The New Product Development Process

Rather than leaving new products to chance, a company must carry out strong new product planning and set up a systematic, customer-driven new product development process for finding and growing new products.

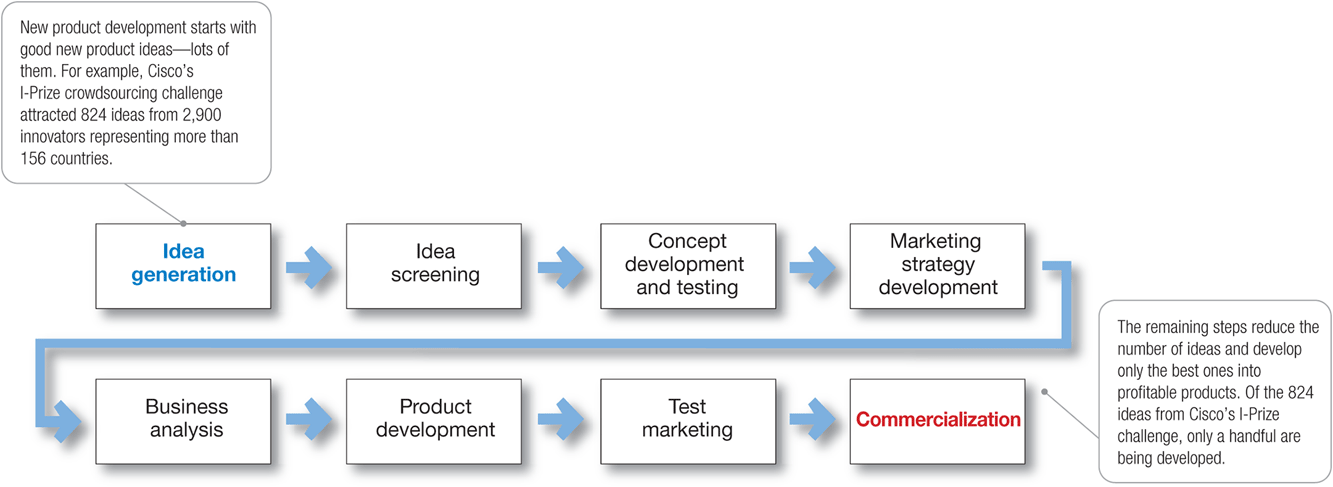

![]() Figure 9.1 shows the eight major steps in this process.

Figure 9.1 shows the eight major steps in this process.

Figure 9.1

Figure 9.1

Major Stages in New Product Development

Idea Generation

New product development starts with idea generation—the systematic search for new product ideas. A company typically generates hundreds—even thousands—of ideas to find a few good ones. Major sources of new product ideas include internal sources and external sources such as customers, competitors, distributors and suppliers, and others.

Internal Idea Sources

Using internal sources, the company can find new ideas through formal R&D. For example, Ford operates an innovation and mobility center in Silicon Valley staffed by engineers, app developers, and scientists working on everything from driverless cars to Works with Nest apps that let consumers control home heating, lighting, and appliances from their vehicles. Chick-fil-A set up a large innovation center called Hatch, where its staff and partners explore new ideas in food, design, and service. Hatch is a place to “ideate, explore, and imagine the future,” to hatch new food and restaurant ideas and bring them to life.4

Beyond its internal R&D process, a company can pick the brains of its own people—from executives to salespeople to scientists, engineers, and manufacturing staff. Many companies have developed successful internal social networks and intrapreneurial programs that encourage employees to develop new product ideas. For example, AT&T has set up an internal online innovation community called The Innovation Pipeline (TIP), through which AT&T employees from all areas and levels of the company submit, discuss, and vote on new product and service ideas. Each quarter, the “founders” of top vote-getting ideas pitch them to AT&T senior executives, who select the best three for further funding and development. Since its inception in 2009, AT&T employees have submitted more than 28,000 ideas to the TIP community, and the company has funded more than 75 TIP projects ranging from customer service enhancements to new product offerings.5

Tech companies such as Facebook and Twitter sponsor periodic “hackathons,” in which employees take a day or a week away from their day-to-day work to develop new ideas. LinkedIn, the 300 million–member professional social media network, holds “hackdays,” one Friday each month when it encourages employees to work on whatever they want that will benefit the company. LinkedIn takes the process a step further with its InCubator program, under which employees can form teams each quarter that pitch innovative new ideas to LinkedIn executives. If approved, the team gets up to 90 days away from its regular work to develop the idea into reality.6

External Idea Sources

Companies can also obtain good new product ideas from any of a number of external sources. For example, distributors and suppliers can contribute ideas. Distributors are close to the market and can pass along information about consumer problems and new product possibilities. Suppliers can tell the company about new concepts, techniques, and materials that can be used to develop new products.

