After studying this chapter, you should be able to:

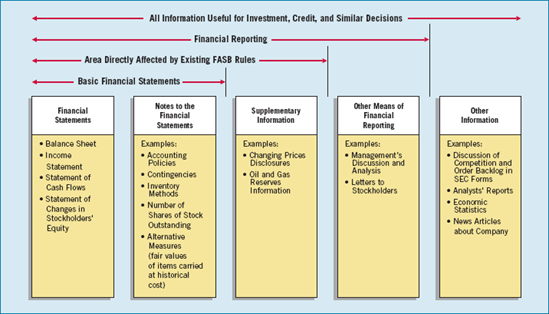

FASB Concepts Statement No. 1 notes that some useful information is best provided in the financial statements, and some is best provided by means other than in financial statements. For example, earnings and cash flows are readily available in financial statements—but investors might do better to look at comparisons to other companies in the same industry, found in news articles or brokerage house reports.

FASB rules directly affect financial statements, notes to the financial statements, and supplementary information. Other types of information found in the annual report, such as management's discussion and analysis, are not subject to FASB rules. Illustration 24-1 indicates the various types of financial information.

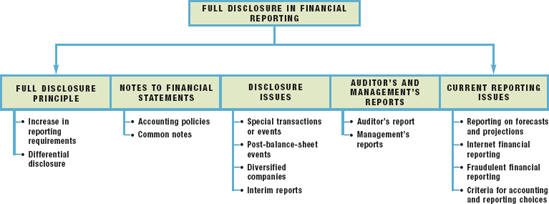

As Chapter 2 indicated, the profession has adopted a full disclosure principle. The full disclosure principle calls for financial reporting of any financial facts significant enough to influence the judgment of an informed reader. In some situations, the benefits of disclosure may be apparent but the costs uncertain. In other instances, the costs may be certain but the benefits of disclosure not as apparent.

For example, recently, the SEC required companies to provide expanded disclosures about their contractual obligations. In light of the off-balance-sheet accounting frauds at companies like Enron, the benefits of these expanded disclosures seem fairly obvious to the investing public. While no one has documented the exact costs of disclosure in these situations, they would appear to be relatively small.

On the other hand, the cost of disclosure can be substantial in some cases and the benefits difficult to assess. For example, at one time the Wall Street Journal reported that if segment reporting were adopted, a company like Fruehauf would have had to increase its accounting staff 50 percent, from 300 to 450 individuals. In this case, the cost of disclosure can be measured, but the benefits are less well defined.

Some even argue that the reporting requirements are so detailed and substantial that users have a difficult time absorbing the information. These critics charge the profession with engaging in information overload.

Financial disasters at Microstrategy, PharMor, WorldCom, and AIG highlight the difficulty of implementing the full disclosure principle. They raise the issue of why investors were not aware of potential problems: Was the information these companies presented not comprehensible? Was it buried? Was it too technical? Was it properly presented and fully disclosed as of the financial statement date, but the situation later deteriorated? Or was it simply not there? In the following sections, we describe the elements of high-quality disclosure that will enable companies to avoid these disclosure pitfalls.

Disclosure requirements have increased substantially. One survey showed that the size of many companies' annual reports is growing in response to demands for increased transparency. For example, annual report page counts ranged from 70 pages for Gateway up to a whopping 244 pages in Eastman Kodak's annual report. Compared to prior years' reports, the percentage increase in pages ranged from 17 percent at IBM to over 80 percent at Siebel Systems.[425] This result is not surprising; as illustrated throughout this textbook, the FASB has issued many pronouncements in the last 10 years that have substantial disclosure provisions.

The reasons for this increase in disclosure requirements are varied. Some of them are:

Complexity of the Business Environment. The increasing complexity of business operations magnifies the difficulty of distilling economic events into summarized reports. Such areas as derivatives, leasing, business combinations, pensions, financing arrangements, revenue recognition, and deferred taxes are complex. As a result, companies extensively use notes to the financial statements to explain these transactions and their future effects.

Necessity for Timely Information. Today, more than ever before, users are demanding information that is current and predictive. For example, users want more complete interim data. Also, the SEC recommends published financial forecasts, long avoided and even feared by management.

Accounting as a Control and Monitoring Device. The government has recently sought public disclosure of such phenomena as management compensation, off-balance-sheet financing arrangements, and related party transactions. An "Enronitis" concern is expressed in many of these newer disclosure requirements, and the SEC has selected accountants and auditors as the agents to assist in controlling and monitoring these concerns.

A trend toward differential disclosure is also occurring. For example, the SEC requires that companies report to it certain substantive information that is not found in annual reports to stockholders. Likewise, the FASB, recognizing that certain disclosure requirements are costly and unnecessary for certain companies, has eliminated reporting requirements for nonpublic enterprises in such areas as fair value of financial instruments and segment reporting.[426]

As we discussed in the opening story, financial disclosure is one of a number of institutional features that contribute to vibrant security markets. In fact, a recent study of disclosure and other mechanisms (such as civil lawsuits and criminal sanctions) found that good disclosure is the most important contributor to a vibrant market.

The study, which compared disclosure and other legal and regulatory elements across 49 countries, found that countries with the best disclosure laws have the biggest stock markets. Countries with more successful market environments also tend to have regulations that make it relatively easy for private investors to sue corporations that provide bad information. That is, while criminal sanctions can be effective in some circumstances, disclosure and other legal and regulatory elements encouraging good disclosure are the most important determinants of highly liquid and deep securities markets.

These findings hold for nations in all stages of economic development, with particular importance for nations that are in the early stages of securities regulation. The lesson: Disclosure is good for your market.

Source: Rebecca Christie, "Study: Disclosure at Heart of Effective Securities Laws," Wall Street Journal Online (August 11, 2003).

Some still complain that the FASB has not gone far enough. They note that certain types of companies (small or nonpublic) should not have to follow complex GAAP requirements such as those for deferred income taxes, leases, or pensions. This issue, often referred to as "big GAAP versus little GAAP," continues to be controversial. The FASB takes the position that there should be one set of GAAP, except in unusual situations.[427]

As you know from your study of this textbook, notes are an integral part of the financial statements of a business enterprise. However, readers of financial statements often overlook them because they are highly technical and often appear in small print. Notes are the means of amplifying or explaining the items presented in the main body of the statements. They can explain in qualitative terms information pertinent to specific financial statement items. In addition, they can provide supplementary data of a quantitative nature to expand the information in the financial statements. Notes also can explain restrictions imposed by financial arrangements or basic contractual agreements. Although notes may be technical and difficult to understand, they provide meaningful information for the user of the financial statements.

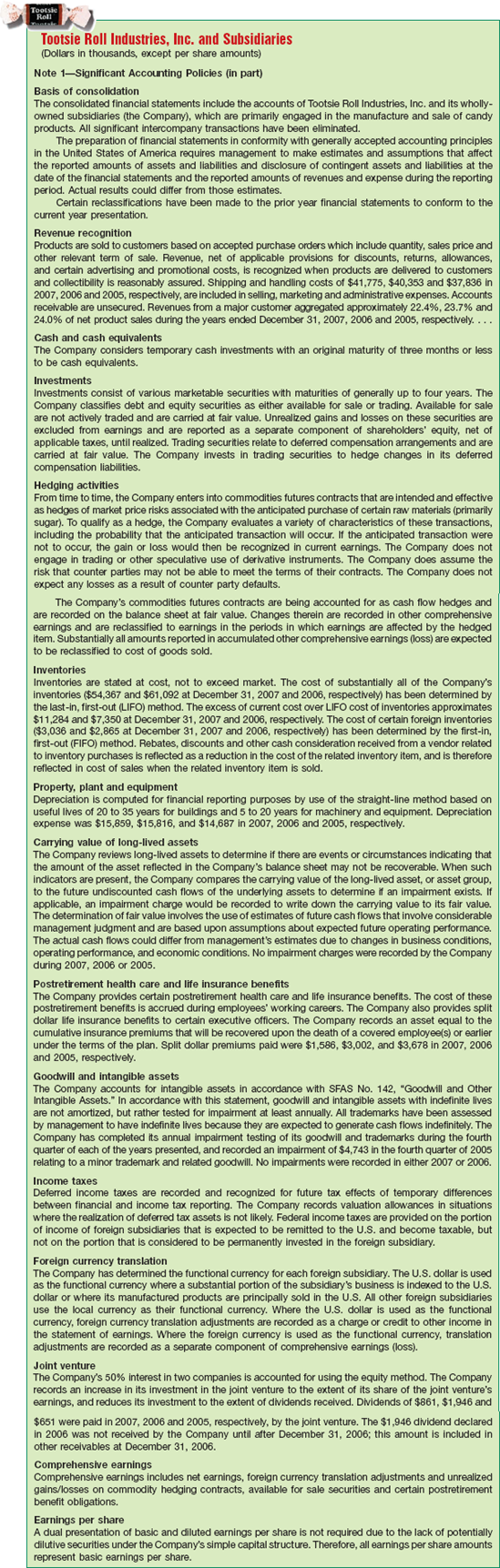

Accounting policies are the specific accounting principles and methods a company currently uses and considers most appropriate to present fairly its financial statements. GAAP states that information about the accounting policies adopted by a reporting entity is essential for financial statement users in making economic decisions. It recommended that companies should present as an integral part of the financial statements a statement identifying the accounting policies adopted and followed by the reporting entity. Companies should present the disclosure as the first note or in a separate Summary of Significant Accounting Policies section preceding the notes to the financial statements.

