount per share, such as 60 cents per share on no-par common stock. In the first case, the rate multiplied by the par value of outstanding shares equals the total dividend. In the second, the dividend equals the amount per share multiplied by the number of shares outstanding. Companies do not declare or pay cash dividends on treasury stock.

Dividend policies vary among corporations. Some companies, such as Bank of America, Clorox Co., and Tootsie Roll Industries, take pride in a long, unbroken string of quarterly dividend payments. They would lower or pass the dividend only if forced to do so by a sustained decline in earnings or a critical shortage of cash.

"Growth" companies, on the other hand, pay little or no cash dividends because their policy is to expand as rapidly as internal and external financing permit. For example, Questcor Pharmaceuticals Inc. has never paid cash dividends to its common stockholders. These investors hope that the price of their shares will appreciate in value. The investors will then realize a profit when they sell their shares. Many companies focus more on increasing share price, stock repurchase programs, and corporate earnings than on dividend payout.

Dividends payable in assets of the corporation other than cash are called property dividends or dividends in kind. Property dividends may be merchandise, real estate, or investments, or whatever form the board of directors designates. Ranchers Exploration and Development Corp. reported one year that it would pay a fourth-quarter dividend in gold bars instead of cash. Because of the obvious difficulties of divisibility of units and delivery to stockholders, the usual property dividend is in the form of securities of other companies that the distributing corporation holds as an investment.

For example, after ruling that DuPont's 23 percent stock interest in General Motors violated antitrust laws, the Supreme Court ordered DuPont to divest itself of the GM stock within 10 years. The stock represented 63 million shares of GM's 281 million shares then outstanding. DuPont could not sell the shares in one block of 63 million. Further, it could not sell 6 million shares annually for the next 10 years without severely depressing the value of the GM stock. DuPont solved its problem by declaring a property dividend and distributing the GM shares as a dividend to its own stockholders.

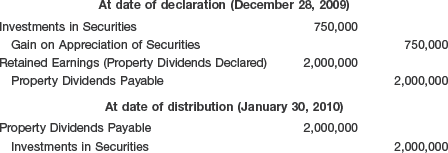

When declaring a property dividend, the corporation should restate at fair value the property it will distribute, recognizing any gain or loss as the difference between the property's fair value and carrying value at date of declaration. The corporation may then record the declared dividend as a debit to Retained Earnings (or Property Dividends Declared) and a credit to Property Dividends Payable, at an amount equal to the fair value of the distributed property. Upon distribution of the dividend, the corporation debits Property Dividends Payable and credits the account containing the distributed asset (restated at fair value).

For example, Trendler, Inc. transferred to stockholders some of its investments in securities costing $1,250,000 by declaring a property dividend on December 28, 2009, to be distributed on January 30, 2010, to stockholders of record on January 15, 2010. At the date of declaration the securities have a market value of $2,000,000. Trendler makes the following entries.

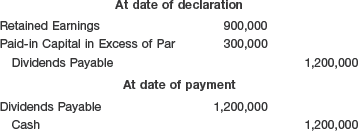

Some corporations use paid-in capital as a basis for dividends. Without proper disclosure of this fact, stockholders may erroneously believe the corporation has been operating at a profit. To avoid this type of deception, intentional or unintentional, a clear statement of the source of every dividend should accompany the dividend check.

Dividends based on other than retained earnings are sometimes described as liquidating dividends. This term implies that such dividends are a return of the stockholder's investment rather than of profits. In other words, any dividend not based on earnings reduces corporate paid-in capital and to that extent, it is a liquidating dividend. Companies in the extractive industries may pay dividends equal to the total of accumulated income and depletion. The portion of these dividends in excess of accumulated income represents a return of part of the stockholder's investment.

For example, McChesney Mines Inc. issued a "dividend" to its common stockholders of $1,200,000. The cash dividend announcement noted that stockholders should consider $900,000 as income and the remainder a return of capital. McChesney Mines records the dividend as follows:

In some cases, management simply decides to cease business and declares a liquidating dividend. In these cases, liquidation may take place over a number of years to ensure an orderly and fair sale of assets. For example, when Overseas National Airways dissolved, it agreed to pay a liquidating dividend to its stockholders over a period of years equivalent to $8.60 per share. Each liquidating dividend payment in such cases reduces paid-in capital.