Competitors are another important source. Companies watch competitors’ ads to get clues about their new products. They buy competing new products, take them apart to see how they work, analyze their sales, and decide whether they should bring out a new product of their own. Other idea sources include trade magazines, shows, websites, and seminars; government agencies; advertising agencies; marketing research firms; university and commercial laboratories; and inventors.

Perhaps the most important sources of new product ideas are customers themselves. The company can analyze customer questions and complaints to find new products that better solve consumer problems. Or it can invite customers to share suggestions and ideas.

![]() For example, The LEGO Group systematically taps users for new product ideas and input via the LEGO Ideas website:7

For example, The LEGO Group systematically taps users for new product ideas and input via the LEGO Ideas website:7

New product ideas from customers: The LEGO Ideas website invites customers to submit and vote on new product ideas. So far, LEGO Ideas has resulted in 12 major new products.

New product ideas from customers: The LEGO Ideas website invites customers to submit and vote on new product ideas. So far, LEGO Ideas has resulted in 12 major new products.

LEGO and the LEGO logo are trademarks of the LEGO Group of Companies, used here by permission. © 2015 The LEGO Group, all rights reserved.

At the LEGO Ideas website, the giant toy maker turns user ideas into new LEGO building sets. The site invites customers to submit their ideas and to evaluate and vote on the ideas of others. Ideas supported by 10,000 votes head to the LEGO Review Board for an internal review by various departments including marketing and design. Ideas passing the review are made into official LEGO products. Customers whose ideas reach production earn 1 percent of total net sales of the product and receive credit as the LEGO Ideas set creator inside every set sold. So far, LEGO Ideas has resulted in 12 major new products, including the likes of LEGO Doctor Who, LEGO Birds, LEGO Big Bang Theory, LEGO Ghostbusters, LEGO WALL•E, LEGO Back to the Future DeLorean Time Machine, and the LEGO Labyrinth Marble Maze.

Crowdsourcing

More broadly, many companies are now developing crowdsourcing or open-innovation new product idea programs. Through crowdsourcing, a company invites broad communities of people—customers, employees, independent scientists and researchers, and even the public at large—into the innovation process. Tapping into a breadth of sources—both inside and outside the company—can produce unexpected and powerful new ideas.

Companies large and small, across all industries, are crowdsourcing product innovation ideas rather than relying only on their own R&D labs.

![]() For example, sports apparel maker Under Armour knows that no matter how many top-notch developers it has inside, sometimes the only way to produce good outside-the-box ideas is by going outside the company. So in its quest to find the Next Big Thing, Under Armour sponsors an annual crowdsourcing competition called the Future Show Innovation Challenge:8

For example, sports apparel maker Under Armour knows that no matter how many top-notch developers it has inside, sometimes the only way to produce good outside-the-box ideas is by going outside the company. So in its quest to find the Next Big Thing, Under Armour sponsors an annual crowdsourcing competition called the Future Show Innovation Challenge:8

Crowdsourcing: Under Armour sponsors an annual crowdsourcing competition called the Future Show Innovation Challenge, in which it invites outside innovators to pitch new product ideas in a splashy, Shark Tank–like reality TV setting.

Crowdsourcing: Under Armour sponsors an annual crowdsourcing competition called the Future Show Innovation Challenge, in which it invites outside innovators to pitch new product ideas in a splashy, Shark Tank–like reality TV setting.