The Summary of Significant Accounting Policies answers such questions as: What method of depreciation is used on plant assets? What valuation method is employed on inventories? What amortization policy is followed in regard to intangible assets? How are marketing costs handled for financial reporting purposes?

Refer to Appendix 5B, pages 210–238, for an illustration of note disclosure of accounting policies (Note 1) and other notes accompanying the audited financial statements of The Procter & Gamble Company. Illustration 24-2 shows another example, from Tootsie Roll Industries.

Analysts examine carefully the summary of accounting policies to determine whether a company is using conservative or liberal accounting practices. For example, depreciating plant assets over an unusually long period of time is considered liberal. Using LIFO inventory valuation in a period of inflation is generally viewed as conservative.

Companies that fail to adopt high-quality reporting policies may be heavily penalized by the market. For example, when Microstrategy disclosed that it would restate prior-year results due to use of aggressive revenue recognition policies, its share price dropped over 60 percent in one day. Investors viewed Microstrategy's quality of earnings as low.

We have discussed many of the notes to the financial statements throughout this textbook, and will discuss others more fully in this chapter. The more common are as follows.

In earlier chapters we discussed the disclosures listed above. The following sections of this chapter illustrate four additional disclosures of significance—special transactions or events, subsequent events, segment reporting, and interim reporting.

Often, note disclosures are needed to give a complete picture of a company's financial position. A good example of such disclosures is the required disclosure of debt triggers that may be buried in financing arrangements. These triggers can require a company to pay off a loan immediately if the debt rating collapses; they are one of the reasons Enron crumbled so quickly. But few Enron stockholders knew about the debt triggers until the gun had gone off. Companies are also disclosing more about their bank credit lines, liquidity, and any special purpose entities. (The latter were major villains in the Enron drama.)

How can you get better informed about note disclosures that may contain important information related to your investments? Beyond your study in this class, a good web resource for understanding the contents of note disclosures is http://www.footnoted.org/. This site highlights "the things companies bury in their SEC filings." It notes that company reports are more complete of late, but only the largest companies are preparing documents that are readable. As the editor of the site noted, "[some companies] are being dragged kicking and screaming into plain English."

Source: Gretchen Morgenson, "Annual Reports: More Pages, But Better?" New York Times (March 17, 2002), and D. Stead, "The Secrets in SEC Filings," BusinessWeek (August 25, 2008), p. 12.

Related-party transactions, errors and fraud, and illegal acts pose especially sensitive and difficult problems. The accountant/auditor who has responsibility for reporting on these types of transactions must take care to properly balance the rights of the reporting company and the needs of users of the financial statements.

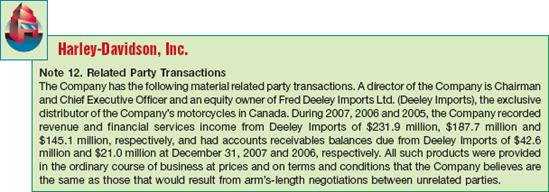

Related-party transactions arise when a company engages in transactions in which one of the parties has the ability to significantly influence the policies of the other. They may also occur when a nontransacting party has the ability to influence the policies of the two transacting parties.[428] Competitive, free-market dealings may not exist in related-party transactions, and so an "arm's-length" basis cannot be assumed. Transactions such as borrowing or lending money at abnormally low or high interest rates, real estate sales at amounts that differ significantly from appraised value, exchanges of nonmonetary assets, and transactions involving enterprises that have no economic substance ("shell corporations") suggest that related parties may be involved.

In order to make adequate disclosure, companies should report the economic substance, rather than the legal form, of these transactions. GAAP requires the following disclosures of material related-party transactions. [1]

The nature of the relationship(s) involved.

A description of the transactions (including transactions to which no amounts or nominal amounts were ascribed) for each of the periods for which income statements are presented.

The dollar amounts of transactions for each of the periods for which income statements are presented.

Amounts due from or to related parties as of the date of each balance sheet presented.

Illustration 24-3, from the annual report of Harley-Davidson, Inc., shows disclosure of related-party transactions.

Many companies are involved in related-party transactions. Errors, fraud (sometimes referred to as irregularities), and illegal acts, however, are the exception rather than the rule. Accounting errors are unintentional mistakes, whereas fraud (misappropriation of assets and fraudulent financial reporting) involves intentional distortions of financial statements.[429] As indicated earlier, companies should correct the financial statements when they discover errors. The same treatment should be given fraud. The discovery of fraud, however, gives rise to a different set of procedures and responsibilities for the accountant/auditor.[430]

Illegal acts encompass such items as illegal political contributions, bribes, kick-backs, and other violations of laws and regulations.[431] In these situations, the accountant/ auditor must evaluate the adequacy of disclosure in the financial statements. For example, if a company derives revenue from an illegal act that is considered material in relation to the financial statements, this information should be disclosed. The SarbanesOxley Act of 2002 is intended to deter these illegal acts. This law adds significant fines and longer jail time for those who improperly sign off on the correctness of financial statements that include willing and knowing misstatements.

Disclosure plays a very important role in these types of transactions because the events are more qualitative than quantitative and involve more subjective than objective evaluation. Users of the financial statements need some indication of the existence and nature of these transactions, through disclosures, modifications in the auditor's report, or reports of changes in auditors.

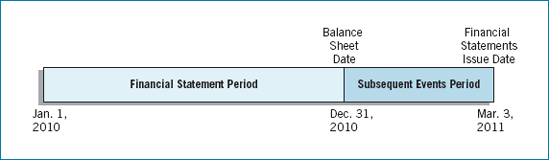

Notes to the financial statements should explain any significant financial events that took place after the formal balance sheet date, but before the statement is issued. These events are referred to as post-balance-sheet events, or just plain subsequent events. Illustration 24-4 shows a time diagram of the subsequent events period.

A period of several weeks, and sometimes months, may elapse after the end of the fiscal year but before the company issues financial statements. Various activities involved in closing the books for the period and issuing the statements all take time: taking and pricing the inventory, reconciling subsidiary ledgers with controlling accounts, preparing necessary adjusting entries, ensuring that all transactions for the period have been entered, obtaining an audit of the financial statements by independent certified public accountants, and printing the annual report. During the period between the balance sheet date and its distribution to stockholders and creditors, important transactions or other events may occur that materially affect the company's financial position or operating situation.

Many who read a balance sheet believe the balance sheet condition is constant, and they project it into the future. However, readers must be told if the company has experienced a significant change—e.g., sold one of its plants, acquired a subsidiary, suffered extraordinary losses, settled significant litigation, or experienced any other important event in the post-balance-sheet period. Without an explanation in a note, the reader might be misled and draw inappropriate conclusions.

Two types of events or transactions occurring after the balance sheet date may have a material effect on the financial statements or may need disclosure so that readers interpret these statements accurately:

Events that provide additional evidence about conditions that existed at the balance sheet date, including the estimates inherent in the process of preparing financial statements. These events are referred to as recognized subsequent events and require adjustments to the financial statements. All information available prior to the issuance of the financial statements helps investors and creditors evaluate estimates previously made. To ignore these subsequent events is to pass up an opportunity to improve the accuracy of the financial statements. This first type of event encompasses information that an accountant would have recorded in the accounts had the information been known at the balance sheet date.

For example, if a loss on an account receivable results from a customer's bankruptcy subsequent to the balance sheet date, the company adjusts the financial statements before their issuance. The bankruptcy stems from the customer's poor financial health existing at the balance sheet date.

The same criterion applies to settlements of litigation. The company must adjust the financial statements if the events that gave rise to the litigation, such as personal injury or patent infringement, took place prior to the balance sheet date.