If management wishes to "capitalize" part of the earnings (i.e., reclassify amounts from earned to contributed capital), and thus retain earnings in the business on a permanent basis, it may issue a stock dividend. In this case, the company distributes no assets. Each stockholder maintains exactly the same proportionate interest in the corporation and the same total book value after the company issues the stock dividend. Of course, the book value per share is lower because each stockholder holds more shares.

A stock dividend therefore is the issuance by a corporation of its own stock to its stockholders on a pro rata basis, without receiving any consideration. In recording a stock dividend, some believe that the company should transfer the par value of the stock issued as a dividend from retained earnings to capital stock. Others believe that it should transfer the fair value of the stock issued—its market value at the declaration date—from retained earnings to capital stock and additional paid-in capital.

The fair value position was adopted, at least in part, in order to influence the stock dividend policies of corporations. Evidently in 1941 both the New York Stock Exchange and many in the accounting profession regarded periodic stock dividends as objectionable. They believed that the term dividend when used with a distribution of additional stock was misleading because investors' net assets did not increase as a result of this "dividend." As a result, these groups decided to make it more difficult for corporations to sustain a series of such stock dividends out of their accumulated earnings, by requiring the use of fair market value when it substantially exceeded book value.[238]

When the stock dividend is less than 20–25 percent of the common shares outstanding at the time of the dividend declaration, the company is therefore required to transfer the fair value of the stock issued from retained earnings. Stock dividends of less than 20–25 percent are often referred to as small (ordinary) stock dividends. This method of handling stock dividends is justified on the grounds that "many recipients of stock dividends look upon them as distributions of corporate earnings and usually in an amount equivalent to the fair value of the additional shares received." [3] We consider this argument unconvincing. It is generally agreed that stock dividends are not income to the recipients. Therefore, sound accounting should not recommend procedures simply because some recipients think they are income.[239]

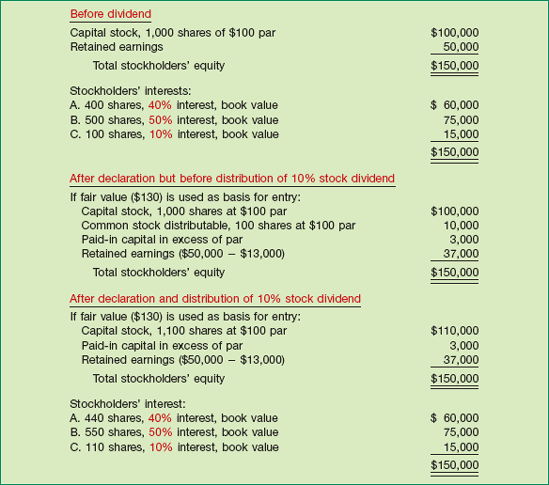

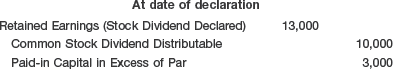

To illustrate a small stock dividend, assume that Vine Corporation has outstanding 1,000 shares of $100 par value capital stock and retained earnings of $50,000. If Vine declares a 10 percent stock dividend, it issues 100 additional shares to current stockholders. If the fair value of the stock at the time of the stock dividend is $130 per share, the entry is:

Note that the stock dividend does not affect any asset or liability. The entry merely reflects a reclassification of stockholders' equity. If Vine prepares a balance sheet between the dates of declaration and distribution, it should show the common stock dividend distributable in the stockholders' equity section as an addition to capital stock (whereas it shows cash or property dividends payable as current liabilities).

When issuing the stock, the entry is:

No matter what the fair value is at the time of the stock dividend, each stockholder retains the same proportionate interest in the corporation.