Thearon W. Henderson / Getty Images

The Future Show challenge invites entrepreneurs and inventors from around the nation to submit new product ideas. Then, from thousands of entries, an Under Armour team culls 12 finalists who go before a panel of seven judges to pitch their products in a splashy, Shark Tank–like reality TV setting. The winner earns $50,000 and a contract to work with Under Armour to help develop the winning product. The goal of the Future Show Challenge is to “cajole top innovators to come to Under Armour first with gee-whizzers,” says CEO Kevin Plank. The first winner, and Plank’s favorite so far, is a made-for-athletes zipper—the UA MagZip—that can be zipped easily with only one hand. Under Armour’s internal R&D team had been trying to develop a better zipper for two years, but “we couldn’t get it to work,” says the company’s vice president of innovation. That simple zipper is just one of dozens of creative new product ideas from the Future Show. But by itself, it makes the entire crowdsourcing effort worthwhile. “We need to be humble enough to know that the next great thing might come from some kid playing college football who happens to have a better idea,” says the Under Armour innovation chief.

Crowdsourcing can produce a flood of innovative ideas. In fact, opening the floodgates to anyone and everyone can overwhelm the company with ideas—some good and some bad. For example, when Cisco Systems sponsored an open-innovation effort called I-Prize, soliciting ideas from external sources, it received more than 820 distinct ideas from more than 2,900 innovators from 156 countries. “The evaluation process was far more labor-intensive than we’d anticipated,” says Cisco’s chief technology officer. It required “significant investments of time, energy, patience, and imagination . . . to discern the gems hidden within rough stones.” In the end, a team of six Cisco people worked full-time for three months to carve out 32 semifinalist ideas as well as nine teams representing 14 countries in six continents for the final phase of the competition.9

Thus, truly innovative companies don’t rely only on one source or another for new product ideas. Instead, they develop extensive innovation networks that capture ideas and inspiration from every possible source, from employees and customers to outside innovators and multiple points beyond.

Idea Screening

The purpose of idea generation is to create a large number of ideas. The purpose of the succeeding stages is to reduce that number. The first idea-reducing stage is idea screening, which helps spot good ideas and drop poor ones as soon as possible. Product development costs rise greatly in later stages, so the company wants to go ahead only with those product ideas that will turn into profitable products.

Many companies require their executives to write up new product ideas in a standard format that can be reviewed by a new product committee. The write-up describes the product or the service, the proposed customer value proposition, the target market, and the competition. It makes some rough estimates of market size, product price, development time and costs, manufacturing costs, and rate of return. The committee then evaluates the idea against a set of general criteria.

One marketing expert describes an R-W-W (“real, win, worth doing”) new product screening framework that asks three questions.10 First, Is it real? Is there a real need and desire for the product, and will customers buy it? Is there a clear product concept, and will such a product satisfy the market? Second, Can we win? Does the product offer a sustainable competitive advantage? Does the company have the resources to make such a product a success? Finally, Is it worth doing? Does the product fit the company’s overall growth strategy? Does it offer sufficient profit potential? The company should be able to answer yes to all three R-W-W questions before developing the new product idea further.

Concept Development and Testing

An attractive idea must then be developed into a product concept. It is important to distinguish between a product idea, a product concept, and a product image. A product idea is an idea for a possible product that the company can see itself offering to the market. A product concept is a detailed version of the idea stated in meaningful consumer terms. A product image is the way consumers perceive an actual or potential product.

Concept Development

Suppose a car manufacturer has developed a practical battery-powered, all-electric car. Its initial models were a sleek, sporty roadster convertible selling for more than $100,000, followed by a full-size sports sedan priced at $71,000.11

![]() However, in the near future it plans to introduce a more-affordable, mass-market compact version that will compete with recently introduced hybrid-electric or all-electric cars such as the Nissan Leaf, Chevy Volt, KIA Soul EV, and Chevy Bolt EV. This 100 percent plug-in electric car will accelerate from 0 to 60 miles per hour in four seconds, travel up to 300 miles on a single charge, recharge in 45 minutes from a normal 120-volt electrical outlet, and cost about one penny per mile to power.

However, in the near future it plans to introduce a more-affordable, mass-market compact version that will compete with recently introduced hybrid-electric or all-electric cars such as the Nissan Leaf, Chevy Volt, KIA Soul EV, and Chevy Bolt EV. This 100 percent plug-in electric car will accelerate from 0 to 60 miles per hour in four seconds, travel up to 300 miles on a single charge, recharge in 45 minutes from a normal 120-volt electrical outlet, and cost about one penny per mile to power.