Events that provide evidence about conditions that did not exist at the balance sheet date but arise subsequent to that date. These events are referred as nonrecognized subsequent events and do not require adjustment of the financial statements. To illustrate, a loss resulting from a customer's fire or flood after the balance sheet date does not reflect conditions existing at that date. Thus, adjustment of the financial statements is not necessary. A company should not recognize subsequent events that provide evidence about conditions that did not exist at the date of the balance sheet but that arose after the balance sheet date.

The following are examples of nonrecognized subsequent events:

Sale of a bond or capital stock issued after the balance sheet date.

A business combination that occurs after the balance sheet date.

Settlement of litigation when the event giving rise to the claim took place after the balance sheet date.

Loss of plant or inventories as a result of fire or natural disaster that occurred after the balance sheet date.

Losses on receivables resulting from conditions (such as a customer's major casualty) arising after the balance sheet date.

Changes in the quoted market prices of securities or foreign exchange rates after the balance sheet date.

Entering into significant commitments or contingent liabilities, for example, by issuing significant guarantees after the balance sheet date. [2][432]

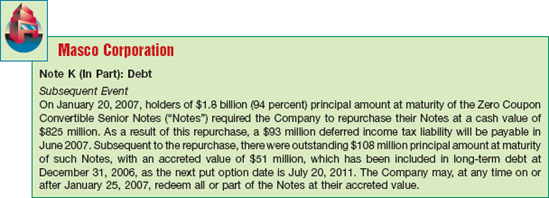

Some nonrecognized subsequent events may have to be disclosed to keep the financial statements from being misleading. For such events, a company discloses the nature of the event and an estimate of its financial effect.

Illustration 24-5 presents an example of subsequent events disclosure, excerpted from the annual report of Masco Corporation.

Many subsequent events or developments do not require adjustment of or disclosure in the financial statements. Typically, these are nonaccounting events or conditions that management normally communicates by other means. These events include legislation, product changes, management changes, strikes, unionization, marketing agreements, and loss of important customers.

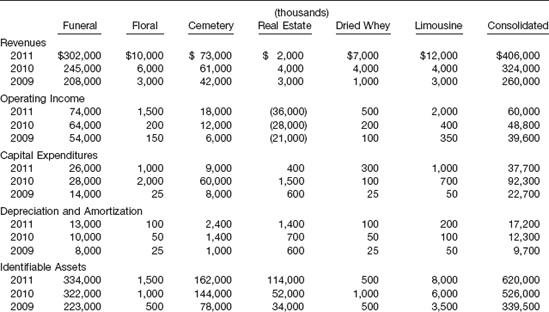

In certain business climates, companies have a tendency to diversify their operations. Take the case of conglomerate General Electric (GE), whose products include locomotives and jet engines, credit card services, and water purification systems. Its NBC Universal subsidiary owns NBC TV, Vivendi Universal Entertainment, and Universal Pictures. When businesses are so diversified, investors and investment analysts want more information about the details behind conglomerate financial statements. Particularly, they want income statement, balance sheet, and cash flow information on the individual segments that compose the total income figure.

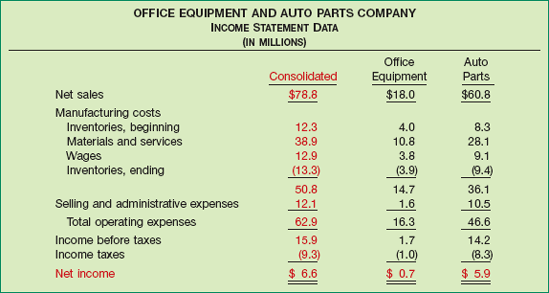

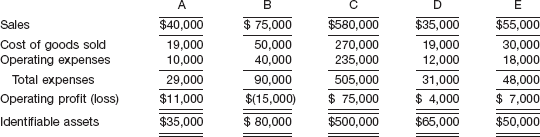

Illustration 24-6 shows segmented (disaggregated) financial information of an office equipment and auto parts company.

Much information is hidden in the aggregated totals. If the analyst has only the consolidated figures, he/she cannot tell the extent to which the differing product lines contribute to the company's profitability, risk, and growth potential. For example, in Illustration 24-6, the office equipment segment looks like a risky venture. Segmented reporting would provide useful information about the two business segments and would be useful for making an informed investment decision regarding the whole company.

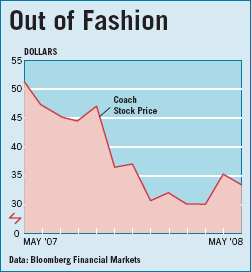

In addition to the example of Coach, Inc. in the opening story, a classic situation that demonstrates the need for segmented data involved Caterpillar, Inc. The SEC cited Caterpillar because it failed to tell investors that nearly a quarter of its income in one year came from a Brazilian unit and was nonrecurring in nature. The company knew that different economic policies in the next year would probably greatly affect earnings of the Brazilian unit. But Caterpillar presented its financial results on a consolidated basis, not disclosing the Brazilian operations. The SEC found that Caterpillar's failure to include information about Brazil left investors with an incomplete picture of the company's financial results and denied investors the opportunity to see the company "through the eyes of management."

Companies have always been somewhat hesitant to disclose segmented data for various reasons:

Without a thorough knowledge of the business and an understanding of such important factors as the competitive environment and capital investment requirements, the investor may find the segmented information meaningless or may even draw improper conclusions about the reported earnings of the segments.

Additional disclosure may be helpful to competitors, labor unions, suppliers, and certain government regulatory agencies, and thus harm the reporting company.

Additional disclosure may discourage management from taking intelligent business risks because segments reporting losses or unsatisfactory earnings may cause stockholder dissatisfaction with management.

The wide variation among companies in the choice of segments, cost allocation, and other accounting problems limits the usefulness of segmented information.

The investor is investing in the company as a whole and not in the particular segments, and it should not matter how any single segment is performing if the overall performance is satisfactory.

Certain technical problems, such as classification of segments and allocation of segment revenues and costs (especially "common costs"), are formidable.

On the other hand, the advocates of segmented disclosures offer these reasons in support of the practice:

Investors need segmented information to make an intelligent investment decision regarding a diversified company.

Sales and earnings of individual segments enable investors to evaluate the differences between segments in growth rate, risk, and profitability, and to forecast consolidated profits.

Segmented reports help investors evaluate the company's investment worth by disclosing the nature of a company's businesses and the relative size of the components.

The absence of segmented reporting by a diversified company may put its unsegmented, single product-line competitors at a competitive disadvantage because the conglomerate may obscure information that its competitors must disclose.

The advocates of segmented disclosures appear to have a much stronger case. Many users indicate that segmented data are the most useful financial information provided, aside from the basic financial statements. As a result, the FASB has issued extensive reporting guidelines in this area.

The objective of reporting segmented financial data is to provide information about the different types of business activities in which an enterprise engages and the different economic environments in which it operates. Meeting this objective will help users of financial statements do the following.

Better understand the enterprise's performance.

Better assess its prospects for future net cash flows.

Make more informed judgments about the enterprise as a whole.

Financial statements can be disaggregated in several ways. For example, they can be dis-aggregated by products or services, by geography, by legal entity, or by type of customer. However, it is not feasible to provide all of that information in every set of financial statements. GAAP requires that general-purpose financial statements include selected information on a single basis of segmentation. Thus, a company can meet the segmented reporting objective by providing financial statements segmented based on how the company's operations are managed. The method chosen is referred to as the management approach. [3] The management approach reflects how management segments the company for making operating decisions. The segments are evident from the components of the company's organization structure. These components are called operating segments.

An operating segment is a component of an enterprise:

That engages in business activities from which it earns revenues and incurs expenses.

Whose operating results are regularly reviewed by the company's chief operating decision maker to assess segment performance and allocate resources to the segment.

For which discrete financial information is available that is generated by or based on the internal financial reporting system.

Companies may aggregate information about two or more operating segments only if the segments have the same basic characteristics in each of the following areas.

The nature of the products and services provided.

The nature of the production process.

The type or class of customer.

The methods of product or service distribution.

If applicable, the nature of the regulatory environment.

After the company decides on the possible segments for disclosure, it makes a quantitative materiality test. This test determines whether the segment is significant enough to warrant actual disclosure. An operating segment is deemed significant, and therefore a reportable segment, if it satisfies one or more of the following quantitative thresholds.

Its revenue (including both sales to external customers and intersegment sales or transfers) is 10 percent or more of the combined revenue of all the company's operating segments.

The absolute amount of its profit or loss is 10 percent or more of the greater, in absolute amount, of (a) the combined operating profit of all operating segments that did not incur a loss, or (b) the combined loss of all operating segments that did report a loss.

Its identifiable assets are 10 percent or more of the combined assets of all operating segments.