Some state statutes specifically prohibit the issuance of stock dividends on treasury stock. In those states that permit treasury shares to participate in the distribution accompanying a stock dividend or stock split, the planned use of the treasury shares influences corporate practice. For example, if a corporation issues treasury shares in connection with employee stock options, the treasury shares may participate in the distribution because the corporation usually adjusts the number of shares under option for any stock dividends or splits. But no useful purpose is served by issuing additional shares to the treasury stock without a specific purpose, since they are essentially equivalent to authorized but unissued shares.

To continue with our example of the effect of the small stock dividend, note in Illustration 15-9 (on page 762) that the stock dividend does not change the total stockholders' equity. Also note that it does not change the proportion of the total shares outstanding held by each stockholder.

If a company has undistributed earnings over several years, and accumulates a sizable balance in retained earnings, the market value of its outstanding shares likely increases. Stock issued at prices less than $50 a share can easily attain a market price in excess of $200 a share. The higher the market price of a stock, however, the less readily some investors can purchase it.

The managements of many corporations believe that better public relations depend on wider ownership of the corporation stock. They therefore target a market price sufficiently low to be within range of the majority of potential investors. To reduce the market value of shares, they use the common device of a stock split. For example, after its stock price increased by 25-fold, Qualcomm Inc. split its stock 4-for-1. Qualcomm's stock had risen above $500 per share, raising concerns that Qualcomm could not meet an analyst target of $1,000 per share. The split reduced the analysts' target to $250, which it could better meet with wider distribution of shares at lower trading prices.

From an accounting standpoint, Qualcomm records no entry for a stock split. However, it enters a memorandum note to indicate the changed par value of the shares and the increased number of shares. Illustration 15-10 shows the lack of change in stockholders' equity for a 2-for-1 stock split on 1,000 shares of $100 par value stock with the par being halved upon issuance of the additional shares.

Stock splits were all the rage in the booming stock market of the 1990s. Of major companies on the New York Stock Exchange, fewer than 80 companies split shares in 1990. By 1998, with stock prices soaring, over 200 companies split shares. Although the split does not increase a stockholder's proportionate ownership of the company, studies show that split shares usually outperform those that don't split, as well as the market as a whole, for several years after the split. In addition, the splits help the company keep the shares in more attractive price ranges.

What about when the market "turns south"? A number of companies who split their shares in the boom markets of the 1990s have since seen their share prices decline to a point considered too low. For example, since Ameritrade's 12-for-1 split in 1999, its stock price declined over 74 percent, so that it was trading around $6 per share in March 2002. Lucent traded at less than $5 a share following a 4-for-1 split. For some investors, these low-priced stocks are unattractive because some brokerage commissions rely on the number of shares traded, not the dollar amount. Others are concerned that low-priced shares are easier for would-be scamsters to manipulate. And if a company's per share price falls below $1 for 30 consecutive days, it is a violation of stock exchange listing requirements.

Some companies are considering reverse stock splits in which, say, 5 shares are consolidated into one. Thus, a stock previously trading at $5 per share would be part of an unsplit share trading at $25. Unsplitting might thus avoid some of the negative consequences of a low trading price. The downside to this strategy is that analysts might view reverse splits as additional bad news about the direction of the stock price. For example, Webvan, a failed Internet grocer, did a 1-for-25 reverse split just before it entered bankruptcy.

Source: Adapted from David Henry, "Stocks: The Case for Unsplitting," BusinessWeek Online (April 1, 2002).

From a legal standpoint, a stock split differs from a stock dividend. How? A stock split increases the number of shares outstanding and decreases the par or stated value per share. A stock dividend, although it increases the number of shares outstanding, does not decrease the par value; thus it increases the total par value of outstanding shares.

The reasons for issuing a stock dividend are numerous and varied. Stock dividends can be primarily a publicity gesture, because many consider stock dividends as dividends. Another reason is that the corporation may simply wish to retain profits in the business by capitalizing a part of retained earnings. In such a situation, it makes a transfer on declaration of a stock dividend from earned capital to contributed capital.