All-electric cars: This is Tesla’s initial all-electric full-size sedan. Later, more-affordable compact models will travel more than 300 miles on a single charge, recharge in 45 minutes from a normal 120-volt electrical outlet, and cost about one penny per mile to power.

All-electric cars: This is Tesla’s initial all-electric full-size sedan. Later, more-affordable compact models will travel more than 300 miles on a single charge, recharge in 45 minutes from a normal 120-volt electrical outlet, and cost about one penny per mile to power.

Tesla

Looking ahead, the marketer’s task is to develop this new product into alternative product concepts, find out how attractive each concept is to customers, and choose the best one. It might create the following product concepts for this all-electric car:

Concept 1. An affordably priced compact car designed as a second family car to be used around town for running errands and visiting friends.

Concept 2. A mid-priced sporty compact appealing to young singles and couples.

Concept 3. A “green” everyday car appealing to environmentally conscious people who want practical, no-polluting transportation.

Concept 4. A compact crossover SUV appealing to those who love the space SUVs provide but lament the poor gas mileage.

Concept Testing

Concept testing calls for testing new product concepts with groups of target consumers. The concepts may be presented to consumers symbolically or physically. Here, in more detail, is concept 3:

An efficient, fun-to-drive, battery-powered compact car that seats four. This 100 percent electric wonder provides practical and reliable transportation with no pollution. It goes 300 miles on a single charge and costs pennies per mile to operate. It’s a sensible, responsible alternative to today’s pollution-producing gas-guzzlers. Its fully equipped base price is $28,800.

Many firms routinely test new product concepts with consumers before attempting to turn them into actual new products. For some concept tests, a word or picture description might be sufficient. However, a more concrete and physical presentation of the concept will increase the reliability of the concept test. After being exposed to the concept, consumers then may be asked to react to it by answering questions similar to those in

![]() Table 9.1.

Table 9.1.

Table 9.1

Table 9.1

Questions for the All-Electric Car Concept Test

The answers to such questions will help the company decide which concept has the strongest appeal. For example, the last question asks about the consumer’s intention to buy. Suppose 2 percent of consumers say they “definitely” would buy and another 5 percent say “probably.” The company could project these figures to the full population in this target group to estimate sales volume. Even then, however, the estimate is uncertain because people do not always carry out their stated intentions.

Marketing Strategy Development

Suppose the carmaker finds that concept 3 for the new electric car model tests best. The next step is marketing strategy development, designing an initial marketing strategy for introducing this car to the market.

The marketing strategy statement consists of three parts. The first part describes the target market; the planned value proposition; and the sales, market-share, and profit goals for the first few years. Thus:

The target market is younger, well-educated, moderate- to high-income individuals, couples, or small families seeking practical, environmentally responsible transportation. The car will be positioned as more fun to drive and less polluting than today’s internal combustion engine or hybrid cars. The company will aim to sell 50,000 cars in the first year, at a loss of not more than $15 million. In the second year, the company will aim for sales of 90,000 cars and a profit of $25 million.

The second part of the marketing strategy statement outlines the product’s planned price, distribution, and marketing budget for the first year:

The battery-powered all-electric car will be offered in three colors—red, white, and blue—and will have a full set of accessories as standard features. It will sell at a base retail price of $28,800, with 15 percent off the list price to dealers. Dealers who sell more than 10 cars per month will get an additional discount of 5 percent on each car sold that month. A marketing budget of $50 million will be split 40-30-30 among a national media campaign, online and social media marketing, and local event marketing. Advertising, the web and mobile sites, and various social media content will emphasize the car’s fun spirit and low emissions. During the first year, $100,000 will be spent on marketing research to find out who is buying the car and what their satisfaction levels are.

The third part of the marketing strategy statement describes the planned long-run sales, profit goals, and marketing mix strategy:

We intend to capture a 3 percent long-run share of the total auto market and realize an after-tax return on investment of 15 percent. To achieve this, product quality will start high and be improved over time. Price will be raised in the second and third years if competition and the economy permit. The total marketing budget will be raised each year by about 10 percent. Marketing research will be reduced to $60,000 per year after the first year.