In applying these tests, the company must consider two additional factors. First, segment data must explain a significant portion of the company's business. Specifically, the segmented results must equal or exceed 75 percent of the combined sales to unaffiliated customers for the entire company. This test prevents a company from providing limited information on only a few segments and lumping all the rest into one category.

Second, the profession recognizes that reporting too many segments may overwhelm users with detailed information. The FASB decided that 10 is a reasonable upper limit for the number of segments that a company must disclose.

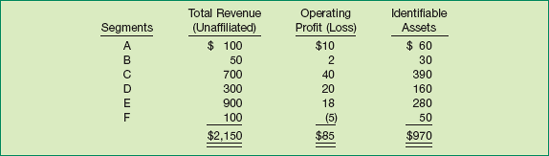

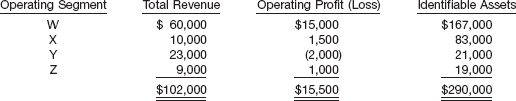

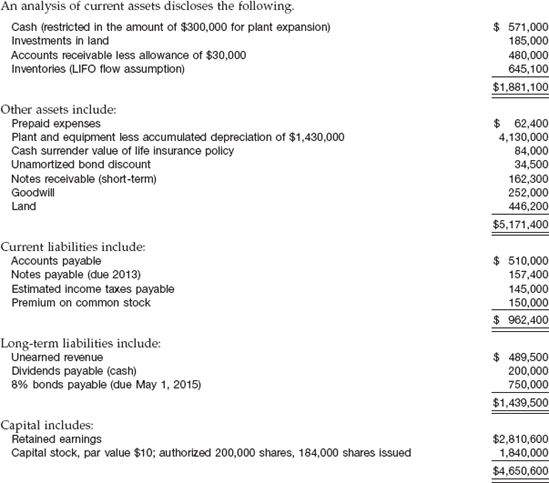

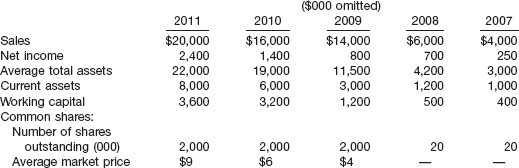

To illustrate these requirements, assume a company has identified six possible reporting segments, as shown in Illustration 24-7 (000s omitted).

The company would apply the respective tests as follows:

Revenue test: 10% × $2,150 = $215; C, D, and E meet this test.

Operating profit (loss) test: 10% × $90 = $9 (note that the $5 loss is ignored, because the test is based on non-loss segments); A, C, D, and E meet this test.

Identifiable assets tests: 10% × $970 = $97; C, D, and E meet this test.

The reporting segments are therefore A, C, D, and E, assuming that these four segments have enough sales to meet the 75 percent of combined sales test. The 75 percent test is computed as follows.

75% of combined sales test: 75% × $2,150 = $1,612.50. The sales of A, C, D, and E total $2,000 ($100 + $700 + $300 + $900); therefore, the 75 percent test is met.

The accounting principles that companies use for segment disclosure need not be the same as the principles they use to prepare the consolidated statements. This flexibility may at first appear inconsistent. But, preparing segment information in accordance with generally accepted accounting principles would be difficult because some principles are not expected to apply at a segment level. Examples are accounting for the cost of company-wide employee benefit plans, accounting for income taxes in a company that files a consolidated tax return, and accounting for inventory on a LIFO basis if the pool includes items in more than one segment.

The FASB does not require allocations of joint, common, or company-wide costs solely for external reporting purposes. Common costs are those incurred for the benefit of more than one segment and whose interrelated nature prevents a completely objective division of costs among segments. For example, the company president's salary is difficult to allocate to various segments. Allocations of common costs are inherently arbitrary and may not be meaningful. There is a presumption that if companies allocate common costs to segments, these allocations are either directly attributable or reasonably allocable.

The FASB requires that an enterprise report the following.

General information about its operating segments. This includes factors that management considers most significant in determining the company's operating segments, and the types of products and services from which each operating segment derives its revenues.

Segment profit and loss and related information. Specifically, companies must report the following information about each operating segment if the amounts are included in determining segment profit or loss.

Revenues from transactions with external customers.

Revenues from transactions with other operating segments of the same enterprise.

Interest revenue.

Interest expense.

Depreciation, depletion, and amortization expense.

Unusual items.

Equity in the net income of investees accounted for by the equity method.

Income tax expense or benefit.

Extraordinary items.

Significant noncash items other than depreciation, depletion, and amortization expense.

Segment assets. A company must report each operating segment's total assets.

Reconciliations. A company must provide a reconciliation of the total of the segments' revenues to total revenues, a reconciliation of the total of the operating segments' profits and losses to its income before income taxes, and a reconciliation of the total of the operating segments' assets to total assets.

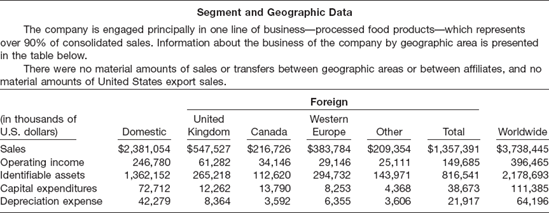

Information about products and services and geographic areas. For each operating segment not based on geography, the company must report (unless it is impracticable): (1) revenues from external customers, (2) long-lived assets, and (3) expenditures during the period for long-lived assets. This information, if material, must be reported (a) in the enterprise's country of domicile and (b) in each other country.

Major customers. If 10 percent or more of company revenue is derived from a single customer, the company must disclose the total amount of revenue from each such customer by segment.

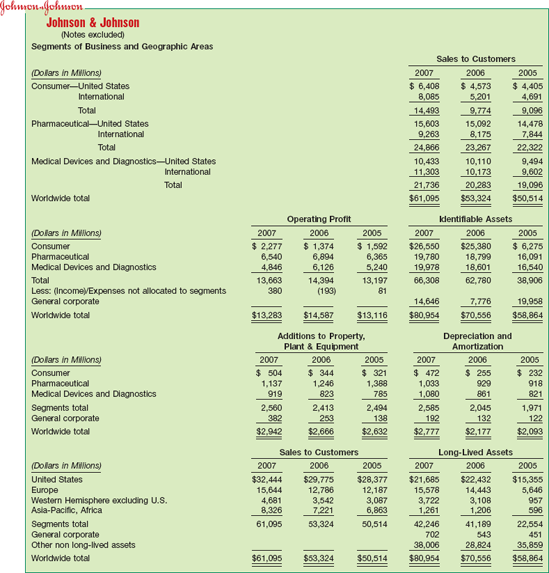

Illustration 24-8 shows the segment disclosure for Johnson & Johnson.

Another source of information for the investor is interim reports. As noted earlier, interim reports cover periods of less than one year. The stock exchanges, the SEC, and the accounting profession have an active interest in the presentation of interim information.

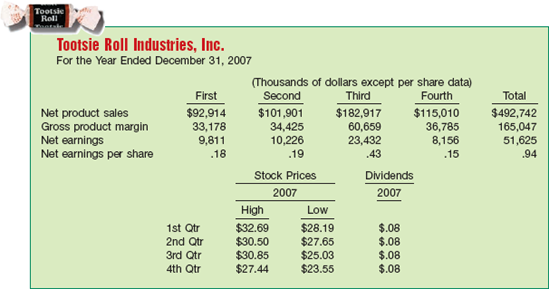

The SEC mandates that certain companies file a Form 10-Q, in which a company discloses quarterly data similar to that disclosed in the annual report. It also requires those companies to disclose selected quarterly information in notes to the annual financial statements. Illustration 24-9 presents the selected quarterly disclosure of Tootsie Roll Industries, Inc. In addition to Form 10-Q, GAAP narrows the reporting alternatives related to interim reports. [4]

Because of the short-term nature of the information in these reports, there is considerable controversy as to the general approach companies should employ. One group, which favors the discrete approach, believes that companies should treat each interim period as a separate accounting period. Using that treatment, companies would follow the principles for deferrals and accruals used for annual reports. In this view, companies should report accounting transactions as they occur, and expense recognition should not change with the period of time covered.

Another group, which favors the integral approach, believes that the interim report is an integral part of the annual report and that deferrals and accruals should take into consideration what will happen for the entire year. In this approach, companies should assign estimated expenses to parts of a year on the basis of sales volume or some other activity base.

At present, many companies follow the discrete approach for certain types of expenses and the integral approach for others, because the standards currently employed in practice are vague and lead to differing interpretations.