A corporation may also use a stock dividend, like a stock split, to increase the marketability of the stock, although marketability is often a secondary consideration. If the stock dividend is large, it has the same effect on market price as a stock split. Whenever corporations issue additional shares for the purpose of reducing the unit market price, then the distribution more closely resembles a stock split than a stock dividend. This effect usually results only if the number of shares issued is more than 20–25 percent of the number of shares previously outstanding. [4] A stock dividend of more than 20–25 percent of the number of shares previously outstanding is called a large stock dividend.[240] Such a distribution should not be called a stock dividend but instead "a split-up effected in the form of a dividend" or "stock split."

Also, since a split-up effected in the form of a dividend does not alter the par value per share, companies generally are required to transfer the par value amount from retained earnings. In other words, companies transfer from retained earnings to capital stock the par value of the stock issued, as opposed to a transfer of the market price of the shares issued as in the case of a small stock dividend.[241] For example, Brown Group, Inc. at one time authorized a 2-for-1 split, effected in the form of a stock dividend. As a result of this authorization, it distributed approximately 10.5 million shares, and transferred more than $39 million representing the par value of the shares issued from Retained Earnings to the Common Stock account.

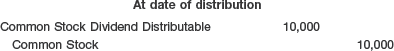

To illustrate a large stock dividend (stock split-up effected in the form of a dividend), Rockland Steel, Inc. declared a 30 percent stock dividend on November 20, payable December 29 to stockholders of record December 12. At the date of declaration, 1,000,000 shares, par value $10, are outstanding and with a fair value of $200 per share. The entries are:

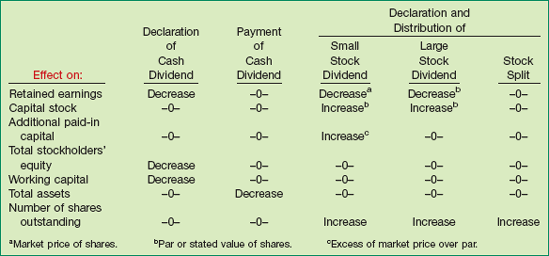

Illustration 15-11 summarizes and compares the effects in the balance sheet and related items of various types of dividends and stock splits.

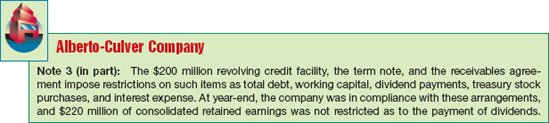

Many corporations restrict retained earnings or dividends, without any formal journal entries. Such restrictions are best disclosed by note. Parenthetical notations are sometimes used, but restrictions imposed by bond indentures and loan agreements commonly require an extended explanation. Notes provide a medium for more complete explanations and free the financial statements from abbreviated notations. The note disclosure should reveal the source of the restriction, pertinent provisions, and the amount of retained earnings subject to restriction, or the amount not restricted.

Restrictions may be based on the retention of a certain retained earnings balance, the ability to maintain certain working capital requirements, additional borrowing, and other considerations. The example from the annual report of Alberto-Culver Company in Illustration 15-12 shows a note disclosing potential restrictions on retained earnings and dividends.