Business Analysis

Once management has decided on its product concept and marketing strategy, it can evaluate the business attractiveness of the proposal. Business analysis involves a review of the sales, costs, and profit projections for a new product to find out whether they satisfy the company’s objectives. If they do, the product can move to the product development stage.

To estimate sales, the company might look at the sales history of similar products and conduct market surveys. It can then estimate minimum and maximum sales to assess the range of risk. After preparing the sales forecast, management can estimate the expected costs and profits for the product, including marketing, R&D, operations, accounting, and finance costs. The company then uses the sales and cost figures to analyze the new product’s financial attractiveness.

Product Development

For many new product concepts, a product may exist only as a word description, a drawing, or perhaps a crude mock-up. If the product concept passes the business test, it moves into product development. Here, R&D or engineering develops the product concept into a physical product. The product development step, however, now calls for a huge jump in investment. It will show whether the product idea can be turned into a workable product.

The R&D department will develop and test one or more physical versions of the product concept. R&D hopes to design a prototype that will satisfy and excite consumers and that can be produced quickly and at budgeted costs. Developing a successful prototype can take days, weeks, months, or even years depending on the product and prototype methods.

Product testing: Carhartt has enlisted an army of Groundbreakers, volunteers who take part in live chats with Carhartt designers, review new product concepts, and field-test products that they helped to create.

Product testing: Carhartt has enlisted an army of Groundbreakers, volunteers who take part in live chats with Carhartt designers, review new product concepts, and field-test products that they helped to create.

Carhartt

Often, products undergo rigorous tests to make sure that they perform safely and effectively or that consumers will find value in them. Companies can do their own product testing or outsource testing to other firms that specialize in testing.

Marketers often involve actual customers in product development and testing.

![]() For example, Carhartt, maker of durable workwear and outerwear, has enlisted an army of Groundbreakers, “hard working men and women to help us create our next generation of products.” These volunteers take part in live chats with Carhartt designers, review new product concepts, and field-test products that they helped to create.12

For example, Carhartt, maker of durable workwear and outerwear, has enlisted an army of Groundbreakers, “hard working men and women to help us create our next generation of products.” These volunteers take part in live chats with Carhartt designers, review new product concepts, and field-test products that they helped to create.12

A new product must have the required functional features and also convey the intended psychological characteristics. The all-electric car, for example, should strike consumers as being well built, comfortable, and safe. Management must learn what makes consumers decide that a car is well built. To some consumers, this means that the car has “solid-sounding” doors. To others, it means that the car is able to withstand a heavy impact in crash tests. Consumer tests are conducted in which consumers test-drive the car and rate its attributes.

Test Marketing

If the product passes both the concept test and the product test, the next step is test marketing, the stage at which the product and its proposed marketing program are tested in realistic market settings. Test marketing gives the marketer experience with marketing a product before going to the great expense of full introduction. It lets the company test the product and its entire marketing program—targeting and positioning strategy, advertising, distribution, pricing, branding and packaging, and budget levels.

The amount of test marketing needed varies with each new product. When introducing a new product requires a big investment, when the risks are high, or when management is not sure of the product or its marketing program, a company may do a lot of test marketing. For instance, Taco Bell took three years and 45 prototypes before introducing Doritos Locos Tacos, now the most successful product launch in the company’s history. And Starbucks spent 20 years developing Starbucks VIA instant coffee—one of its most risky product rollouts ever—and several months testing the product in Starbucks shops in Chicago and Seattle before releasing it nationally. The testing paid off. The Starbucks VIA line now accounts for more than $300 million in sales annually.13

However, test marketing costs can be high, and testing takes time that may allow market opportunities to slip by or competitors to gain advantages. A company may do little or no test marketing when the costs of developing and introducing a new product are low or when management is already confident about the new product. For example, companies often do not test-market simple line extensions or copies of competitors’ successful products.

Companies may also shorten or skip testing in the face of fast-changing market developments.