Generally, companies should use the same accounting principles for interim reports and for annual reports. They should recognize revenues in interim periods on the same basis as they are for annual periods. For example, if Cedars Corp. uses the installment-sales method as the basis for recognizing revenue on an annual basis, then it should use the installment basis for interim reports as well. Also, Cedars should treat costs directly associated with revenues (product costs, such as materials, labor and related fringe benefits, and manufacturing overhead) in the same manner for interim reports as for annual reports.

Companies should use the same inventory pricing methods (FIFO, LIFO, etc.) for interim reports and for annual reports. However, the following exceptions are appropriate at interim reporting periods.

Companies may use the gross profit method for interim inventory pricing. But they must disclose the method and adjustments to reconcile with annual inventory.

When a company liquidates LIFO inventories at an interim date and expects to replace them by year-end, cost of goods sold should include the expected cost of replacing the liquidated LIFO base, rather than give effect to the interim liquidation.

Companies should not defer inventory market declines beyond the interim period unless they are temporary and no loss is expected for the fiscal year.

Companies ordinarily should defer planned variances under a standard cost system; such variances are expected to be absorbed by year-end.

Companies often charge to the interim period, as incurred, costs and expenses other than product costs (often referred to as period costs). But companies may allocate these costs among interim periods on the basis of an estimate of time expired, benefit received, or activity associated with the periods. Companies display considerable latitude in accounting for these costs in interim periods, and many believe more definitive guidelines are needed.

Regarding disclosure, companies should report the following interim data at a minimum.

Sales or gross revenues, provision for income taxes, extraordinary items, and net income.

Basic and diluted earnings per share where appropriate.

Seasonal revenue, cost, or expenses.

Significant changes in estimates or provisions for income taxes.

Disposal of a component of a business and extraordinary, unusual, or infrequently occurring items.

Contingent items.

Changes in accounting principles or estimates.

Significant changes in financial position.

The FASB encourages, but does not require, companies to publish an interim balance sheet and statement of cash flows. If a company does not present this information, it should disclose significant changes in such items as liquid assets, net working capital, long-term liabilities, and stockholders' equity.

GAAP reflects a preference for the integral approach. However, within this broad guideline, a number of unique reporting problems develop related to the following items.

Advertising and Similar Costs. The general guidelines are that companies should defer in an interim period costs such as advertising if the benefits extend beyond that period; otherwise the company should expense those costs as incurred. But such a determination is difficult, and even if the company defers the costs, how should it allocate them between quarters?

Because of the vague guidelines in this area, accounting for advertising varies widely. At one time, some companies in the food industry, such as RJR Nabisco and Pillsbury, charged advertising costs as a percentage of sales and adjusted to actual at year-end, whereas General Foods and Kellogg expensed these costs as incurred.

The same type of problem relates to such items as Social Security taxes, research and development costs, and major repairs. For example, should the company expense Social Security costs (payroll taxes) on highly paid personnel early in the year, or allocate and spread them to subsequent quarters? Should a major repair that occurs later in the year be anticipated and allocated proportionately to earlier periods?

Expenses Subject to Year-End Adjustment. Companies often do not know with a great deal of certainty amounts of bad debts, executive bonuses, pension costs, and inventory shrinkage until year-end. They should estimate these costs and allocate them to interim periods as best they can. Companies use a variety of allocation techniques to accomplish this objective.

Income Taxes. Not every dollar of corporate taxable income is taxed at the same rate; the tax rate is progressive. This aspect of business income taxes poses a problem in preparing interim financial statements. Should the company use the annualized approach, which is to annualize income to date and accrue the proportionate income tax for the period to date? Or should it follow the marginal principle approach, which is to apply the lower rate of tax to the first amount of income earned? At one time, companies generally followed the latter approach and accrued the tax applicable to each additional dollar of income.

The profession now, however, uses the annualized approach. This requires that "at the end of each interim period the company should make its best estimate of the effective tax rate expected to be applicable for the full fiscal year. The rate so determined should be used in providing for income taxes on income for the quarter." [5][433]

Because businesses did not uniformly apply this guideline in accounting for similar situations, the FASB issued authoritative guidance. GAAP now requires companies, when computing the year-to-date tax, to apply the estimated annual effective tax rate to the year-to-date "ordinary" income at the end of each interim period. Further, the interim period tax related to "ordinary" income shall be the difference between the amount so computed and the amounts reported for previous interim periods of the fiscal period. [6][434]

Extraordinary Items. Extraordinary items consist of unusual and nonrecurring material gains and losses. In the past, companies handled them in interim reports in one of three ways: (1) absorbed them entirely in the quarter in which they occurred; (2) prorated them over four quarters; or (3) disclosed them only by note. The required approach now is to charge or credit the loss or gain in the quarter in which it occurs, instead of attempting some arbitrary multiple-period allocation. This approach is consistent with the way in which companies must handle extraordinary items on an annual basis. No attempt is made to prorate the extraordinary items over several years.

Some favor the omission of extraordinary items from the quarterly net income. They believe that inclusion of extraordinary items that may be large in proportion to interim results distorts the predictive value of interim reports. Many, however, consider such an omission inappropriate because it deviates from actual results.

Earnings per Share. Interim reporting of earnings per share has all the problems inherent in computing and presenting annual earnings per share, and then some. If a company issues shares in the third period, EPS for the first two periods will not reflect year-end EPS. If an extraordinary item is present in one period and the company sells new equity shares in another period, the EPS figure for the extraordinary item will change for the year. On an annual basis only one EPS figure can be associated with an extraordinary item and that figure does not change; the interim figure is subject to change.

For purposes of computing earnings per share and making the required disclosure determinations, each interim period should stand alone. That is, all applicable tests should be made for that single period.

Seasonality. Seasonality occurs when most of a company's sales occur in one short period of the year while certain costs are fairly evenly spread throughout the year. For example, the natural gas industry has its heavy sales in the winter months. In contrast, the beverage industry has its heavy sales in the summer months.

The problem of seasonality is related to the expense recognition principle in accounting. Generally, expenses are associated with the revenues they create. In a seasonal business, wide fluctuations in profits occur because off-season sales do not absorb the company's fixed costs (for example, manufacturing, selling, and administrative costs that tend to remain fairly constant regardless of sales or production).

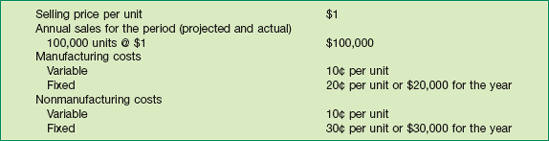

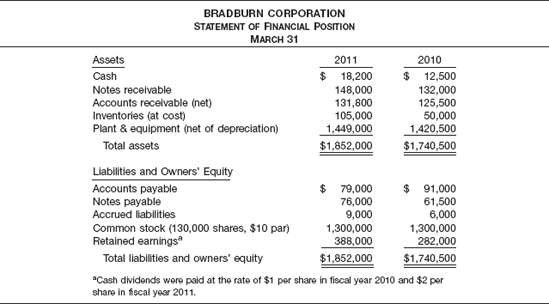

To illustrate why seasonality is a problem, assume the following information.

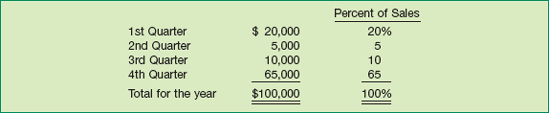

Sales for four quarters and the year (projected and actual) were:

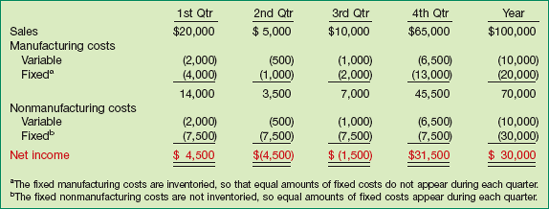

Under the present accounting framework, the income statements for the quarters might be as shown in Illustration 24-12.

An investor who uses the first quarter's results might be misled. If the first quarter's earnings are $4,500, should this figure be multiplied by four to predict annual earnings of $18,000? Or, if first-quarter sales of $20,000 are 20 percent of the predicted sales for the year, would the net income for the year be $22,500 ($4,500 × 5)? Both figures are obviously wrong, and after the second quarter's results occur, the investor may become even more confused.

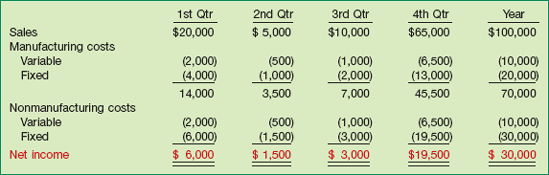

The problem with the conventional approach is that the fixed nonmanufacturing costs are not charged in proportion to sales. Some enterprises have adopted a way of avoiding this problem by making all fixed nonmanufacturing costs follow the sales pattern, as shown in Illustration 24-13.