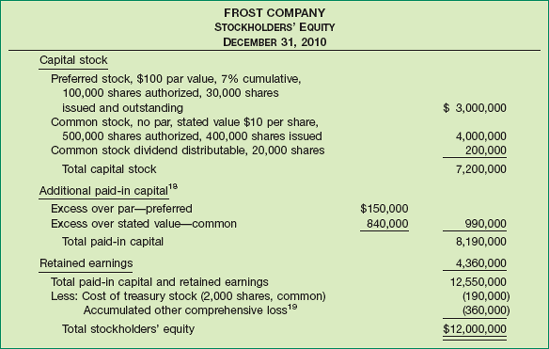

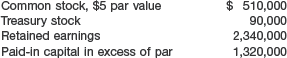

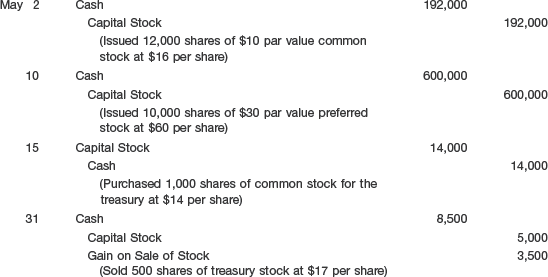

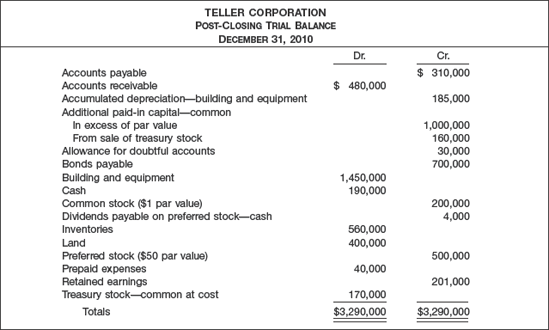

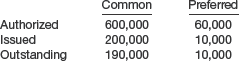

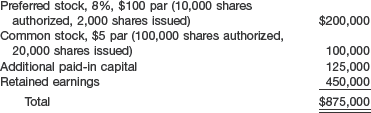

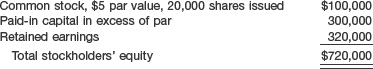

Illustration 15-13 shows a comprehensive stockholders' equity section from the balance sheet of Frost Company that includes most of the equity items we discussed in this chapter.

Frost should disclose the pertinent rights and privileges of the various securities outstanding. For example, companies must disclose all of the following: dividend and liquidation preferences, participation rights, call prices and dates, conversion or exercise prices and pertinent dates, sinking fund requirements, unusual voting rights, and significant terms of contracts to issue additional shares. Liquidation preferences should be disclosed in the equity section of the balance sheet, rather than in the notes to the financial statements, to emphasize the possible effect of this restriction on future cash flows. [5]

The statement of stockholders' equity is frequently presented in the following basic format.

Balance at the beginning of the period.

Additions.

Deductions.

Balance at the end of the period.

Companies must disclose changes in the separate accounts comprising stockholders' equity, to make the financial statements sufficiently informative.[244] Such changes may be disclosed in separate statements or in the basic financial statements or notes thereto.[245]

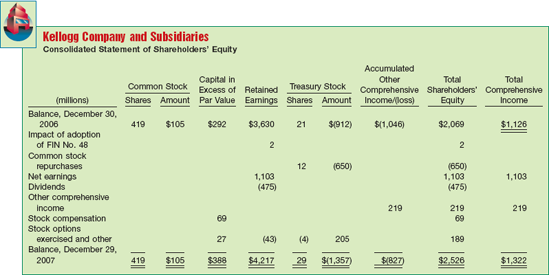

A columnar format for the presentation of changes in stockholders' equity items in published annual reports is gaining in popularity. An example is Kellogg Company's statement of stockholders' equity, shown in Illustration 15-14.

Analysts use stockholders' equity ratios to evaluate a company's profitability and long-term solvency. We discuss and illustrate the following three ratios below.

The rate of return on common stock equity measures profitability from the common stockholders' viewpoint. This ratio shows how many dollars of net income the company earned for each dollar invested by the owners. Return on equity (ROE) also helps investors judge the worthiness of a stock when the overall market is not doing well. For example, Best Buy shares dropped nearly 40 percent, along with the broader market in 2001–2002. But a review of its return on equity during this period and since shows a steady return of 20 to 22 percent while the overall market ROE declined from 16 percent to 8 percent. More importantly, Best Buy and other stocks, such as 3M and Procter & Gamble, recovered their lost market value, while other stocks with less robust ROEs stayed in the doldrums.

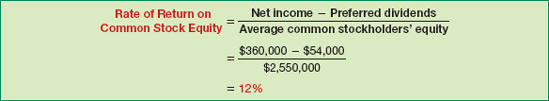

Return on equity equals net income less preferred dividends, divided by average common stockholders' equity. For example, assume that Gerber's Inc. had net income of $360,000, declared and paid preferred dividends of $54,000, and average common stockholders' equity of $2,550,000. Illustration 15-15 shows how to compute Gerber's ratio.