![]() For example, to take advantage of digital and mobile trends, Starbucks quickly introduced a less-than-perfect mobile payments app, then worked out the flaws during the six months after launch. The Starbucks app now accounts for 8 million transactions per week. “We don’t think it is okay if things aren’t perfect,” says Starbucks’ chief digital officer, “but we’re willing to innovate and have speed to market trump a 100 percent guarantee that it’ll be perfect.”14

For example, to take advantage of digital and mobile trends, Starbucks quickly introduced a less-than-perfect mobile payments app, then worked out the flaws during the six months after launch. The Starbucks app now accounts for 8 million transactions per week. “We don’t think it is okay if things aren’t perfect,” says Starbucks’ chief digital officer, “but we’re willing to innovate and have speed to market trump a 100 percent guarantee that it’ll be perfect.”14

Companies sometimes shorten or skip test marketing to take advantage of fast-changing market developments, as Starbucks did with its hugely successful mobile payments app.

Companies sometimes shorten or skip test marketing to take advantage of fast-changing market developments, as Starbucks did with its hugely successful mobile payments app.

Kevin Schafer/Getty Images

As an alternative to extensive and costly standard test markets, companies can use controlled test markets or simulated test markets. In controlled test markets, new products and tactics are tested among controlled panels of shoppers and stores. By combining information on each test consumer’s purchases with consumer demographic and media viewing information, the company assess the impact of in-store and in-home marketing efforts. Using simulated test markets, researchers measure consumer responses to new products and marketing tactics in laboratory stores or simulated online shopping environments. Both controlled test markets and simulated test markets reduce the costs of test marketing and speed up the process.

Commercialization

Test marketing gives management the information needed to make a final decision about whether to launch the new product. If the company goes ahead with commercialization—introducing the new product into the market—it will face high costs. For example, the company may need to build or rent a manufacturing facility. And, in the case of a major new consumer product, it may spend hundreds of millions of dollars for advertising, sales promotion, and other marketing efforts in the first year. For instance, in a single month surrounding the introduction of the Apple Watch, Apple spent $38 million on TV advertising campaign alone for the new product. Tide spent $150 million on a campaign to launch Tide Pods in the highly competitive U.S. laundry detergent market. And to introduce the original Surface tablet, Microsoft spent close to $400 million on an advertising blitz that spanned TV, print, radio, outdoor, the Internet, events, public relations, and sampling.15

A company launching a new product must first decide on introduction timing. If the new product will eat into the sales of other company products, the introduction may be delayed. If the product can be improved further or if the economy is down, the company may wait until the following year to launch it. However, if competitors are ready to introduce their own competing products, the company may push to introduce its new product sooner.

Next, the company must decide where to launch the new product—in a single location, a region, the national market, or the international market. Some companies may quickly introduce new models into the full national market. Companies with international distribution systems may introduce new products through swift global rollouts. For example, Apple launched its iPhone 6 and iPhone 6 Plus phones in its fastest-ever global rollout, making them available in 115 countries within less than three months of initial introduction.16

Managing New Product Development

The new product development process shown in Figure 9.1 highlights the important activities needed to find, develop, and introduce new products. However, new product development involves more than just going through a set of steps. Companies must take a holistic approach to managing this process. Successful new product development requires a customer-centered, team-based, and systematic effort.

Customer-Centered New Product Development

Above all else, new product development must be customer centered. When looking for and developing new products, companies often rely too heavily on technical research in their R&D laboratories. But like everything else in marketing, successful new product development begins with a thorough understanding of what consumers need and value. Customer-centered new product development focuses on finding new ways to solve customer problems and create more customer-satisfying experiences.

One study found that the most successful new products are ones that are differentiated, solve major customer problems, and offer a compelling customer value proposition. Another study showed that companies that directly engage their customers in the new product innovation process had twice the return on assets and triple the growth in operating income of firms that did not. Thus, customer involvement has a positive effect on the new product development process and product success. “Choosing what kind of value your innovation will create and then sticking to that is critical,” says one expert.17

Customer-centered new product development: Financial software maker Intuit follows a “Design for Delight” philosophy that says products should delight customers by providing experiences that go beyond their expectations.

Customer-centered new product development: Financial software maker Intuit follows a “Design for Delight” philosophy that says products should delight customers by providing experiences that go beyond their expectations.

Reprinted with permission. ©Intuit Inc. All rights reserved.