This approach solves some of the problems of interim reporting: Sales in the first quarter are 20 percent of total sales for the year, and net income in the first quarter is 20 percent of total income. In this case, as in the previous example, the investor cannot rely on multiplying any given quarter by four, but can use comparative data or rely on some estimate of sales in relation to income for a given period.

The greater the degree of seasonality experienced by a company, the greater the possibility of distortion. Because there are no definitive guidelines for handling such items as the fixed nonmanufacturing costs, variability in income can be substantial. To alleviate this problem, the profession recommends that companies subject to material seasonal variations disclose the seasonal nature of their business and consider supplementing their interim reports with information for 12-month periods ended at the interim date for the current and preceding years.

The two illustrations highlight the difference between the discrete and integral approaches. Illustration 24-12 represents the discrete approach, in which the fixed nonmanufacturing expenses are expensed as incurred. Illustration 24-13 shows the integral approach, in which expenses are charged to expense on the basis of some measure of activity.

Continuing Controversy. The profession has developed some rules for interim reporting, but much still has to be done. As yet, it is unclear whether the discrete or the integral method, or some combination of the two, will be settled on.

Discussion also persists about the independent auditor's involvement in interim reports. Many auditors are reluctant to express an opinion on interim financial information, arguing that the data are too tentative and subjective. On the other hand, more people are advocating some examination of interim reports. As a compromise, the SEC currently requires that auditors perform a review of interim financial information. Such a review, which is much more limited in its procedures than the annual audit, provides some assurance that the interim information appears to be in accord with GAAP.[435]

Analysts and investors want financial information as soon as possible, before it's old news. We may not be far from a continuous database system in which corporate financial records can be accessed via the Internet. Investors might be able to access a company's financial records whenever they wish and put the information in the format they need. Thus, they could learn about sales slippage, cost increases, or earnings changes as they happen, rather than waiting until after the quarter has ended.[436]

A steady stream of information from the company to the investor could be very positive because it might alleviate management's continual concern with short-run interim numbers. Today many contend that U.S. management is too oriented to the short-term. The truth of this statement is echoed by the words of the president of a large company who decided to retire early: "I wanted to look forward to a year made up of four seasons rather than four quarters."

The SEC has decided that timeliness of information is of extreme importance. First, the SEC has said that large public companies will have only 60 days to complete their annual reports, down from 90 days. Quarterly reports must be done within 40 days of the close of the quarter, instead of 45. In addition, corporate executives and shareholders with more than 10 percent of a company's outstanding stock now have two days to disclose their sale or purchase of stock.

Also, in a bid to increase Internet disclosure, the SEC encourages companies to post current, quarterly, and annual reports on their websites—or explain why they don't. The Internet postings would have to be made by the day the company submits the information to the SEC, rather than within 24 hours as current rules allow.

Another important source of information, which is often overlooked, is the auditor's report. An auditor is an accounting professional who conducts an independent examination of a company's accounting data.

If satisfied that the financial statements present the financial position, results of operations, and cash flows fairly in accordance with generally accepted accounting principles, the auditor expresses an unqualified opinion. An example is shown in Illustration 24-14 (on page 1336).[437]

In preparing the report, the auditor follows these reporting standards.

The report states whether the financial statements are in accordance with generally accepted accounting principles.

The report identifies those circumstances in which the company has not consistently observed such principles in the current period in relation to the preceding period.

Users are to regard the informative disclosures in the financial statements as reasonably adequate unless the report states otherwise.

The report contains either an expression of opinion regarding the financial statements taken as a whole or an assertion to the effect that an opinion cannot be expressed. When the auditor cannot express an overall opinion, the report should state the reasons. In all cases where an auditor's name is associated with financial statements, the report should contain a clear-cut indication of the character of the auditor's examination, if any, and the degree of responsibility being taken.

In most cases, the auditor issues a standard unqualified or clean opinion. That is, the auditor expresses the opinion that the financial statements present fairly, in all material respects, the financial position, results of operations, and cash flows of the entity in conformity with generally accepted accounting principles.

Certain circumstances, although they do not affect the auditor's unqualified opinion, may require the auditor to add an explanatory paragraph to the audit report. Some of the more important circumstances are as follows.

Going Concern. The auditor must evaluate whether there is substantial doubt about the entity's ability to continue as a going concern for a reasonable period of time, taking into consideration all available information about the future. (The future is at least, but not limited to, 12 months from the end of the reporting period.) If substantial doubt exists about the company continuing as a going concern, the auditor adds to the report an explanatory note describing the potential problem. [7]

Lack of Consistency. If a company has changed accounting principles or the method of their application in a way that has a material effect on the comparability of its financial statements, the auditor should refer to the change in an explanatory paragraph of the report. Such an explanatory paragraph should identify the nature of the change and refer readers to the note in the financial statements that discusses the change in detail. The auditor's concurrence with a change is implicit unless the auditor takes exception to the change in expressing an opinion as to fair presentation in conformity with generally accepted accounting principles.

Emphasis of a Matter. The auditor may wish to emphasize a matter regarding the financial statements, but nevertheless intends to express an unqualified opinion. For example, the auditor may wish to emphasize that the entity is a component of a larger business enterprise or that it has had significant transactions with related parties. The auditor presents such explanatory information in a separate paragraph of the report.

In some situations, however, the auditor is required to express (1) a qualified opinion or (2) an adverse opinion, or (3) to disclaim an opinion.

A qualified opinion contains an exception to the standard opinion. Ordinarily the exception is not of sufficient magnitude to invalidate the statements as a whole; if it were, an adverse opinion would be rendered. The usual circumstances in which the auditor may deviate from the standard unqualified short-form report on financial statements are as follows.

The scope of the examination is limited or affected by conditions or restrictions.

The statements do not fairly present financial position or results of operations because of:

Lack of conformity with generally accepted accounting principles and standards.

Inadequate disclosure.

If confronted with one of the situations noted above, the auditor must offer a qualified opinion. A qualified opinion states that, except for the effects of the matter to which the qualification relates, the financial statements present fairly, in all material respects, the financial position, results of operations, and cash flows in conformity with generally accepted accounting principles.

Illustration 24-15 (page 1338) shows an example of an auditor's report with a qualified opinion. The auditor qualified the opinion because the company used an accounting principle at variance with generally accepted accounting principles.

An adverse opinion is required in any report in which the exceptions to fair presentation are so material that in the independent auditor's judgment, a qualified opinion is not justified. In such a case, the financial statements taken as a whole are not presented in accordance with generally accepted accounting principles. Adverse opinions are rare, because most companies change their accounting to conform with GAAP. The SEC will not permit a company listed on an exchange to have an adverse opinion.

A disclaimer of an opinion is appropriate when the auditor has gathered so little information on the financial statements that no opinion can be expressed.

The audit report should provide useful information to the investor. One investment banker noted, "Probably the first item to check is the auditor's opinion to see whether or not it is a clean one—'in conformity with generally accepted accounting principles'—or is qualified in regard to differences between the auditor and company management in the accounting treatment of some major item, or in the outcome of some major litigation."

The SEC mandates inclusion of management's discussion and analysis (MD&A). This section covers three financial aspects of an enterprise's business—liquidity, capital resources, and results of operations. In it, management highlights favorable or unfavorable trends and identifies significant events and uncertainties that affect these three factors. This approach obviously involves subjective estimates, opinions, and soft data. However, the SEC believes that the relevance of this information exceeds the potential lack of reliability.

Illustration 24-16 presents an excerpt from the MD&A section (2007 "Business Risks" only) of PepsiCo's annual report.

The MD&A section also must provide information about the effects of inflation and changing prices, if they are material to financial statement trends. The SEC has not required specific numerical computations, and companies have provided little analysis on changing prices.

An additional voluntary disclosure provided in the MD&A of many companies is discussion of the company's critical accounting policies. This disclosure identifies accounting policies that require management to make subjective judgments regarding uncertainties, resulting in potentially significant effects on the financial results.[438] For example, in its critical accounting policy disclosure, PepsiCo showed the impact on stock-based compensation expense in response to changes in estimated interest rates and stock return volatility. Through this voluntary disclosure, companies can expand on the information contained in the notes to the financial statements to indicate the sensitivity of the financial results to accounting policy judgments.

The Sarbanes-Oxley Act requires the SEC to develop guidelines for all publicly traded companies to report on management's responsibilities for, and assessment of, the internal control system. An example of the type of disclosure that public companies are now making is shown in Illustration 24-17.[439]

In recent years, the investing public's demand for more and better information has focused on disclosure of corporate expectations for the future.[440] These disclosures take one of two forms:[441]

Financial forecasts. A financial forecast is a set of prospective financial statements that present, to the best of the responsible party's knowledge and belief, a company's expected financial position, results of operations, and cash flows. The responsible party bases a financial forecast on conditions it expects to exist and the course of action it expects to take.