As shown in Illustration 15-15, when preferred stock is present, income available to common stockholders equals net income less preferred dividends. Similarly, the amount of common stock equity used in this ratio equals total stockholders' equity less the par value of preferred stock.

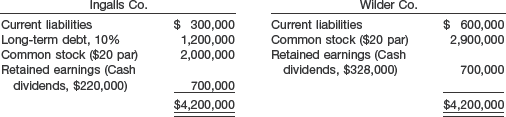

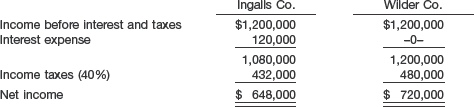

A company can improve its return on common stock equity through the prudent use of debt or preferred stock financing. Trading on the equity describes the practice of using borrowed money or issuing preferred stock in hopes of obtaining a higher rate of return on the money used. Shareholders win if return on the assets is higher than the cost of financing these assets. When this happens, the rate of return on common stock equity will exceed the rate of return on total assets. In short, the company is "trading on the equity at a gain." In this situation, the money obtained from bondholders or preferred stockholders earns enough to pay the interest or preferred dividends and leaves a profit for the common stockholders. On the other hand, if the cost of the financing is higher that the rate earned on the assets, the company is trading on equity at a loss and stockholders lose.

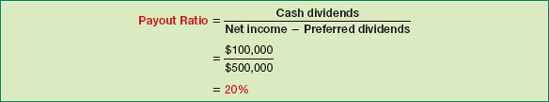

Another ratio of interest to investors, the payout ratio, is the ratio of cash dividends to net income. If preferred stock is outstanding, this ratio equals cash dividends paid to common stockholders, divided by net income available to common stockholders. For example, assume that Troy Co. has cash dividends of $100,000 and net income of $500,000, and no preferred stock outstanding. Illustration 15-16 shows the payout ratio computation.

Recently, the payout ratio has plummeted. In 1982, more than half of earnings were converted to dividends. In the second quarter of 2007, just 29 percent of the earnings of the S&P 500 was distributed via dividends.[246]

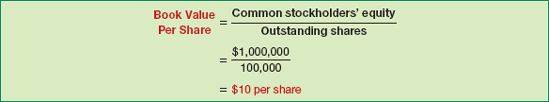

A much-used basis for evaluating net worth is found in the book value or equity value per share of stock. Book value per share of stock is the amount each share would receive if the company were liquidated on the basis of amounts reported on the balance sheet. However, the figure loses much of its relevance if the valuations on the balance sheet fail to approximate fair value of the assets. Book value per share equals common stockholders' equity divided by outstanding common shares. Assume that Chen Corporation's common stockholders' equity is $1,000,000 and it has 100,000 shares of common stock outstanding. Illustration 15-17 shows its book value per share computation.

The primary iGAAP reporting standards related to stockholders' equity are IAS 1 ("Presentation of Financial Statements"), IAS 32 ("Financial Instruments: Presentation"), and IAS 39 ("Financial Instruments: Recognition and Measurement"). The accounting for transactions related to stockholders' equity, such as issuance of shares, purchase of treasury stock, and declaration and payment of dividends, are similar under both iGAAP and U.S. GAAP. Major differences relate to terminology used, introduction of items such as revaluation surplus, and presentation of stockholders' equity information.

Many countries have different investor groups than the United States. For example, in Germany, financial institutions like banks are not only the major creditors but often are the largest stockholders as well. In the United States and the United Kingdom, many companies rely on substantial investment from private investors.

The accounting for treasury stock retirements differs between iGAAP and U.S. GAAP. Under U.S. GAAP a company has three options: (1) charge the excess of the cost of treasury stock over par value to retained earnings, (2) allocate the difference between paid-in capital and retained earnings, or (3) charge the entire amount to paid-in capital. Under iGAAP, the excess may have to be charged to paid-in capital, depending on the original transaction related to the issuance of the stock.