Intuit—maker of financial software such as TurboTax, QuickBooks, and Quicken—is a strong proponent of customer-driven new product development:18

Intuit follows a “Design for Delight (D4D)” development philosophy that says products should delight customers by providing experiences that go beyond their expectations.

Design for Delight starts with customer empathy—knowing customers better than they know themselves. To that end, each year, Intuit conducts 10,000 hours of what it calls “follow-me-homes,” in which design employees observe firsthand how customers use its products at home and at work. They look to understand problems and needs that even customers themselves might not recognize. Based on customer observations, the next D4D step is to “go broad, go narrow”—developing many customer-driven product ideas, then narrowing them down to one or a few great ideas for products that will solve customer problems. The final D4D step involves turning the great ideas into actual products and services that create customer delight, collecting customer feedback steadily throughout the development process. Intuit works relentlessly to embed Design for Delight concepts deeply into its culture. “You’ve got to feel it,” says the company’s vice president of design innovation. “It can’t be in your head. It’s got to be in your heart. It’s got to be in your gut. And we want to put it in our products.”

Thus, today’s innovative companies get out of the research lab and connect with customers in search of fresh ways to meet customer needs. Customer-centered new product development begins and ends with understanding customers and involving them in the process.

Team-Based New Product Development

Good new product development also requires a total-company, cross-functional effort. Some companies organize their new product development process into the orderly sequence of steps shown in Figure 9.1, starting with idea generation and ending with commercialization. Under this sequential product development approach, one company department works individually to complete its stage of the process before passing the new product along to the next department and stage. This orderly, step-by-step process can help bring control to complex and risky projects. But it can also be dangerously slow. In fast-changing, highly competitive markets, such slow-but-sure product development can result in product failures, lost sales and profits, and crumbling market positions.

To get their new products to market more quickly, many companies use a team-based new product development approach. Under this approach, company departments work closely together in cross-functional teams, overlapping the steps in the product development process to save time and increase effectiveness. Instead of passing the new product from department to department, the company assembles a team of people from various departments that stays with the new product from start to finish. Such teams usually include people from the marketing, finance, design, manufacturing, and legal departments and even supplier and customer companies. In the sequential process, a bottleneck at one phase can seriously slow an entire project. In the team-based approach, however, if one area hits snags, it works to resolve them while the team moves on.

The team-based approach does have some limitations, however. For example, it sometimes creates more organizational tension and confusion than the more orderly sequential approach. However, in rapidly changing industries facing increasingly shorter product life cycles, the rewards of fast and flexible product development far exceed the risks. Companies that combine a customer-centered approach with team-based new product development gain a big competitive edge by getting the right new products to market faster.

Systematic New Product Development

Finally, the new product development process should be holistic and systematic rather than compartmentalized and haphazard. Otherwise, few new ideas will surface, and many good ideas will sputter and die. To avoid these problems, a company can install an innovation management system to collect, review, evaluate, and manage new product ideas.

The company can appoint a respected senior person to be its innovation manager. It can set up web-based idea management software and encourage all company stakeholders—employees, suppliers, distributors, dealers—to become involved in finding and developing new products. It can assign a cross-functional innovation management committee to evaluate proposed new product ideas and help bring good ideas to market. It can also create recognition programs to reward those who contribute the best ideas.

The innovation management system approach yields two favorable outcomes. First, it helps create an innovation-oriented company culture. It shows that top management supports, encourages, and rewards innovation. Second, it will yield a larger number of new product ideas, among which will be found some especially good ones. The good new ideas will be more systematically developed, producing more new product successes. No longer will good ideas wither for the lack of a sounding board or a senior product advocate.

Thus, new product success requires more than simply thinking up a few good ideas, turning them into products, and finding customers for them. It requires a holistic approach for finding new ways to create valued customer experiences, from generating and screening new product ideas to creating and rolling out want-satisfying products to customers. More than this, successful new product development requires a whole-company commitment. At companies known for their new product prowess, such as Samsung, Google, Apple, 3M, P&G, and GE, the entire culture encourages, supports, and rewards innovation. For example, at Google and its parent company Alphabet, innovation is more just than a process—it’s part of the company’s DNA (see Real Marketing 9.1).