Financial projections. Financial projections are prospective financial statements that present, to the best of the responsible party's knowledge and belief, given one or more hypothetical assumptions, an entity's expected financial position, results of operations, and cash flows. The responsible party bases a financial projection on conditions it expects would exist and the course of action it expects would be taken, given one or more hypothetical assumptions.

The difference between a financial forecast and a financial projection is clear-cut: A forecast provides information on what is expected to happen, whereas a projection provides information on what might take place, but is not necessarily expected to happen.

Whether companies should be required to provide financial forecasts is the subject of intensive discussion with journalists, corporate executives, the SEC, financial analysts, accountants, and others. Predictably, there are strong arguments on either side. Listed below are some of the arguments.

Arguments for requiring published forecasts:

Investment decisions are based on future expectations. Therefore information about the future facilitates better decisions.

Companies already circulate forecasts informally. This situation should be regulated to ensure that the forecasts are available to all investors.

Circumstances now change so rapidly that historical information is no longer adequate for prediction.

Arguments against requiring published forecasts:

No one can foretell the future. Therefore forecasts will inevitably be wrong. Worse, they may mislead, if they convey an impression of precision about the future,.

Companies may strive only to meet their published forecasts, thereby failing to produce results that are in the stockholders' best interest.

If forecasts prove inaccurate, there will be recriminations and probably legal actions.[442]

Disclosure of forecasts will be detrimental to organizations, because forecasts will inform competitors (foreign and domestic), as well as investors.

The AICPA has issued a statement on standards for accountants' services on prospective financial information. This statement establishes guidelines for the preparation and presentation of financial forecasts and projections.[443] It requires accountants to provide (1) a summary of significant assumptions used in the forecast or projection and (2) guidelines for minimum presentation.

To encourage management to disclose prospective financial information, the SEC has a safe harbor rule. It provides protection to a company that presents an erroneous forecast, as long as the company prepared the forecast on a reasonable basis and disclosed it in good faith.[444] However, many companies note that the safe harbor rule does not work in practice, since it does not cover oral statements, nor has it kept them from investor lawsuits.

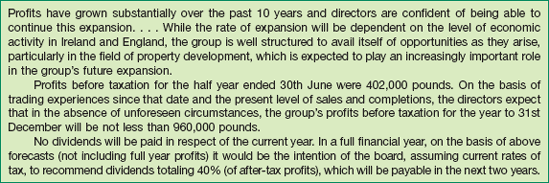

Great Britain permits financial forecasts, and the results have been fairly successful. Some significant differences do exist between the English and the U.S. business and legal environments.[445] But such differences probably could be overcome if influential interests in this country cooperated to produce an atmosphere conducive to quality forecasting. A typical British forecast adapted from a construction company's report to support a public offering of stock is as follows.

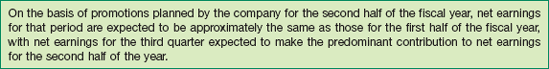

A general narrative-type forecast issued by a U.S. corporation might appear as follows.

What happens if a company does not meet its forecasts? Can the company and the auditor be sued? If a company, for example, projects an earnings increase of 15 percent and achieves only 5 percent, should stockholders be permitted to have some judicial recourse against the company?

One court case involving Monsanto Chemical Corporation set a precedent. In this case, Monsanto predicted that sales would increase 8 to 9 percent and that earnings would rise 4 to 5 percent. In the last part of the year, the demand for Monsanto's products dropped as a result of a business turndown. Instead of increasing, the company's earnings declined. Investors sued the company because the projected earnings figure was erroneous, but a judge dismissed the suit because the forecasts were the best estimates of qualified people whose intents were honest.

As indicated earlier, the SEC's safe harbor rules are intended to protect companies that provide good-faith projections. However, much concern exists as to how the SEC and the courts will interpret such terms as "good faith" and "reasonable assumptions" when erroneous forecasts mislead users of this information.

Most companies now use the power and reach of the Internet to provide more useful information to financial statement readers. All large companies have Internet sites, and a large proportion of companies' websites contain links to their financial statements and other disclosures. The popularity of such reporting is not surprising, since companies can reduce the costs of printing and disseminating paper reports with the use of Internet reporting.

Does Internet financial reporting improve the usefulness of a company's financial reports? Yes, in several ways: First, dissemination of reports via the Web allows firms to communicate more easily and quickly with users than do traditional paper reports. In addition, Internet reporting allows users to take advantage of tools such as search engines and hyperlinks to quickly find information about the firm and, sometimes, to download the information for analysis, perhaps in computer spreadsheets. Finally, Internet reporting can help make financial reports more relevant by allowing companies to report expanded disaggregated data and more timely data than is possible through paper-based reporting. For example, some companies voluntarily report weekly sales data and segment operating data on their websites.

Given the widespread use of the Internet by investors and creditors, it is not surprising that organizations are developing new technologies and standards to further enable Internet financial reporting. An example is the increasing use of extensible business reporting language (XBRL). XBRL is a computer language adapted from the code of the Internet. It "tags" accounting data to correspond to financial reporting items that are reported in the balance sheet, income statement, and the cash flow statement. Once tagged, any company's XBRL data can be easily processed using spreadsheets and other computer programs. In fact, the SEC is planning to require all companies and mutual funds to prepare their financial reports using XBRL, thereby allowing users to more easily search a company's reports, extract and analyze data, and perform financial comparisons within industries.[446]

To complement the implementation of XBRL use, the SEC has also announced a major upgrade to its EDGAR database. The new system is called IDEA (short for Interactive Data Electronic Applications). This replacement of EDGAR marks the SEC's transition from collecting forms and documents to making the information itself freely available to investors in a timely form they can readily use. With IDEA, investors will be able to quickly collate information from thousands of companies and forms and create reports and analysis on the fly, in any way they choose. It is hoped that IDEA will open the door for both the SEC and investors to the new world of financial disclosure in interactive data (XBRL) format.[447]

As indicated earlier in the Convergence Corner discussions, the FASB and the IASB are exploring better ways to present information in the financial statements. Recently, these two standard-setters have issued a discussion paper that requests input on a proposed reformatting of the financial statements. The table below provides a "snapshot" of the proposed changes (go to http://www.fasb.org/project/financial_statement_presentation.shtml to learn more about this joint international project).

Statement of Financial Position | Statement of Comprehensive Income | Statement of Cash Flows |

|---|---|---|

Business

Financing

Income Taxes | Business

Financing

Income Taxes | Business

Financing

Income Taxes |

As indicated, each statement will use the same format. While the proposed changes will not affect the measurement of individual financial statement elements, the use of a consistent format (e.g., Business, Financing, Income Taxes), will help users understand the interrelationships in the financial statements. In addition, a new schedule reconciling cash flows to comprehensive income will be provided. As part of this schedule, changes in fair value will be included. It is a good thing the timeline for the project is lengthy, as these changes in presentation are significant.

Fraudulent financial reporting is defined as "intentional or reckless conduct, whether act or omission, that results in materially misleading financial statements."[448] Fraudulent reporting can involve gross and deliberate distortion of corporate records (such as inventory count tags), or misapplication of accounting principles (failure to disclose material transactions). Although frauds are unusual, recent events involving such well-known companies as Enron, WorldCom, Adelphia, and Tyco indicate that more must be done to address this issue.

Fraudulent financial reporting usually occurs because of conditions in a company's internal or external environment. Influences in the internal environment relate to poor internal control systems, management's poor attitude toward ethics, or perhaps a company's liquidity or profitability. Those in the external environment may relate to industry conditions, overall business environment, or legal and regulatory considerations.

General incentives for fraudulent financial reporting vary. Common ones are the desire to obtain a higher stock price, to avoid default on a loan covenant, or to make a personal gain of some type (additional compensation, promotion). Situational pressures on the company or an individual manager also may lead to fraudulent financial reporting. Examples of these situational pressures include the following.

Sudden decreases in revenue or market share for a single company or an entire industry.

Unrealistic budget pressures may occur when headquarters arbitrarily determines profit objectives (particularly for short-term results) and budgets without taking actual conditions into account.

Financial pressure resulting from bonus plans that depend on short-term economic performance. This pressure is particularly acute when the bonus is a significant component of the individual's total compensation.

Opportunities for fraudulent financial reporting are present in circumstances when the fraud is easy to commit and when detection is difficult. Frequently these opportunities arise from:

The absence of a board of directors or audit committee that vigilantly oversees the financial reporting process.