A major difference between iGAAP and U.S. GAAP relates to the account Revaluation Surplus. Revaluation surplus arises under iGAAP because companies are permitted to revalue their property, plant, and equipment to fair value under certain circumstances. This account is part of general reserves under iGAAP and is not considered contributed capital.

Both iGAAP and U.S. GAAP consider the statement of stockholders' equity a primary financial statement. However, under iGAAP a company has the option of preparing a statement of stockholders' equity similar to U.S. GAAP or preparing a statement of recognized income and expense (SoRIE). The SoRIE reports the items that were charged directly to equity such as revaluation surplus and then adds the net income for the period to arrive at total recognized income and expense. In this situation, additional note disclosure is required to provide reconciliations of other equity items.

While there are many similarities in the accounting for stockholders' equity between U.S. GAAP and iGAAP, the following disclosure for Mallorca Ltd. highlights some of the key differences.

As noted, included in Mallorca's stockholders' equity is an asset revaluation surplus, which is not permitted in U.S. GAAP. Also some gains and losses are recorded directly in equity. As discussed in Chapter 4, iGAAP companies may report such gains and losses in a Statement of Recognized Income and Expense, instead of preparing a traditional statement of stockholders' equity.

As indicated in earlier discussions, the IASB and the FASB are currently working on a project related to financial statement presentation. An important part of this study is to determine whether certain line items, subtotals, and totals should be clearly defined and required to be displayed in the financial statements. For example, it is likely that the statement of stockholders' equity and its presentation will be examined closely. The statement of recognized income and expense now permitted under iGAAP will probably be eliminated. In addition, the options of how to present other comprehensive income under U.S. GAAP will change in any converged standard. Also, the FASB has been working on a standard that will likely converge to iGAAP in the area of hybrid financial instruments.

A stock dividend is a capitalization of retained earnings that reduces retained earnings and increases certain contributed capital accounts. The par value per share and total stockholders' equity remain unchanged with a stock dividend, and all stockholders retain their same proportionate share of ownership. A stock split results in an increase or decrease in the number of shares outstanding, with a corresponding decrease or increase in the par or stated value per share. No accounting entry is required for a stock split.

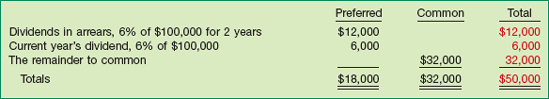

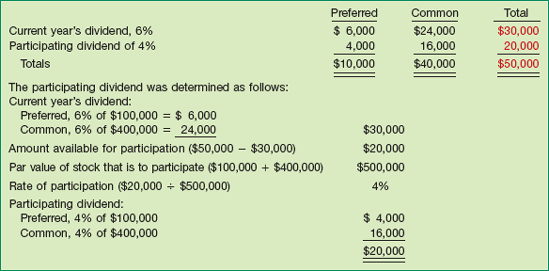

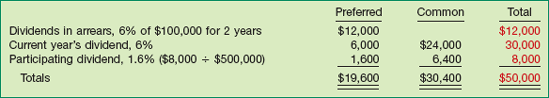

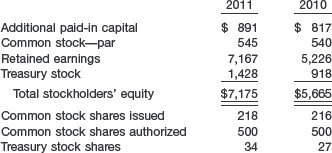

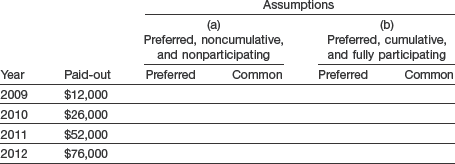

Illustrations 15A-1 to 15A-4 indicate the effects of various dividend preferences on dividend distributions to common and preferred stockholders. Assume that in 2010, Mason Company is to distribute $50,000 as cash dividends, its outstanding common stock has a par value of $400,000, and its 6 percent preferred stock has a par value of $100,000. Mason would distribute dividends to each class, employing the assumptions given, as follows:

If the preferred stock is noncumulative and nonparticipating:

If the preferred stock is cumulative and nonparticipating, and Mason Company did not pay dividends on the preferred stock in the preceding two years:

If the preferred stock is noncumulative and is fully participating:[247]

If the preferred stock is cumulative and is fully participating, and Mason Company did not pay dividends on the preferred stock in the preceding two years:

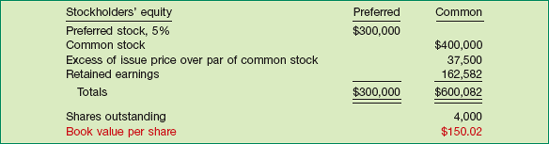

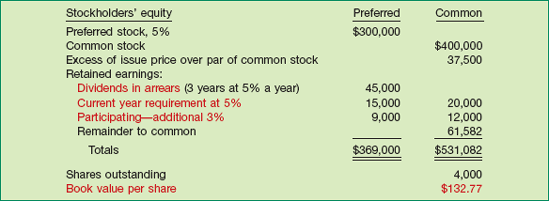

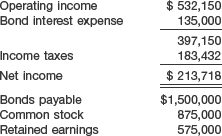

Book value per share in its simplest form is computed as net assets divided by outstanding shares at the end of the year. The computation of book value per share becomes more complicated if a company has preferred stock in its capital structure. For example, if preferred dividends are in arrears, if the preferred stock is participating, or if preferred stock has a redemption or liquidating value higher than its carrying amount, the company must allocate retained earnings between the preferred and common stockholders in computing book value.

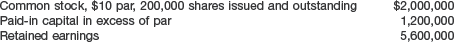

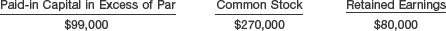

To illustrate, assume that the following situation exists.

The situation in Illustration 15A-5 assumes that no preferred dividends are in arrears and that the preferred is not participating. Now assume that the same facts exist except that the 5 percent preferred is cumulative, participating up to 8 percent, and that dividends for three years before the current year are in arrears. Illustration 15A-6 shows how to compute the book value of the common stock, assuming that no action has yet been taken concerning dividends for the current year.

In connection with the book value computation, the analyst must know how to handle the following items: the number of authorized and unissued shares; the number of treasury shares on hand; any commitments with respect to the issuance of unissued shares or the reissuance of treasury shares; and the relative rights and privileges of the various types of stock authorized. As an example, if the liquidating value of the preferred stock is higher than its carrying amount, the liquidating amount should be used in the book value computation.

SUMMARY OF LEARNING OBJECTIVE FOR APPENDIX 15A

FASB Codification References

FASB ASC 480-10-05. [Predecessor literature: "Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity," Statement of Financial Accounting Standards No. 150 (Norwalk Conn.: FASB, 2003).]

FASB ASC 505-10-50-3. [Predecessor literature: "Disclosure of Information about Capital Structure," Statement of Financial Accounting Standards No. 129 (Norwalk, Conn.: FASB, 1997).]

FASB ASC 505-20-05-2. [Predecessor literature: American Institute of Certified Public Accountants, Accounting Research and Terminology Bulletins, No. 43 (New York: AICPA, 1961), Ch. 7, par. 10.]

FASB ASC 505-20-25-3. [Predecessor literature: American Institute of Certified Public Accountants, Accounting Research and Terminology Bulletins, No. 43 (New York: AICPA, 1961), par. 13.]

FASB ASC 505-10-50-3. [Predecessor literature: "Disclosure of Information about Capital Structure," Statement of Financial Accounting Standards No. 129 (Norwalk, Conn.: FASB, February 1997), par. 4.]

FASB ASC 220-10-05. [Predecessor literature: "Reporting Comprehensive Income," Statement of Financial Accounting Standards No. 130 (Norwalk, Conn.: FASB, June 1997).]

Note: All asterisked Questions, Exercises, and Problems relate to material in the appendix to the chapter.

In the absence of restrictive provisions, what are the basic rights of stockholders of a corporation?

Why is a preemptive right important?

Distinguish between common and preferred stock.

Why is the distinction between paid-in capital and retained earnings important?