Weak or nonexistent internal accounting controls. This situation can occur, for example, when a company's revenue system is overloaded as a result of a rapid expansion of sales, an acquisition of a new division, or the entry into a new, unfamiliar line of business.

Unusual or complex transactions such as the consolidation of two companies, the divestiture or closing of a specific operation, and the purchase and sale of derivative instruments.

Accounting estimates requiring significant subjective judgment by company management, such as the allowance for loan losses and the estimated liability for warranty expense.

Ineffective internal audit staffs resulting from inadequate staff size and severely limited audit scope.

A weak corporate ethical climate contributes to these situations. Opportunities for fraudulent financial reporting also increase dramatically when the accounting principles followed in reporting transactions are nonexistent, evolving, or subject to varying interpretations.[449]

The AICPA has issued numerous auditing standards in response to concerns of the accounting profession, the media, and the public.[450] For example, the recent standard on fraudulent financial reporting "raises the bar" on the performance of financial statement audits by explicitly requiring auditors to assess the risk of material financial misstatement due to fraud.[451] As indicated earlier, the Sarbanes-Oxley Act now raises the penalty substantially for executives who are involved in fraudulent financial reporting.

ESM Government Securities, Inc. (ESM) is a classic case exemplifying the seriousness of financial reporting frauds. ESM was a Fort Lauderdale securities dealer entrusted with monies to invest by municipalities from Toledo, Ohio, to Beaumont, Texas. The cities that provided funds thought, based on the company name, that ESM was collateralized with government securities.

Examination of ESM's balance sheet indicated that the company owed about as much as it expected to collect. Unfortunately, the amount it expected to collect was from insolvent affiliates which, in effect, meant that ESM was bankrupt. In fact, ESM had been bankrupt for more than six years, and the fraud was discovered only because a customer questioned a note to the balance sheet! ESM had disguised more than $300 million of losses.

Source: For an expanded discussion of this case, see Robert J. Sack and Robert Tangreti, "ESM: Implications for the Profession," Journal of Accountancy (April 1987).

Throughout this textbook, we have stressed the need to provide information that is useful to predict the amounts, timing, and uncertainty of future cash flows. To achieve this objective, companies must make judicious choices between alternative accounting concepts, methods, and means of disclosure. You are probably surprised by the large number of choices that exist among acceptable alternatives.

You should recognize, however, as indicated in Chapter 1, that accounting is greatly influenced by its environment. It does not exist in a vacuum. Therefore, it is unrealistic to assume that the profession can entirely eliminate alternative presentations of certain transactions and events. Nevertheless, we are hopeful that the profession, by adhering to the conceptual framework, will be able to focus on the needs of financial statement users and eliminate diversity where appropriate. The SEC's and FASB's projects on principle-based standards are directed at these very issues. They seek to develop guidance that will result in accounting and financial reporting that reflects the economic substance of the transactions, not the desired financial result of management. The profession must continue its efforts to develop a sound foundation upon which to build financial standards and practice. As Aristotle said, "The correct beginning is more than half the whole."

iGAAP and U.S. GAAP disclosure requirements are similar in many regards. The iGAAP standards addressing related-party disclosures are: IAS 1 ("First Time Adoption of IFRS"); IAS 24 ("Related Party Disclosures"); disclosure and recognition of post-balance-sheet events in IAS 10 ("Events after the Balance Sheet Date); segment reporting iGAAP provisions in IFRS 8 ("Operating Segments"); and interim reporting requirements in IAS 34 ("Interim Financial Reporting").

Due to the broader range of judgments allowed in more principle-based iGAAP, note disclosures generally are more expansive under iGAAP compared to U.S. GAAP.

Like U.S. GAAP, iGAAP requires that for transactions with related parties, companies disclose the amounts involved in a transaction, the amount, terms and nature of the outstanding balances, and any doubtful amounts related to those outstanding balances for each major category of related parties. There is no specific requirement to disclose the name of the related party.

iGAAP and U.S. GAAP have similar standards on post-balance-sheet events. That is, under both sets of GAAP, events that occurred after the balance sheet date that provide additional evidence of conditions that existed at the balance sheet date are recognized in the financial statements.

Following the recent issuance of IFRS 8, "Operating Segments," the requirements under iGAAP and U.S. GAAP are very similar. That is, both GAAPs use the management approach to identify reportable segments, and similar segment disclosures are required.

Neither U.S. GAAP nor iGAAP requires interim reports. Rather the SEC and stock exchanges outside the U.S. establish the rules. In the U.S., interim reports generally are provided on a quarterly basis; outside the U.S., 6-month interim reports are common.

Because iGAAP and U.S. GAAP are quite similar in their disclosure provisions, we provide some observations on the application of iGAAP by foreign companies listing securities in the United States. Recently the staff of the SEC reviewed the financial statements filed with the SEC by 100 foreign issuers, prepared for the first time using iGAAP. The staff did not make any statements regarding the overall quality of the reports but did identify areas where additional questions might be asked. Here are some of the items that warranted staff comment:

Revenue recognition, especially where a company provided generic policy disclosure but did not provide disclosure specific to its circumstances.

Intangible assets and goodwill, including the factors that led a company to recognize them in a business combination.

Companies' policies for identifying and evaluating impairment, the circumstances resulting in impairment recognition, or the circumstances surrounding impairment reversals of long-lived assets including goodwill.

Leases, including their terms and the future minimum payments under operating and financial leases.

Contingent liabilities, including their nature and estimated financial effects.

The significant terms of financial instruments, including derivatives, their effects on future cash flow, and the recognition and measurement criteria the company applied in accounting for financial instruments.

Additional issues related to income statement and cash flow statement formats and related notes.

Sir David Tweedie, chair of the IASB, recently stated, "By 2011–2012, U.S. and international accounting should be pretty much the same." There is no question that iGAAP and U.S. GAAP are converging quickly. We have provided the Convergence Corner discussions to help you understand the issues surrounding convergence as they relate to intermediate accounting. After reading these discussions, you should realize that iGAAP and U.S. GAAP are very similar in many areas, with differences in those areas revolving around some minor technical points. In other situations, the differences are major; for example, iGAAP does not permit LIFO inventory accounting. Our hope is that the FASB and IASB can quickly complete their convergence efforts, resulting in a single set of high-quality accounting standards for use by companies around the world.

Companies should use the same accounting principles for interim reports that they use for annual reports. A number of unique reporting problems develop related to the following items: (1) advertising and similar costs, (2) expenses subject to year-end adjustment, (3) income taxes, (4) extraordinary items, (5) earnings per share, and (6) seasonality.

An adverse opinion is required when the exceptions to fair presentation are so material that a qualified opinion is not justified. A disclaimer of an opinion is appropriate when the auditor has so little information on the financial statements that no opinion can be expressed.

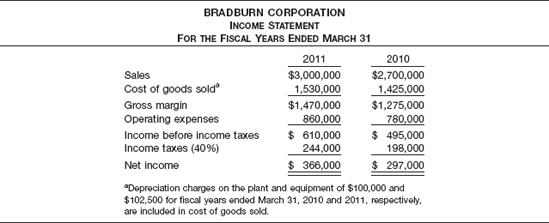

What would be important to you in studying a company's financial statements? The answer depends on your particular interest—whether you are a creditor, stockholder, potential investor, manager, government agency, or labor leader. For example, short-term creditors such as banks are primarily interested in the ability of the firm to pay its currently maturing obligations. In that case, you would examine the current assets and their relation to short-term liabilities to evaluate the short-run solvency of the firm.

Bondholders, on the other hand, look more to long-term indicators, such as the enterprise's capital structure, past and projected earnings, and changes in financial position. Stockholders, present or prospective, also are interested in many of the features considered by a long-term creditor. As a stockholder, you would focus on the earnings picture, because changes in it greatly affect the market price of your investment. You also would be concerned with the financial position of the company, because it affects indirectly the stability of earnings.

The managers of a company are concerned about the composition of its capital structure and about the changes and trends in earnings. This financial information has a direct influence on the type, amount, and cost of external financing that the company can obtain. In addition, the company managers find financial information useful on a day-to-day operating basis in such areas as capital budgeting, breakeven analysis, variance analysis, gross margin analysis, and for internal control purposes.

Readers of financial statements can gather information by examining relationships between items on the statements and identifying trends in these relationships. The relationships are expressed numerically in ratios and percentages, and trends are identified through comparative analysis.

A problem with learning how to analyze statements is that the means may become an end in itself. Analysts could identify and calculate thousands of possible relationships and trends. If one knows only how to calculate ratios and trends without understanding how such information can be used, little is accomplished. Therefore, a logical approach to financial statement analysis is necessary, consisting of the following steps.